- South Korea

- /

- Semiconductors

- /

- KOSE:A000660

KRX October 2024 Stocks Possibly Priced Below Intrinsic Value Estimates

Reviewed by Simply Wall St

In the last week, the South Korean market has been flat, but it has shown a 6.3% increase over the past 12 months with earnings forecasted to grow by 30% annually. In this context of steady growth and promising earnings potential, identifying stocks that may be priced below their intrinsic value can offer investors opportunities for long-term gains.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Samwha ElectricLtd (KOSE:A009470) | ₩47300.00 | ₩92761.73 | 49% |

| PharmaResearch (KOSDAQ:A214450) | ₩208000.00 | ₩423683.56 | 50.9% |

| APR (KOSE:A278470) | ₩267000.00 | ₩527353.86 | 49.4% |

| Cosmecca Korea (KOSDAQ:A241710) | ₩78300.00 | ₩152465.43 | 48.6% |

| T'Way Air (KOSE:A091810) | ₩3200.00 | ₩5680.03 | 43.7% |

| ABCO Electronics (KOSDAQ:A036010) | ₩5790.00 | ₩11477.97 | 49.6% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1655.00 | ₩2974.63 | 44.4% |

| Global Tax Free (KOSDAQ:A204620) | ₩3595.00 | ₩6410.53 | 43.9% |

| Hotel ShillaLtd (KOSE:A008770) | ₩45600.00 | ₩81706.61 | 44.2% |

| Hd Hyundai MipoLtd (KOSE:A010620) | ₩100000.00 | ₩178014.81 | 43.8% |

Here we highlight a subset of our preferred stocks from the screener.

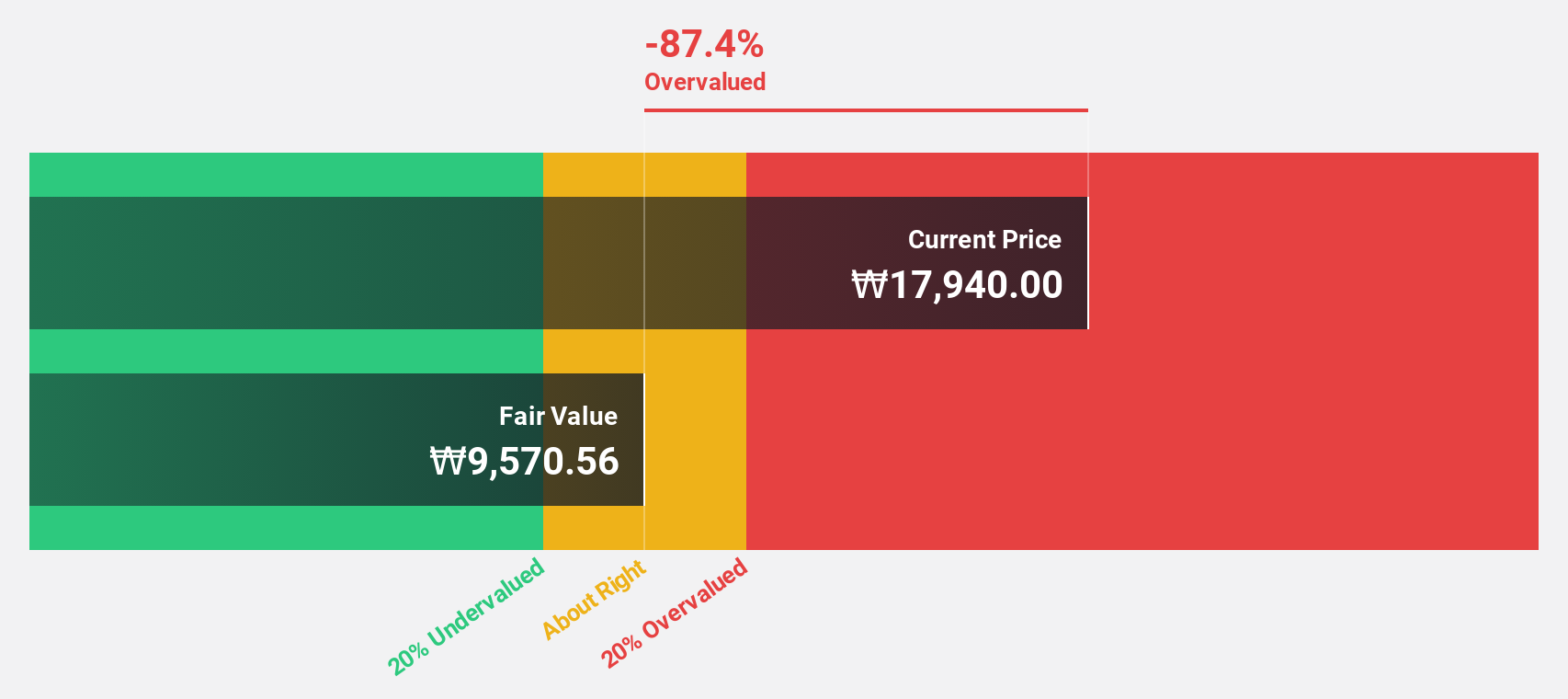

Kakao Games (KOSDAQ:A293490)

Overview: Kakao Games Corporation operates a mobile and PC online game service platform for gamers worldwide, with a market cap of ₩1.46 trillion.

Operations: The company's revenue segments include Computer Graphics, which generated ₩986.72 million.

Estimated Discount To Fair Value: 41.1%

Kakao Games appears undervalued, trading at ₩17,800, significantly below its estimated fair value of ₩30,228.2. With earnings forecasted to grow over 100% annually and revenue projected to increase by 10.6% per year—slightly above the South Korean market average—the company shows promising financial potential despite a low future return on equity of 6.5%. Recent private placements could enhance liquidity and strategic growth opportunities for Kakao Games moving forward.

- Our growth report here indicates Kakao Games may be poised for an improving outlook.

- Click here to discover the nuances of Kakao Games with our detailed financial health report.

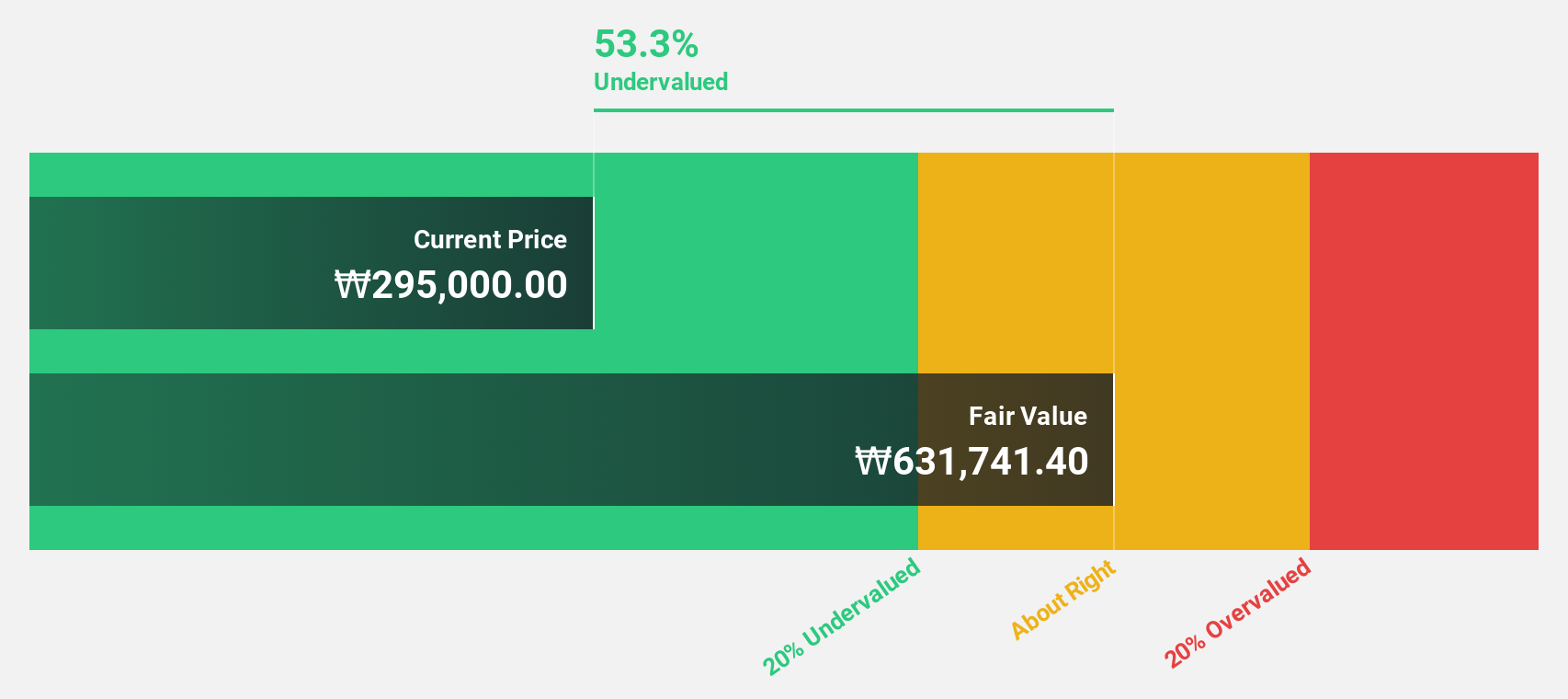

SK hynix (KOSE:A000660)

Overview: SK hynix Inc., with a market cap of ₩122.57 trillion, is involved in the manufacture, distribution, and sale of semiconductor products across Korea, China, the rest of Asia, the United States, and Europe.

Operations: The company's revenue primarily comes from its semiconductor products segment, which generated ₩49.22 billion.

Estimated Discount To Fair Value: 13.6%

SK hynix is trading at ₩178,000, approximately 13.6% below its estimated fair value of ₩205,993.41. The company recently turned profitable with significant earnings growth expected at 49.67% annually over the next three years, outpacing market averages. Despite a volatile share price and low future return on equity forecasts (18.7%), SK hynix's recent product innovations in GDDR7 graphics memory could bolster revenue growth forecasted at 22% per year.

- Our expertly prepared growth report on SK hynix implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of SK hynix stock in this financial health report.

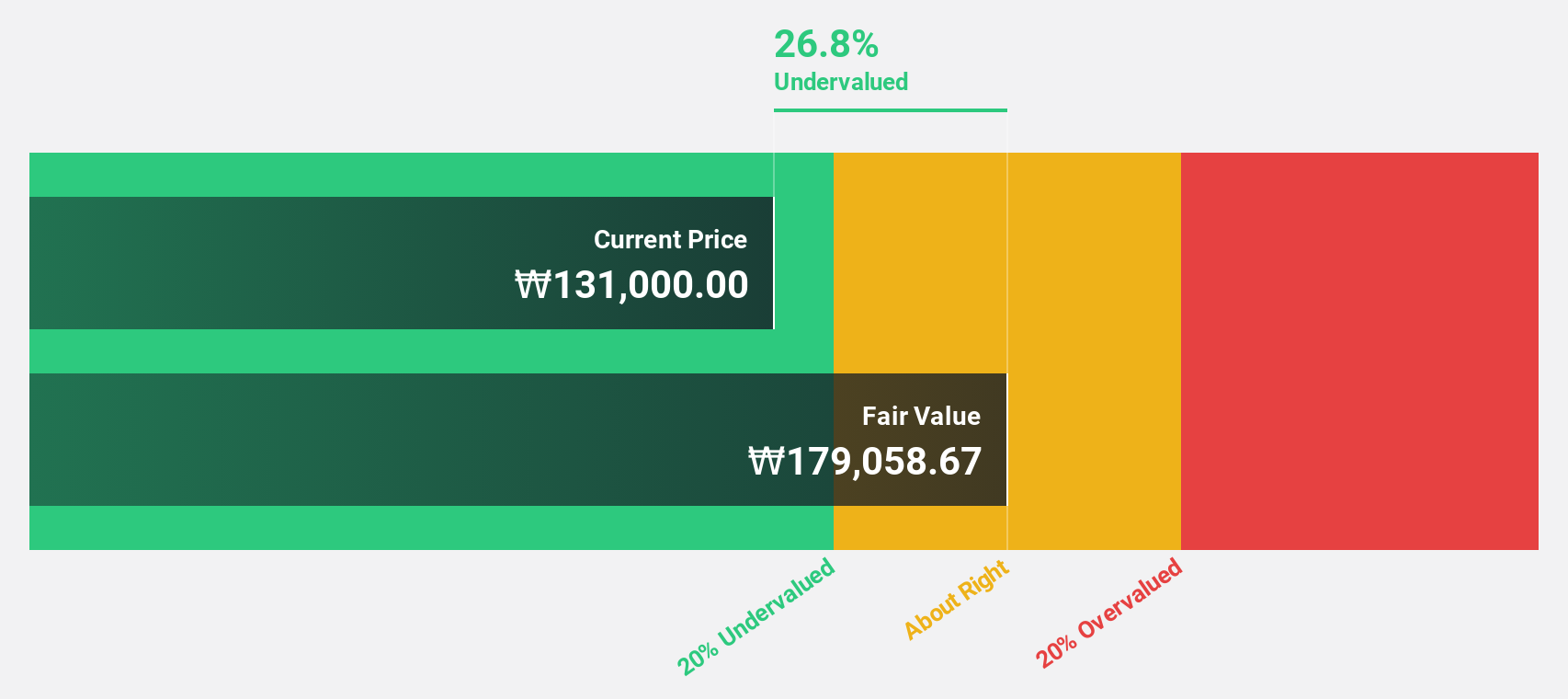

APR (KOSE:A278470)

Overview: APR Co., Ltd is a company that manufactures and sells cosmetic products for men and women, with a market cap of ₩2.02 billion.

Operations: The company's revenue segments include Cosmetics at ₩614.77 million and Apparel Fashion at ₩64.46 million.

Estimated Discount To Fair Value: 49.4%

APR Co., Ltd. trades at ₩267,000, significantly undervalued compared to its estimated fair value of ₩527,353.86, with analysts anticipating a 53.8% price increase. Despite high non-cash earnings and recent share buybacks totaling KRW 19 billion, the stock remains volatile. Forecasts suggest revenue growth at 21.6% annually—exceeding market averages—and strong future return on equity at 31.6%. However, earnings growth is expected to lag behind the broader Korean market's pace.

- Our earnings growth report unveils the potential for significant increases in APR's future results.

- Take a closer look at APR's balance sheet health here in our report.

Make It Happen

- Reveal the 35 hidden gems among our Undervalued KRX Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000660

SK hynix

Engages in the manufacture, distribution, and sale of semiconductor products in Korea, China, rest of Asia, the United States, and Europe.

Undervalued with excellent balance sheet.