- South Korea

- /

- Media

- /

- KOSDAQ:A052220

iMBC Co.,Ltd.'s (KOSDAQ:052220) Popularity With Investors Under Threat As Stock Sinks 25%

iMBC Co.,Ltd. (KOSDAQ:052220) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 34%, which is great even in a bull market.

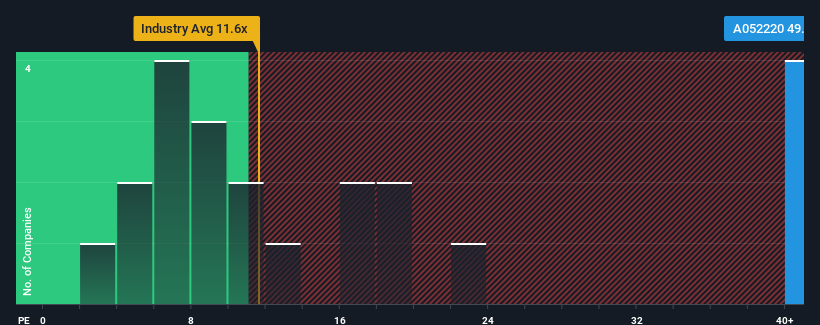

Even after such a large drop in price, iMBCLtd's price-to-earnings (or "P/E") ratio of 49.2x might still make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 11x and even P/E's below 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For instance, iMBCLtd's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for iMBCLtd

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, iMBCLtd would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 5.8% decrease to the company's bottom line. Even so, admirably EPS has lifted 77% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

It's interesting to note that the rest of the market is similarly expected to grow by 21% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it interesting that iMBCLtd is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Nevertheless, they may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On iMBCLtd's P/E

A significant share price dive has done very little to deflate iMBCLtd's very lofty P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of iMBCLtd revealed its three-year earnings trends aren't impacting its high P/E as much as we would have predicted, given they look similar to current market expectations. Right now we are uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for iMBCLtd (1 makes us a bit uncomfortable!) that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if iMBCLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A052220

iMBCLtd

A digital content company, provides broadcasting and replays in South Korea and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives