- South Korea

- /

- Entertainment

- /

- KOSDAQ:A194480

Devsisters (KOSDAQ:194480) Share Prices Have Dropped 59% In The Last Five Years

It is a pleasure to report that the Devsisters corporation (KOSDAQ:194480) is up 36% in the last quarter. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. In that time the share price has delivered a rude shock to holders, who find themselves down 59% after a long stretch. So is the recent increase sufficient to restore confidence in the stock? Not yet. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

Check out our latest analysis for Devsisters

Given that Devsisters didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Devsisters grew its revenue at 21% per year. That's better than most loss-making companies. In contrast, the share price is has averaged a loss of 10% per year - that's quite disappointing. It's safe to say investor expectations are more grounded now. Given the revenue growth we'd consider the stock to be quite an interesting prospect if the company has a clear path to profitability.

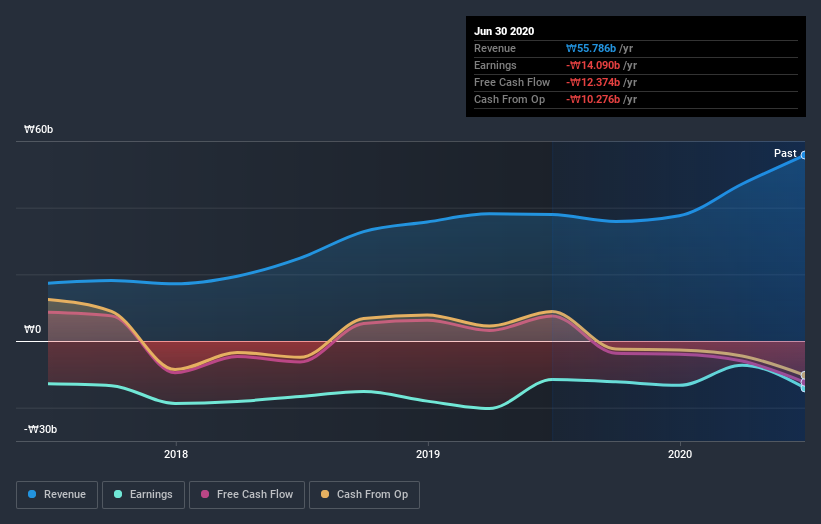

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Devsisters' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Devsisters has rewarded shareholders with a total shareholder return of 53% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 10% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Devsisters has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Devsisters, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A194480

Devsisters

Engages in the development of mobile games in South Korea and internationally.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion