- South Korea

- /

- Entertainment

- /

- KOSDAQ:A225570

Exploring High Growth Tech Stocks For Potential Opportunities

Reviewed by Simply Wall St

Amidst global market fluctuations, with U.S. stocks experiencing volatility due to political and economic uncertainties, investors are keenly observing the impact of policy changes on various sectors. In this environment, identifying high-growth tech stocks that demonstrate resilience and adaptability can present potential opportunities for those looking to navigate these dynamic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.59% | 31.50% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1301 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

NEXON Games (KOSDAQ:A225570)

Simply Wall St Growth Rating: ★★★★★★

Overview: NEXON Games Co., Ltd. operates as a game developer with a market cap of ₩875.21 billion.

Operations: The company generates revenue primarily through the development and distribution of online games. Its business model focuses on creating engaging gaming experiences that attract a global user base, leveraging both in-game purchases and subscription models for monetization.

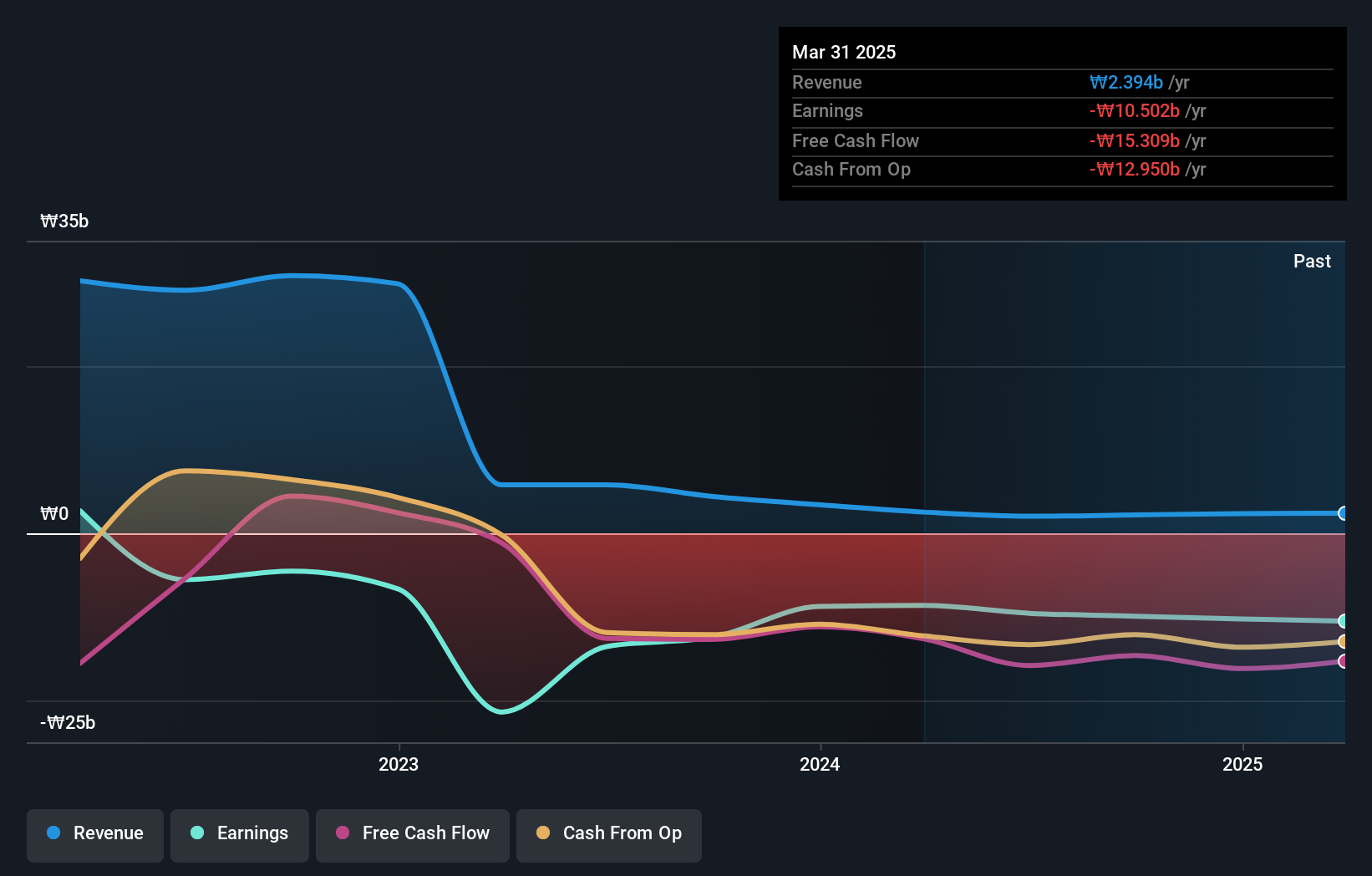

With a robust 25.3% annual revenue growth forecast, NEXON Games is outpacing the broader Korean market's 9.8% expansion rate, indicating strong market capture and potential scalability in its operations. This growth trajectory is complemented by an impressive expected earnings surge of 70.1% annually, showcasing operational efficiency and a keen ability to monetize its offerings effectively. The company's commitment to innovation is evident from its R&D investments which have been strategically aligned with emerging tech trends in gaming and digital entertainment, ensuring it remains at the forefront of industry advancements while catering to a dynamic consumer base.

- Click here and access our complete health analysis report to understand the dynamics of NEXON Games.

Review our historical performance report to gain insights into NEXON Games''s past performance.

Genomictree (KOSDAQ:A228760)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Genomictree Inc. is a biomarker-based molecular diagnostics company that develops and commercializes products for detecting cancer and infectious diseases, with a market cap of ₩363.33 billion.

Operations: The company's primary revenue stream is from its Cancer Molecular Diagnosis Business, generating ₩1.93 billion, while its Genomic Analysis and related activities contribute ₩109.21 million.

