High Growth Tech Stocks in Asia Featuring Three Prominent Companies

Reviewed by Simply Wall St

As global markets show signs of easing trade tensions, with U.S. equities experiencing gains and small- to mid-cap stocks posting a third consecutive week of growth, the Asian market remains a focal point for investors seeking high-growth opportunities in the tech sector. In this environment, identifying promising tech stocks involves looking for companies that can leverage favorable policy shifts and technological advancements to drive sustainable growth amidst ongoing economic uncertainties.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.94% | 28.01% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 31.75% | 32.37% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 21.74% | 25.00% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

SM Entertainment (KOSDAQ:A041510)

Simply Wall St Growth Rating: ★★★★☆☆

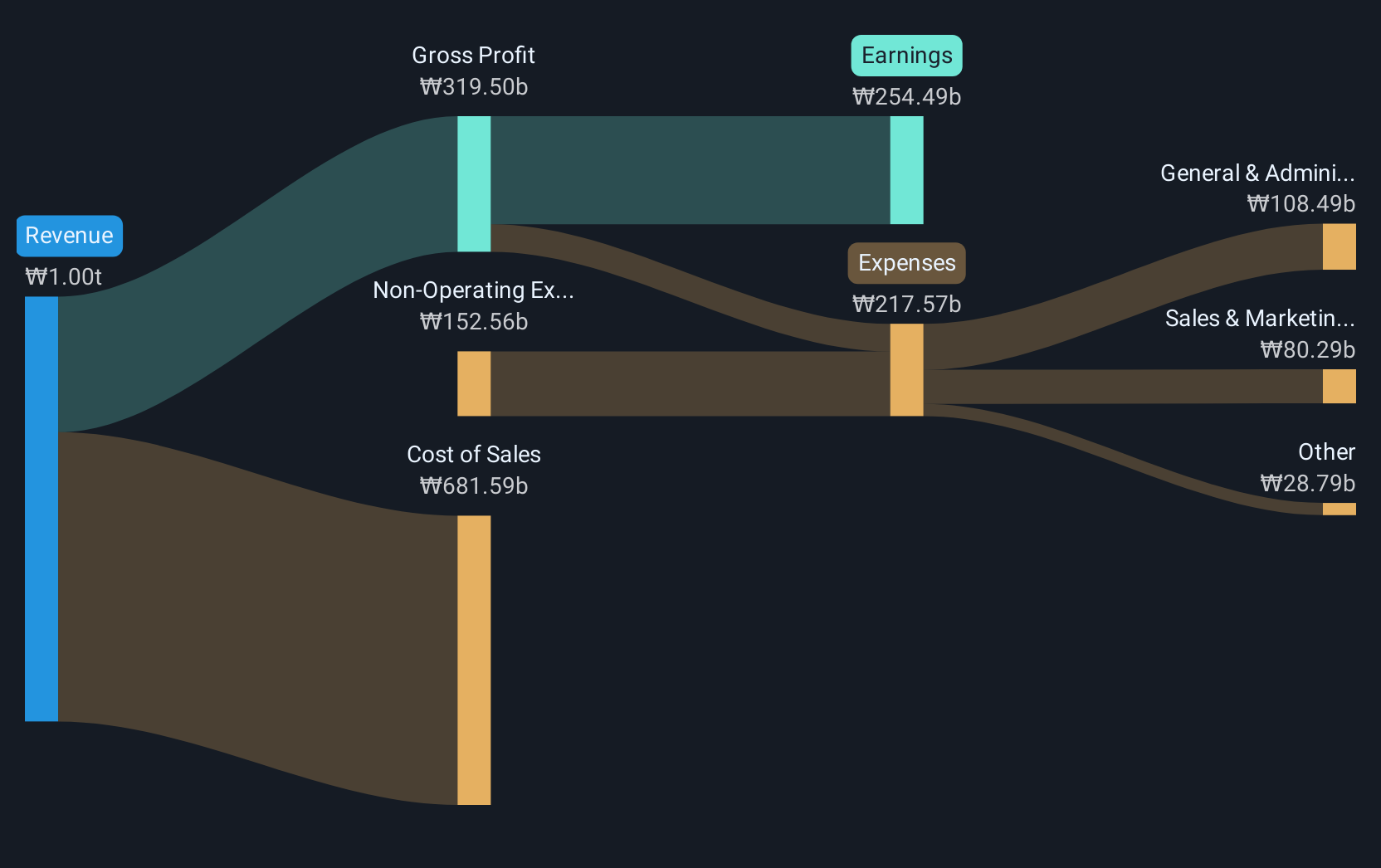

Overview: SM Entertainment Co., Ltd. is involved in music and sound production, talent management, and music/audio content publication both domestically and internationally, with a market cap of ₩2.84 trillion.

Operations: The company generates revenue primarily through its entertainment segment, excluding advertising agency activities, which contributes ₩903.63 billion. The advertising agency segment adds ₩71.43 billion to the overall revenue mix.

SM Entertainment, amidst a challenging landscape marked by a significant one-off loss of ₩67.8 billion, still projects robust growth with an expected earnings increase of 47.1% annually over the next three years—outpacing the Korean market's average of 21.6%. Despite a dip in profit margins from 9.1% to 1.9%, revenue growth remains strong at 11.2% per year, suggesting resilience and potential for recovery in its operational performance. The company's commitment to innovation and expansion into new entertainment verticals could drive future prospects, although it currently trails behind the industry with last year’s earnings shrinking by 79%.

Shanghai Film (SHSE:601595)

Simply Wall St Growth Rating: ★★★★★☆

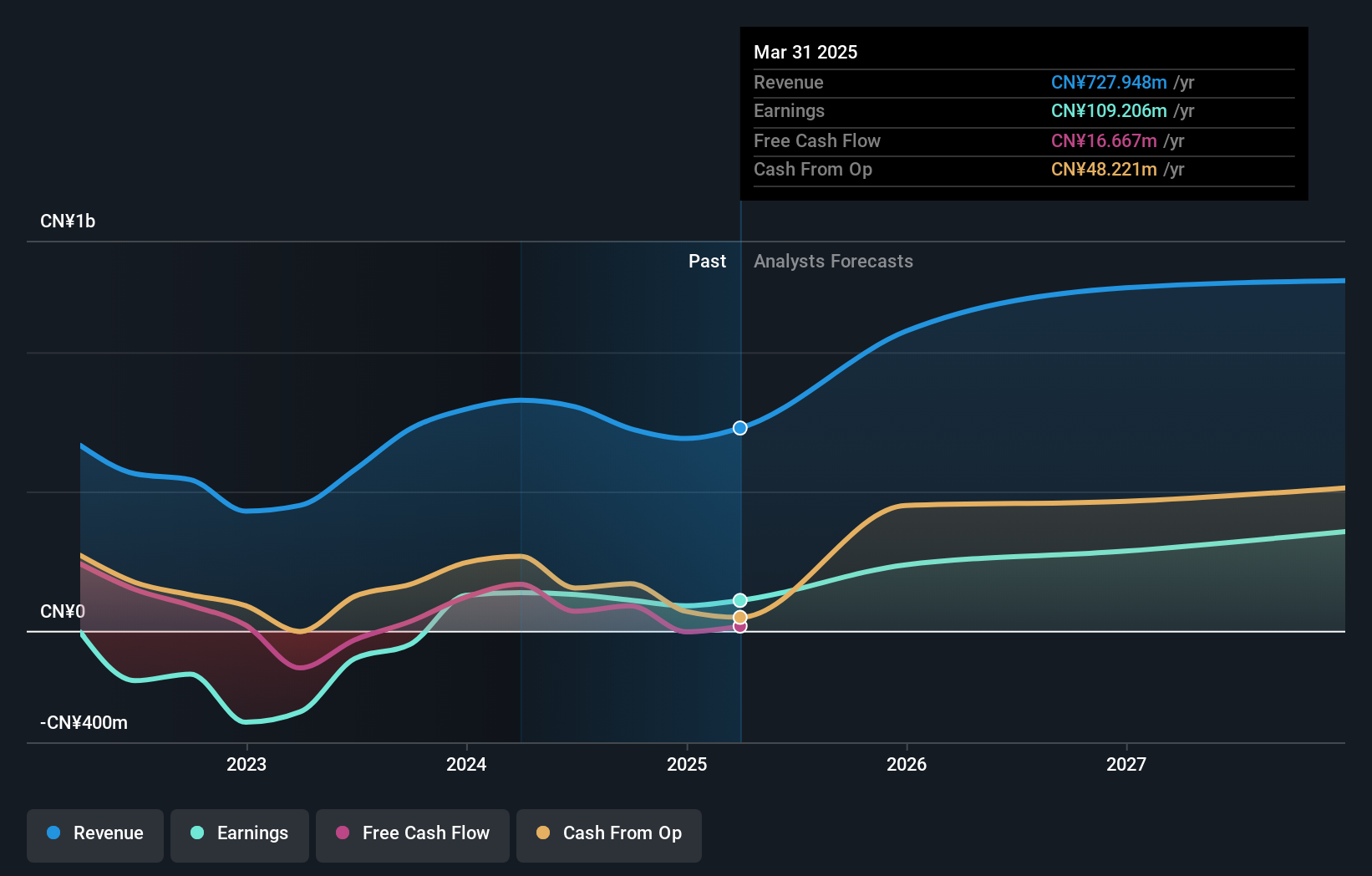

Overview: Shanghai Film Co., Ltd. is involved in film distribution and screening activities within China, with a market capitalization of CN¥14.68 billion.

Operations: Shanghai Film Co., Ltd. generates revenue primarily through its film distribution and screening operations in China. The company focuses on leveraging its market position to enhance its presence in the domestic entertainment industry, contributing to a market capitalization of CN¥14.68 billion.

Shanghai Film has demonstrated a notable rebound in its first quarter of 2025, with revenue climbing to CNY 247.53 million from CNY 209.96 million year-over-year and net income rising to CNY 65.27 million from CNY 46.11 million, reflecting a robust growth trajectory. Despite a dip in annual sales to CNY 690.37 million in 2024 from CNY 795.23 million the previous year, the firm's strategic focus on enhancing its cinematic productions and distribution capabilities is evident. With earnings per share also improving, Shanghai Film appears poised for further expansion, leveraging high-profile releases and technological advancements in film production to potentially outperform the broader Chinese entertainment market's growth rate of 23.9%.

- Take a closer look at Shanghai Film's potential here in our health report.

Review our historical performance report to gain insights into Shanghai Film's's past performance.

Servyou Software Group (SHSE:603171)

Simply Wall St Growth Rating: ★★★★☆☆

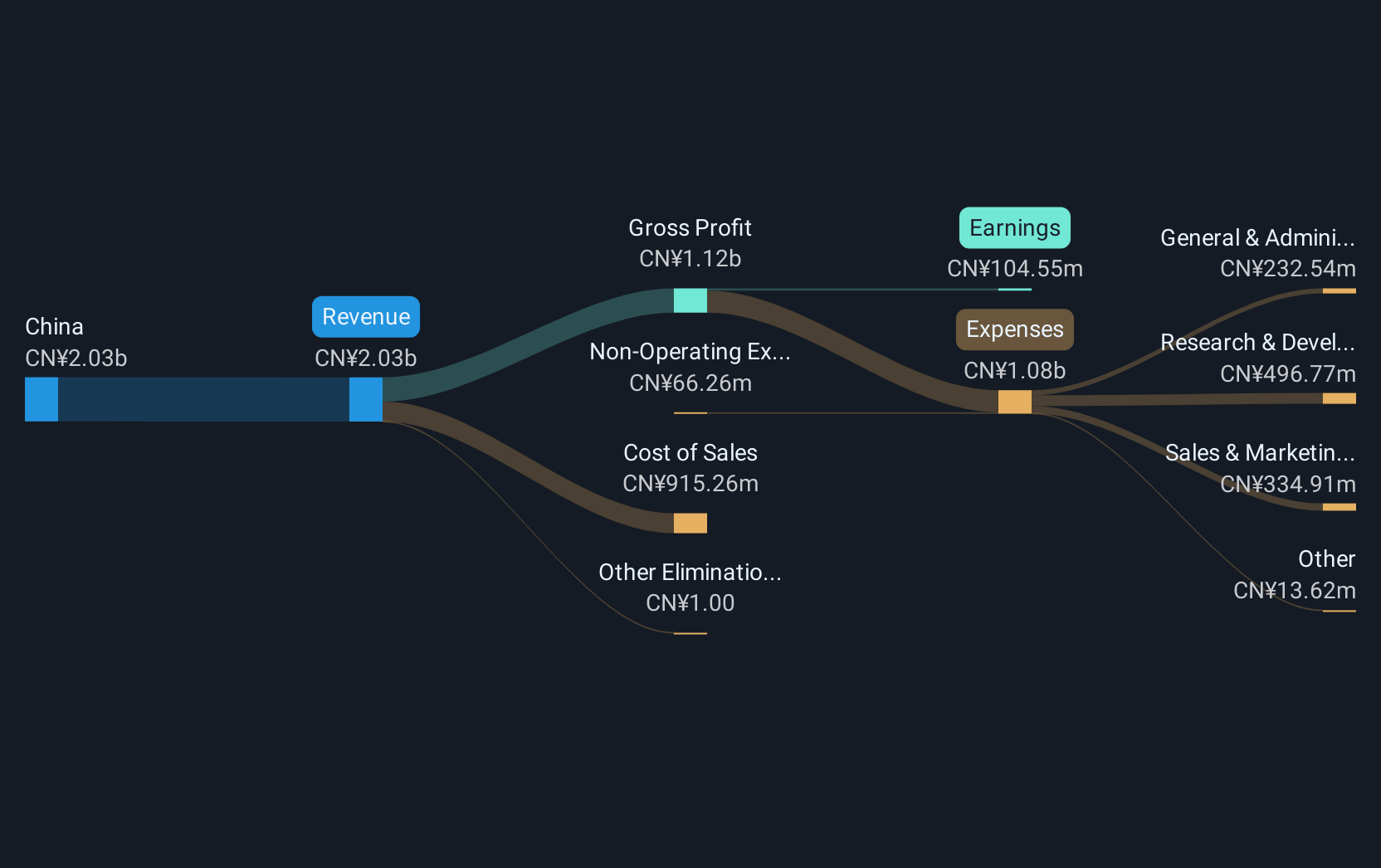

Overview: Servyou Software Group Co., Ltd. offers financial and tax information services in China through its subsidiaries, with a market capitalization of CN¥18.93 billion.

Operations: The company generates revenue primarily from its Digital Finance and Taxation Service Cloud Business, which contributes CN¥1.29 billion, and the Digital Government Business, contributing CN¥857.47 million.

Servyou Software Group has recently showcased robust financial health, with its annual revenue climbing to CNY 1.94 billion, up from CNY 1.83 billion the previous year, and net income rising significantly to CNY 112.58 million from CNY 83.39 million. This growth trajectory is further underscored by an impressive annualized earnings growth rate of 43.6%. The company's commitment to innovation is evident in its R&D investments, aligning with industry shifts towards more advanced software solutions and services that promise recurring revenue streams through subscription models. With earnings poised for substantial growth over the next three years, Servyou stands out in a competitive market where it has outpaced average industry growth rates, positioning itself well for future expansions amidst evolving technological landscapes.

- Delve into the full analysis health report here for a deeper understanding of Servyou Software Group.

Explore historical data to track Servyou Software Group's performance over time in our Past section.

Key Takeaways

- Click this link to deep-dive into the 484 companies within our Asian High Growth Tech and AI Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Servyou Software Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603171

Servyou Software Group

Provides financial and tax information services in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives