- South Korea

- /

- Interactive Media and Services

- /

- KOSDAQ:A239340

Introducing ZUM Internet (KOSDAQ:239340), A Stock That Climbed 19% In The Last Year

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if when you choose to buy stocks, some of them will be below average performers. For example, the ZUM Internet Corp. (KOSDAQ:239340), share price is up over the last year, but its gain of 19% trails the market return. We'll need to follow ZUM Internet for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for ZUM Internet

We don't think that ZUM Internet's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

ZUM Internet actually shrunk its revenue over the last year, with a reduction of 4.0%. The lacklustre gain of 19% over twelve months, is not a bad result given the falling revenue. We'd want to see progress to profitability before getting too interested in this stock.

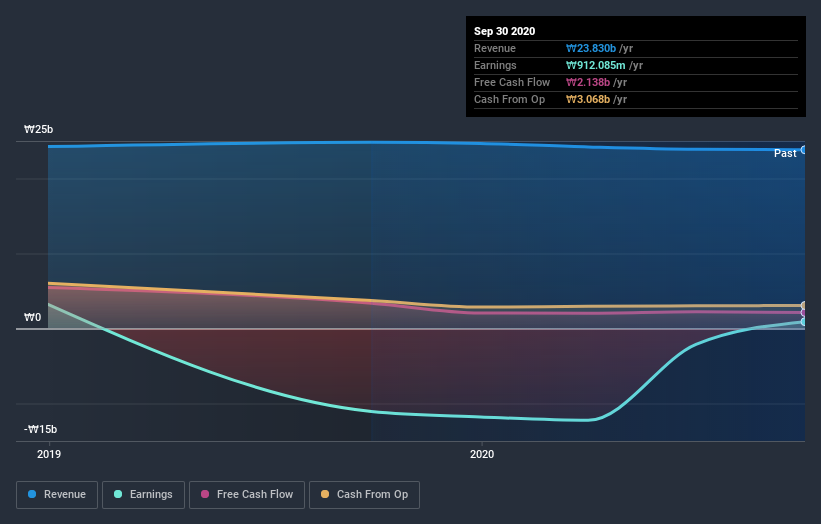

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

ZUM Internet shareholders have gained 19% for the year. The bad news is that's no better than the average market return, which was roughly 38%. The last three months haven't been great for shareholder returns, since the share price has trailed the market by 35% in the last three months. But a weak quarter certainly doesn't diminish the longer-term achievements of the business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade ZUM Internet, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ESTaid might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A239340

Flawless balance sheet low.

Market Insights

Community Narratives