- South Korea

- /

- Media

- /

- KOSDAQ:A033130

Did Business Growth Power DIGITAL CHOSUN's (KOSDAQ:033130) Share Price Gain of 167%?

Unfortunately, investing is risky - companies can and do go bankrupt. But when you pick a company that is really flourishing, you can make more than 100%. Take, for example DIGITAL CHOSUN Inc. (KOSDAQ:033130). Its share price is already up an impressive 167% in the last twelve months. Meanwhile the share price is 4.4% higher than it was a week ago. The longer term returns have not been as good, with the stock price only 25% higher than it was three years ago.

Check out our latest analysis for DIGITAL CHOSUN

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months, DIGITAL CHOSUN actually shrank its EPS by 18%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We are skeptical of the suggestion that the 1.0% dividend yield would entice buyers to the stock. Unfortunately DIGITAL CHOSUN's fell 9.1% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

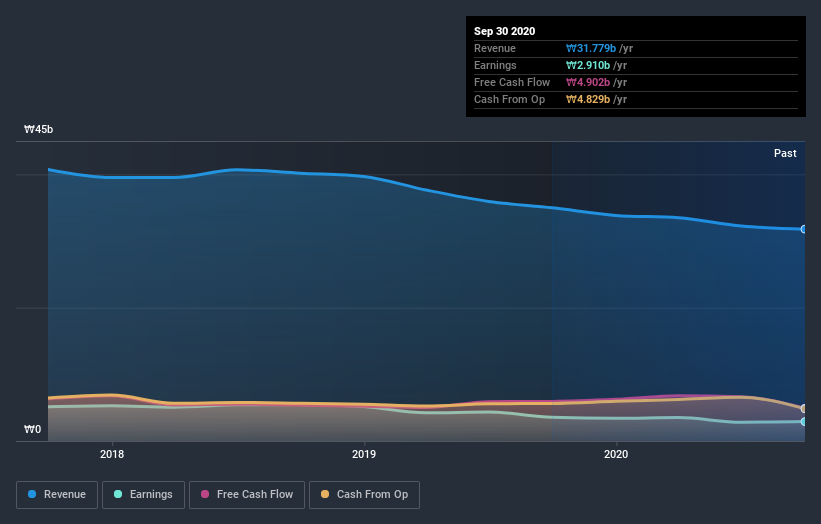

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at DIGITAL CHOSUN's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that DIGITAL CHOSUN shareholders have received a total shareholder return of 168% over one year. And that does include the dividend. That certainly beats the loss of about 6% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for DIGITAL CHOSUN (of which 1 doesn't sit too well with us!) you should know about.

Of course DIGITAL CHOSUN may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade DIGITAL CHOSUN, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A033130

DIGITAL CHOSUN

Engages in the information processing, outdoor advertising, and Internet content businesses.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives