- South Korea

- /

- Entertainment

- /

- KOSDAQ:A289220

With GIANTSTEP Inc. (KOSDAQ:289220) It Looks Like You'll Get What You Pay For

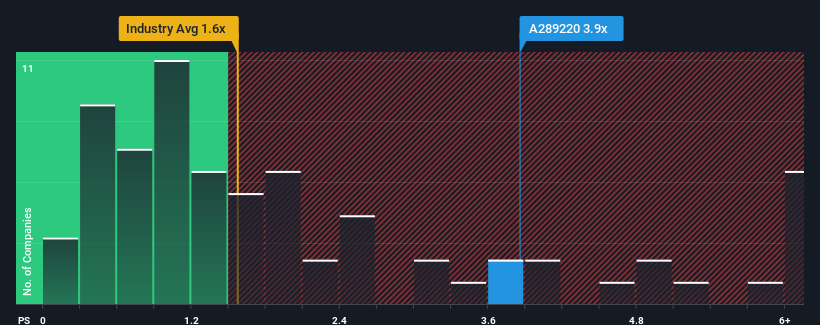

GIANTSTEP Inc.'s (KOSDAQ:289220) price-to-sales (or "P/S") ratio of 3.9x may look like a poor investment opportunity when you consider close to half the companies in the Entertainment industry in Korea have P/S ratios below 1.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for GIANTSTEP

How GIANTSTEP Has Been Performing

We'd have to say that with no tangible growth over the last year, GIANTSTEP's revenue has been unimpressive. It might be that many are expecting an improvement to the uninspiring revenue performance over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for GIANTSTEP, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, GIANTSTEP would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 87% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

This is in contrast to the rest of the industry, which is expected to grow by 17% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why GIANTSTEP is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On GIANTSTEP's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that GIANTSTEP maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with GIANTSTEP.

If you're unsure about the strength of GIANTSTEP's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A289220

GIANTSTEP

Produces digital media for various clients related to visual image production in feature films, commercials, music video, and television industries.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.