- South Korea

- /

- Entertainment

- /

- KOSDAQ:A051780

Investors Don't See Light At End Of CUROHOLDINGS Co., Ltd.'s (KOSDAQ:051780) Tunnel And Push Stock Down 28%

CUROHOLDINGS Co., Ltd. (KOSDAQ:051780) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

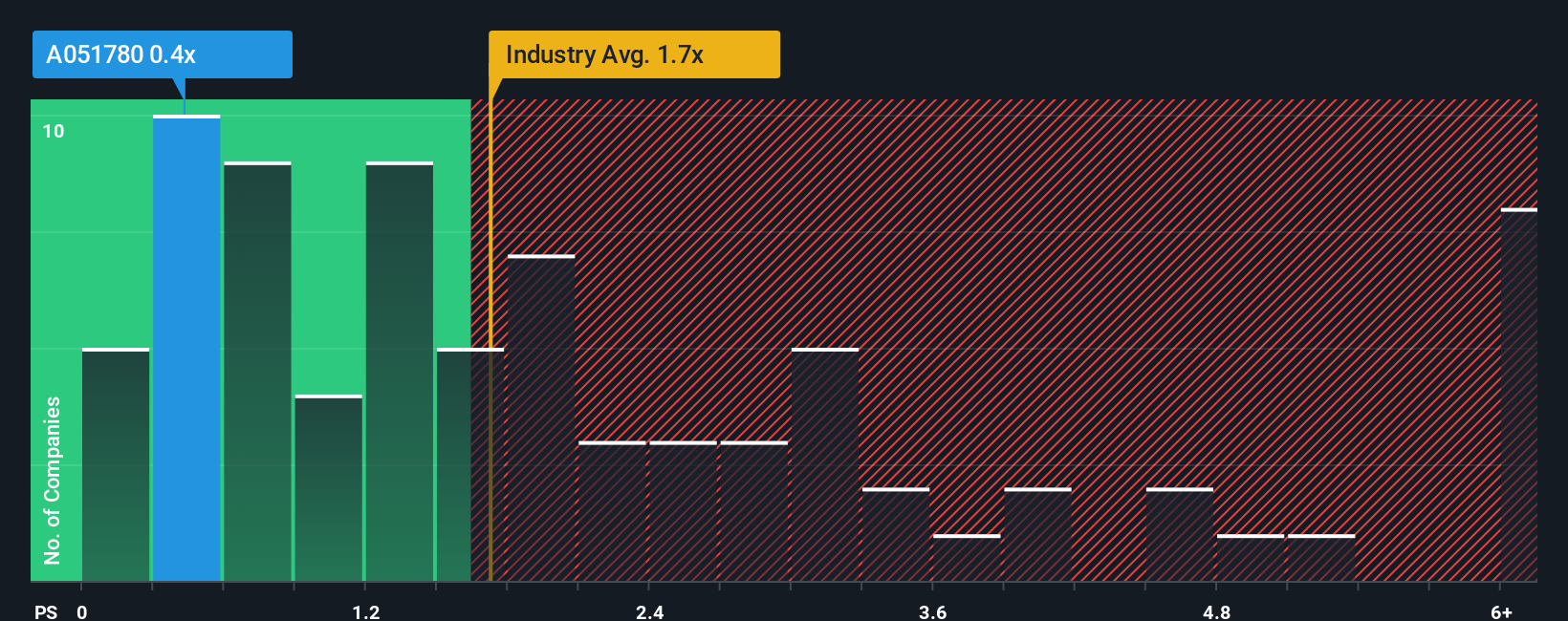

Since its price has dipped substantially, CUROHOLDINGS may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Entertainment industry in Korea have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for CUROHOLDINGS

How Has CUROHOLDINGS Performed Recently?

It looks like revenue growth has deserted CUROHOLDINGS recently, which is not something to boast about. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. Those who are bullish on CUROHOLDINGS will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for CUROHOLDINGS, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For CUROHOLDINGS?

CUROHOLDINGS' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The longer-term trend has been no better as the company has no revenue growth to show for over the last three years either. Therefore, it's fair to say that revenue growth has definitely eluded the company recently.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 21% shows it's an unpleasant look.

With this in mind, we understand why CUROHOLDINGS' P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

CUROHOLDINGS' recently weak share price has pulled its P/S back below other Entertainment companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that CUROHOLDINGS maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you take the next step, you should know about the 4 warning signs for CUROHOLDINGS (3 are potentially serious!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A051780

CUROHOLDINGS

Engages in the entertainment and coffee businesses in South Korea.

Good value with slight risk.

Market Insights

Community Narratives