- South Korea

- /

- Entertainment

- /

- KOSDAQ:A048550

Health Check: How Prudently Does SM Culture & Contents (KOSDAQ:048550) Use Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that SM Culture & Contents Co., Ltd. (KOSDAQ:048550) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for SM Culture & Contents

What Is SM Culture & Contents's Debt?

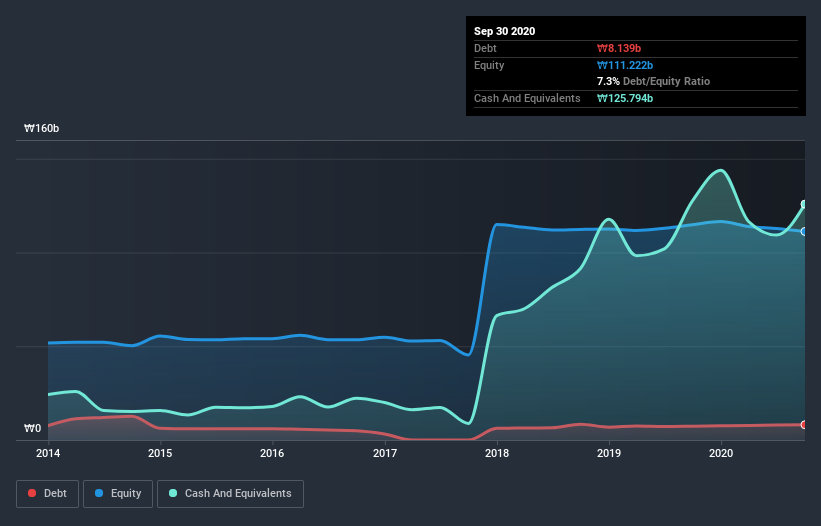

The image below, which you can click on for greater detail, shows that at September 2020 SM Culture & Contents had debt of ₩8.14b, up from ₩7.38b in one year. However, its balance sheet shows it holds ₩125.8b in cash, so it actually has ₩117.7b net cash.

A Look At SM Culture & Contents's Liabilities

Zooming in on the latest balance sheet data, we can see that SM Culture & Contents had liabilities of ₩168.7b due within 12 months and liabilities of ₩3.75b due beyond that. Offsetting this, it had ₩125.8b in cash and ₩107.2b in receivables that were due within 12 months. So it actually has ₩60.5b more liquid assets than total liabilities.

This surplus liquidity suggests that SM Culture & Contents's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet is as strong as beautiful a rare rhino. Succinctly put, SM Culture & Contents boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is SM Culture & Contents's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, SM Culture & Contents made a loss at the EBIT level, and saw its revenue drop to ₩136b, which is a fall of 24%. That makes us nervous, to say the least.

So How Risky Is SM Culture & Contents?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months SM Culture & Contents lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of ₩848m and booked a ₩3.5b accounting loss. Given it only has net cash of ₩117.7b, the company may need to raise more capital if it doesn't reach break-even soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how SM Culture & Contents's profit, revenue, and operating cashflow have changed over the last few years.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade SM Culture & Contents, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A048550

SM Culture & Contents

Engages in the entertainment business in South Korea and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026