Despite Genomictree's modest revenue base of ₩2 billion, the company is positioned for significant growth with a projected annual revenue increase of 90.5%. This far exceeds the broader Korean market's growth rate of 9.8%, highlighting its potential to capture a larger market share. Moreover, Genomictree is on the brink of profitability, with earnings expected to surge by 107.8% annually over the next three years. This forecasted turnaround is critical as it transitions from current unprofitability towards sustainable financial health. The firm's investment in R&D, although not quantified here, plays a pivotal role in fostering innovation and securing its competitive edge in the biotech sector.

- Get an in-depth perspective on Genomictree's performance by reading our health report here.

Gain insights into Genomictree's historical performance by reviewing our past performance report.

Inspur Digital Enterprise Technology (SEHK:596)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Inspur Digital Enterprise Technology Limited is an investment holding company that offers software development, other software services, and cloud services in the People’s Republic of China, with a market capitalization of approximately HK$3.56 billion.

Operations: Inspur Digital focuses on three main revenue streams: cloud services, management software, and IoT solutions, with IoT solutions generating the highest revenue at CN¥3.53 billion. The company operates primarily in the Chinese market.

Inspur Digital Enterprise Technology's recent financial performance underscores its solid position in the tech sector, with a notable increase in net income to CNY 105.7 million from the previous year's CNY 49.24 million, reflecting an earnings growth of 84.5%. This growth rate not only surpasses the software industry average of 15.9% but also positions Inspur well above the Hong Kong market's forecasted annual profit growth of 11.5%. The company's R&D expenditure aligns with its revenue trajectory, which is expected to rise by 23.3% annually, significantly outpacing the market projection of 7.8%. Such investment in innovation is pivotal as it fuels further advancements and competitive edge in a rapidly evolving technological landscape.

- Navigate through the intricacies of Inspur Digital Enterprise Technology with our comprehensive health report here.

Understand Inspur Digital Enterprise Technology's track record by examining our Past report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1301 High Growth Tech and AI Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEXON Games might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A225570

NEXON Games

Operates as a game developer in South Korea and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives