- South Korea

- /

- Interactive Media and Services

- /

- KOSDAQ:A046140

Pinning Down SBS Contents Hub Co., Ltd.'s (KOSDAQ:046140) P/E Is Difficult Right Now

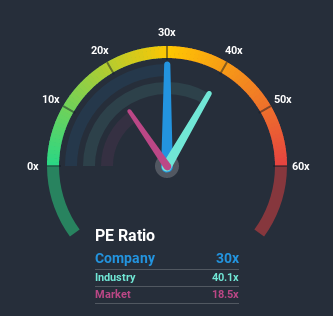

With a price-to-earnings (or "P/E") ratio of 30x SBS Contents Hub Co., Ltd. (KOSDAQ:046140) may be sending very bearish signals at the moment, given that almost half of all companies in Korea have P/E ratios under 18x and even P/E's lower than 10x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For instance, SBS Contents Hub's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for SBS Contents Hub

How Is SBS Contents Hub's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like SBS Contents Hub's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 48% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that SBS Contents Hub's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From SBS Contents Hub's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that SBS Contents Hub currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 3 warning signs for SBS Contents Hub (1 is a bit unpleasant!) that you should be aware of.

If you're unsure about the strength of SBS Contents Hub's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you’re looking to trade SBS Contents Hub, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade SBS Contents Hub, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A046140

SBS Contents Hub

SBS Contents Hub Co., Ltd. engages in the content distribution business in South Korea and internationally.

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives