- South Korea

- /

- Communications

- /

- KOSDAQ:A178320

KRX Growth Companies With High Insider Ownership October 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has experienced a 1.4% decline, maintaining a flat performance over the past year despite forecasts of 30% annual earnings growth. In this environment, identifying growth companies with high insider ownership can be beneficial as it may indicate strong confidence from those closest to the business in its future potential.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

We're going to check out a few of the best picks from our screener tool.

YG Entertainment (KOSDAQ:A122870)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: YG Entertainment Inc. is an entertainment company operating in South Korea, Japan, and internationally with a market cap of approximately ₩686.23 billion.

Operations: The company generates revenue primarily from its entertainment segment, totaling approximately ₩493.91 billion.

Insider Ownership: 23.2%

Earnings Growth Forecast: 60.1% p.a.

YG Entertainment faces challenges with recent financial losses, reporting a KRW 1,924.89 million net loss for Q2 2024. Despite this, the company's earnings are expected to grow significantly at 60.1% annually over the next three years, outpacing the Korean market's growth rate. Revenue is also forecasted to increase by 17.1% per year, surpassing market averages. Trading below fair value estimates and analyst price targets suggest potential upside amidst high insider ownership stability.

- Navigate through the intricacies of YG Entertainment with our comprehensive analyst estimates report here.

- Our valuation report here indicates YG Entertainment may be overvalued.

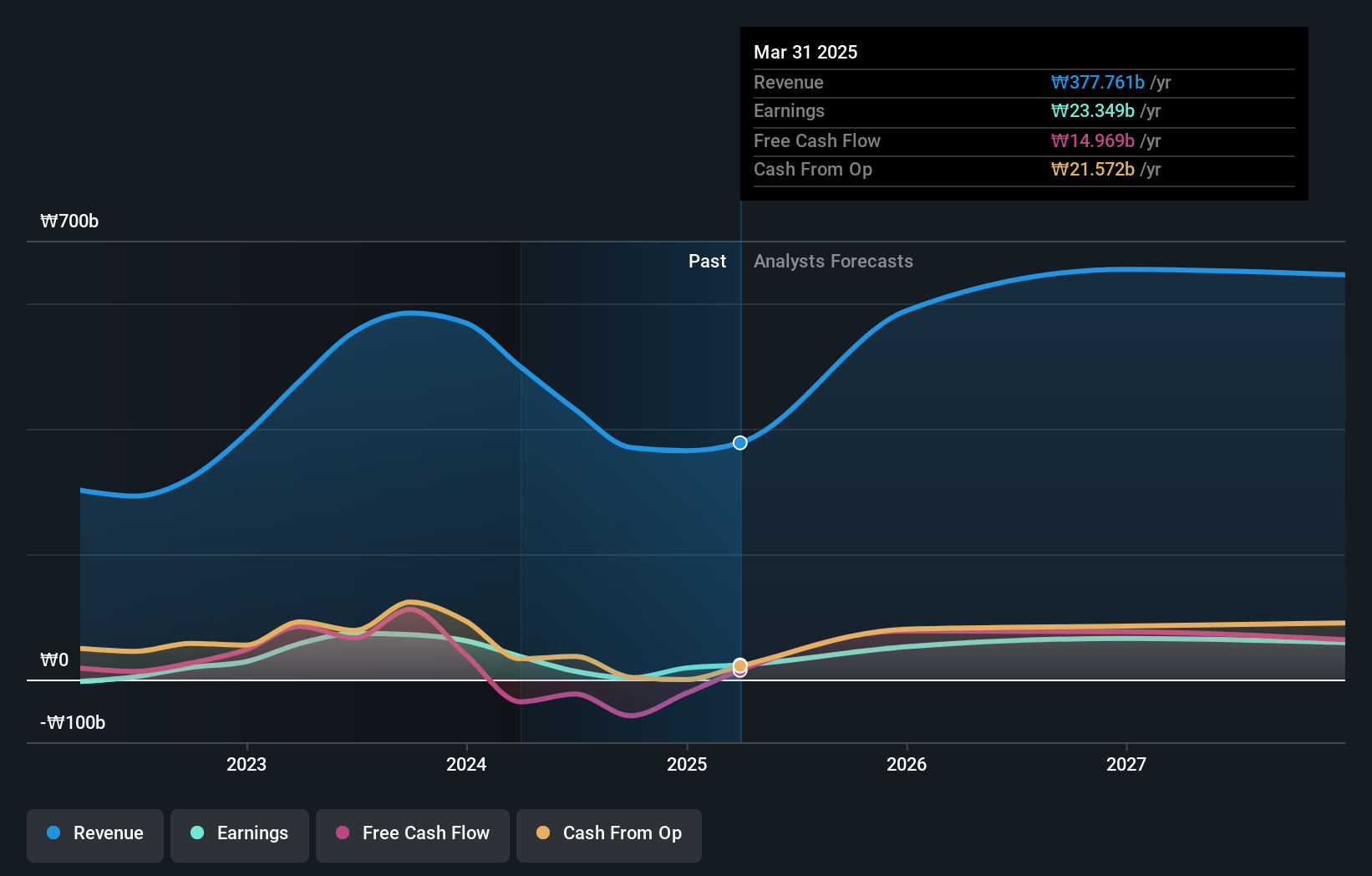

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

Overview: Seojin System Co., Ltd. operates in the telecommunications sector by providing equipment such as telecom gear, repeaters, mechanical products, and LED devices, with a market cap of ₩1.60 billion.

Operations: The company's revenue segments include the EMS Division, generating ₩1.52 billion, and the Semiconductor segment, contributing ₩169.98 million.

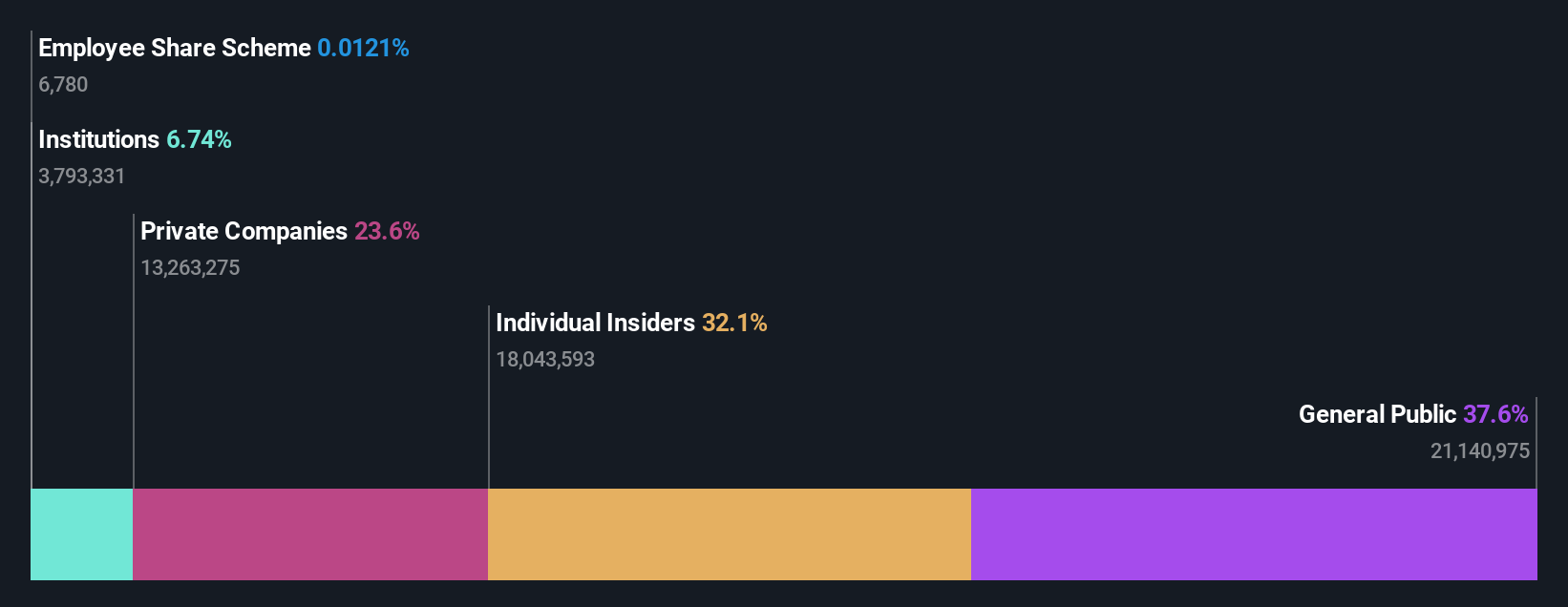

Insider Ownership: 30.5%

Earnings Growth Forecast: 52.1% p.a.

Seojin System Ltd. is experiencing rapid growth, with earnings projected to rise 52.1% annually, surpassing the Korean market's 29.7%. Revenue is expected to grow at 33.6% per year, significantly outpacing the market average of 10.5%. Despite past shareholder dilution and interest payments not being well covered by earnings, analysts forecast a potential stock price increase of 37%, trading at a substantial discount to estimated fair value and benefiting from high insider ownership stability.

- Unlock comprehensive insights into our analysis of Seojin SystemLtd stock in this growth report.

- The valuation report we've compiled suggests that Seojin SystemLtd's current price could be quite moderate.

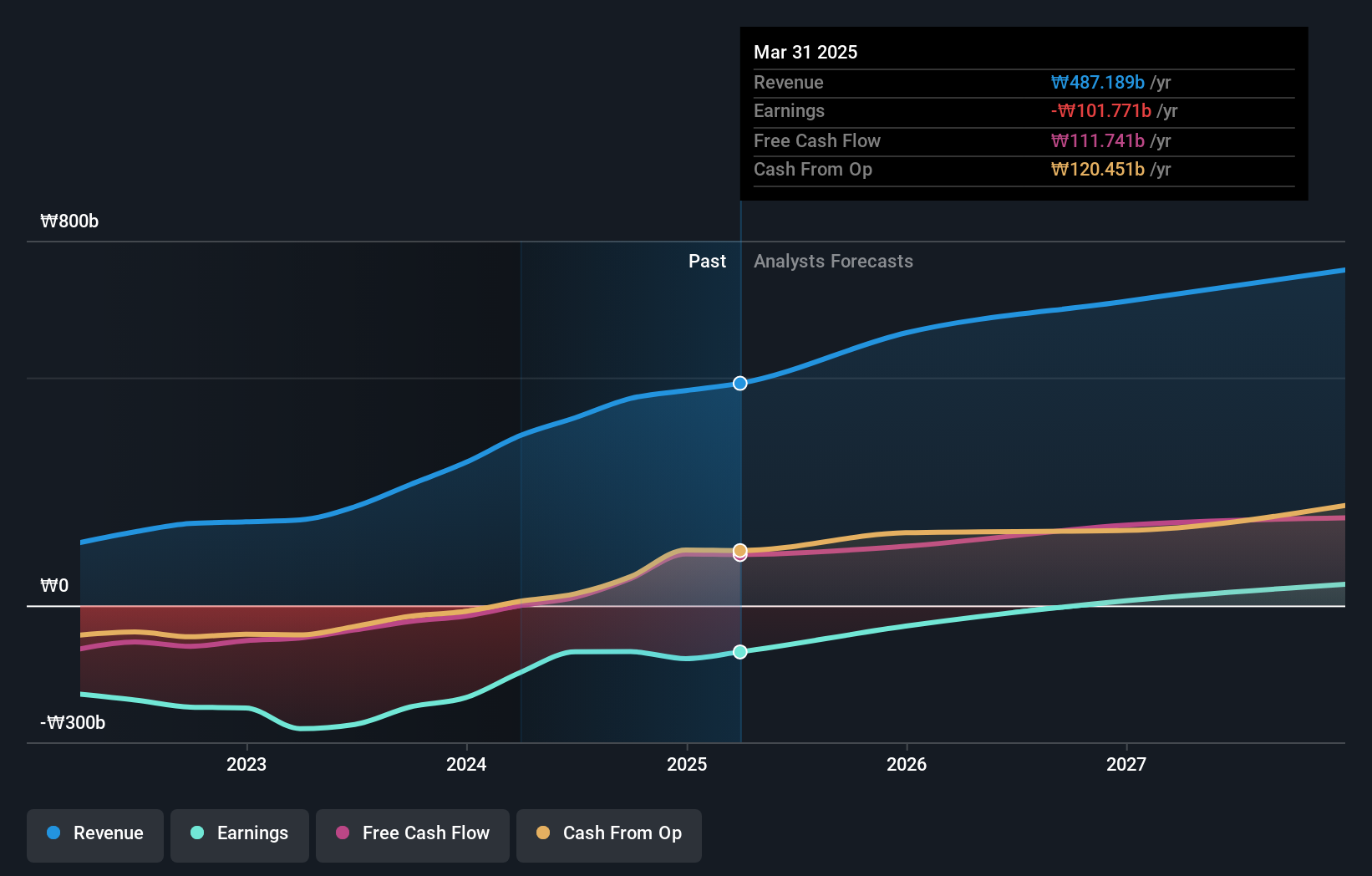

Lotte Tour Development (KOSE:A032350)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Tour Development Co., Ltd., along with its subsidiaries, provides travel and tourism services in South Korea and has a market cap of approximately ₩774.92 billion.

Operations: The company's revenue segments include the Dream Tower Integrated Resort Division with ₩337.15 billion, the Travel Related Service Sector (excluding Internet Journalism) contributing ₩72.47 billion, and the Internet Media Sector generating ₩2.19 million.

Insider Ownership: 29.4%

Earnings Growth Forecast: 103.4% p.a.

Lotte Tour Development is forecast to achieve profitability within three years, with expected annual profit growth surpassing the market average. Revenue is projected to grow at 15% annually, faster than the Korean market's 10.5%. Recent earnings show a significant reduction in net loss from KRW 47.79 billion to KRW 2.49 billion year-over-year for Q2, reflecting operational improvements. The stock trades at a substantial discount to its estimated fair value, though insider trading activity remains minimal recently.

- Click to explore a detailed breakdown of our findings in Lotte Tour Development's earnings growth report.

- The analysis detailed in our Lotte Tour Development valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Investigate our full lineup of 86 Fast Growing KRX Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Seojin SystemLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A178320

Seojin SystemLtd

Provides telecom equipment, repeaters, mechanical products, and LED and other equipment.

Very undervalued with exceptional growth potential.

Market Insights

Community Narratives