- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A399720

Gaonchips And 2 Other Undiscovered Gems in South Korea

Reviewed by Simply Wall St

The South Korea stock market recently paused its three-day winning streak, with the KOSPI index resting just above the 2,700-point mark. Despite minor setbacks, positive global forecasts and optimism over interest rates suggest renewed support for the market. In this context, identifying promising small-cap stocks can be particularly rewarding. Gaonchips and two other lesser-known companies in South Korea present intriguing opportunities worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.98% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 22.60% | -1.67% | ★★★★★★ |

| SELVAS Healthcare | 13.58% | 10.16% | 77.14% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.38% | ★★★★★☆ |

| Ubiquoss Holdings | 2.69% | 9.93% | 14.22% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Gaonchips (KOSDAQ:A399720)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gaonchips Co., Ltd. manufactures semiconductors and has a market cap of ₩601.99 billion.

Operations: Gaonchips generates revenue primarily from its semiconductor manufacturing segment, amounting to ₩68.88 billion.

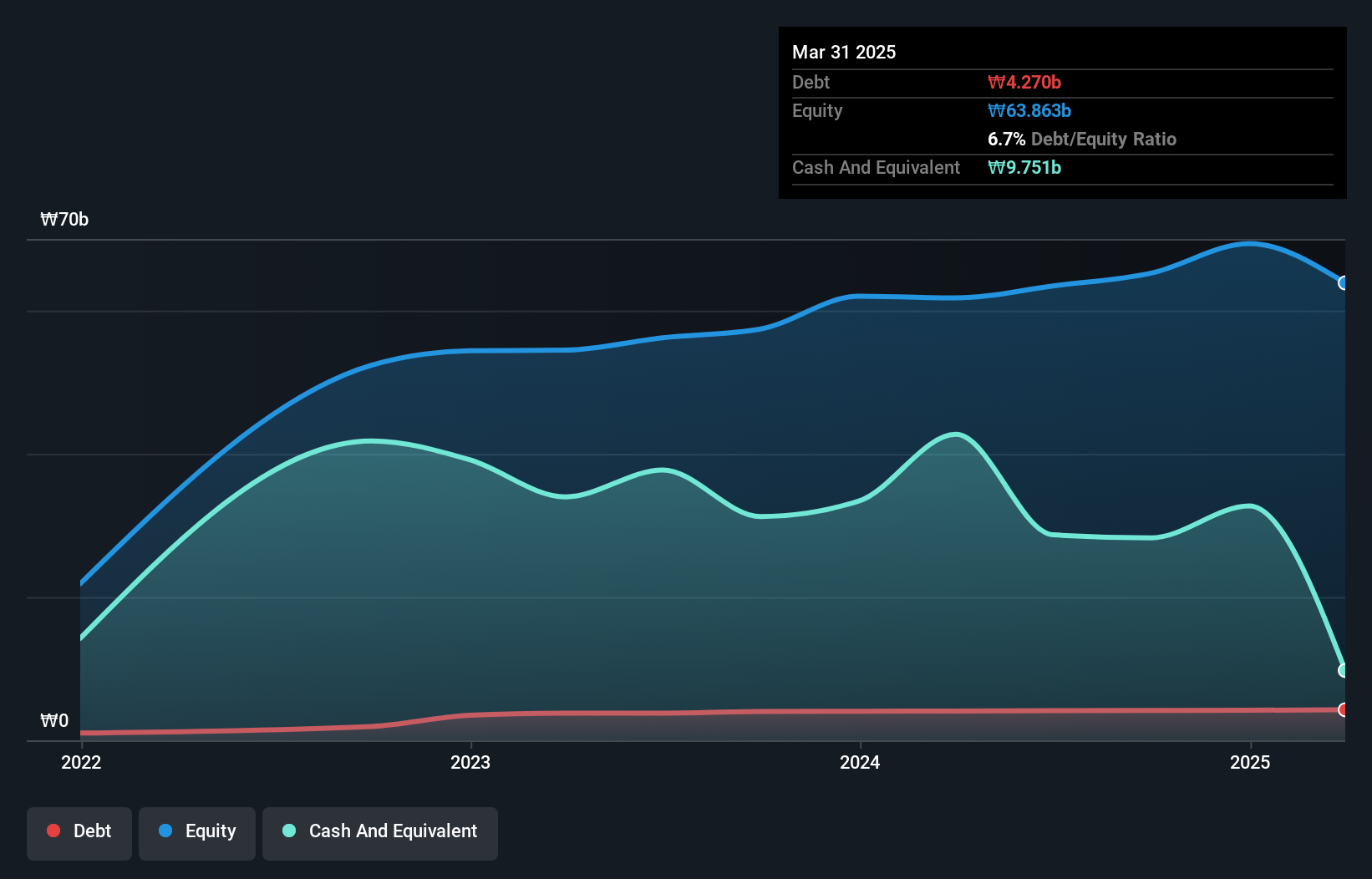

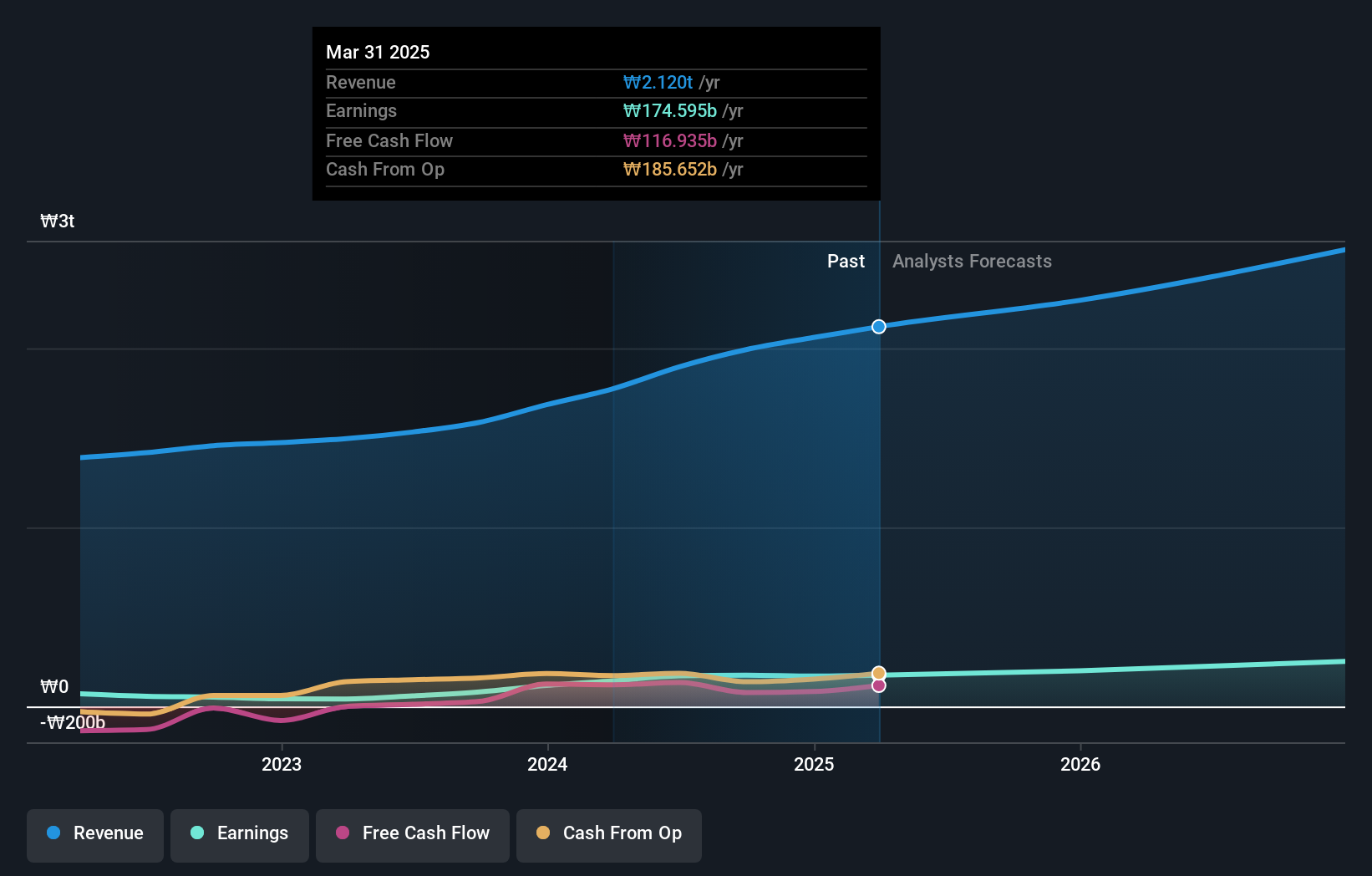

Gaonchips, a small-cap semiconductor player in South Korea, has shown impressive performance with earnings growing by 111% over the past year. This growth far outpaces the industry average of -14%. The company is profitable and has more cash than its total debt, ensuring financial stability. Despite a highly volatile share price over the past three months, Gaonchips' high-quality earnings and forecasted annual growth of 69% position it well for future expansion.

- Unlock comprehensive insights into our analysis of Gaonchips stock in this health report.

Understand Gaonchips' track record by examining our Past report.

Sebang Global Battery (KOSE:A004490)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sebang Global Battery Co., Ltd. manufactures and sells lead acid batteries in South Korea and internationally, with a market cap of ₩1.37 trillion.

Operations: Sebang Global Battery generates revenue primarily from the sale of lead acid batteries in both domestic and international markets. The company's financial performance includes a gross profit margin of 15.23% for the most recent period, highlighting its profitability within the industry.

Sebang Global Battery, a small-cap player in South Korea's battery industry, has shown impressive earnings growth of 190.8% over the past year, outpacing the Auto Components sector's 19.8%. The company trades at a significant discount of 30.1% below its estimated fair value and boasts high-quality earnings. Despite an increase in its debt to equity ratio from 12.5% to 17.1% over five years, it holds more cash than total debt, ensuring financial stability and robust interest coverage.

- Click to explore a detailed breakdown of our findings in Sebang Global Battery's health report.

Evaluate Sebang Global Battery's historical performance by accessing our past performance report.

Hanil Cement (KOSE:A300720)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hanil Cement Co., Ltd. produces and sells cements, ready-mixed concretes, and admixtures with a market cap of ₩1.07 trillion.

Operations: Hanil Cement generates revenue primarily from its Cement Sector (₩917.01 billion), Ready-Mixed Concrete Sector (₩294.82 billion), and Remital Sector (₩493.88 billion).

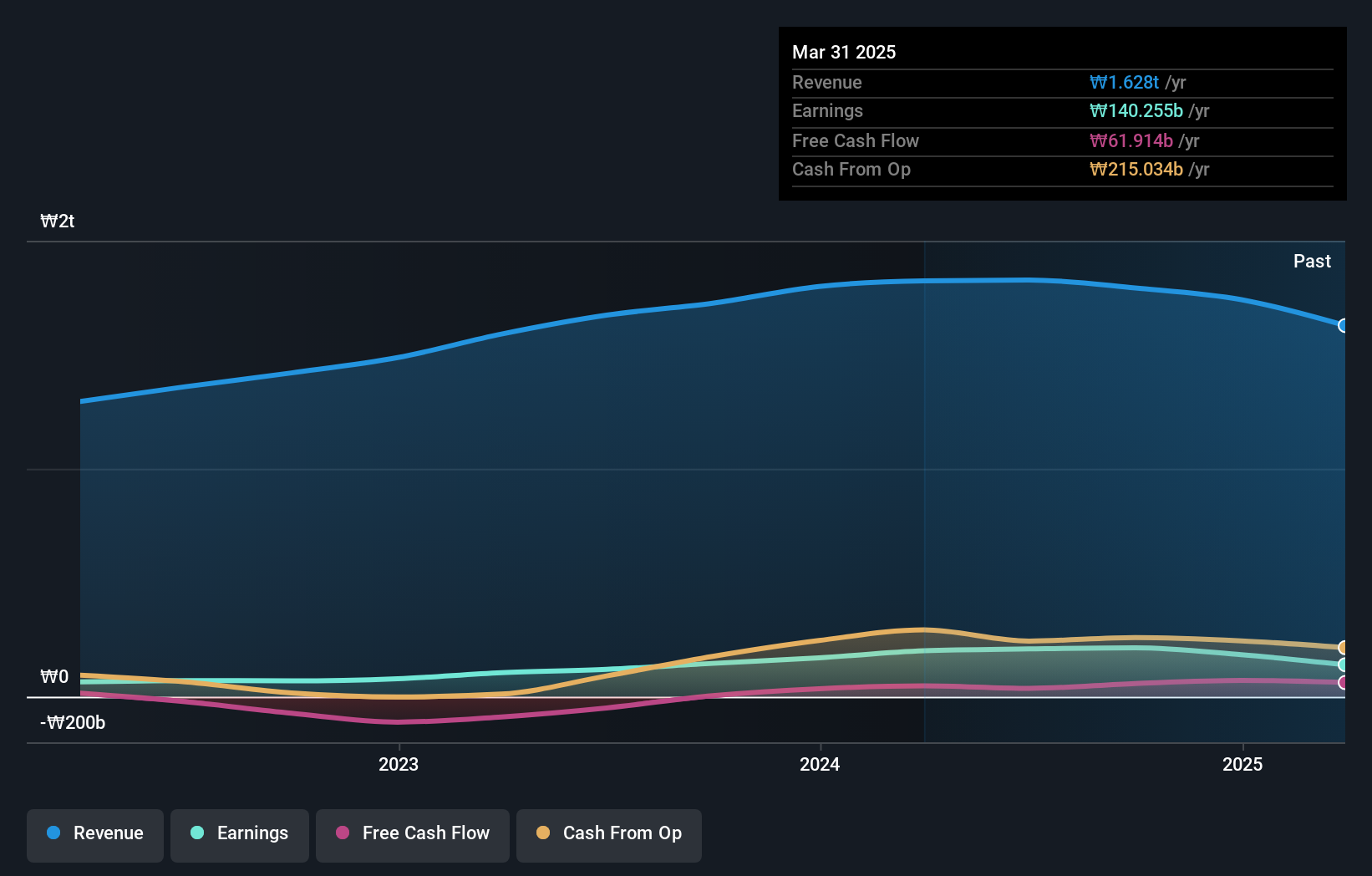

Hanil Cement, a notable player in South Korea's materials sector, has seen its earnings grow by 90.7% over the past year, outpacing the industry average of 7.2%. With high-quality earnings and a forecasted annual growth rate of 6.57%, Hanil is on an upward trajectory. Its net debt to equity ratio stands at a satisfactory 20.8%, and interest payments are well covered by EBIT at 14.5 times coverage, indicating robust financial health despite recent challenges in free cash flow management.

- Click here and access our complete health analysis report to understand the dynamics of Hanil Cement.

Explore historical data to track Hanil Cement's performance over time in our Past section.

Next Steps

- Click this link to deep-dive into the 189 companies within our KRX Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A399720

Mediocre balance sheet very low.

Market Insights

Community Narratives