- South Korea

- /

- Metals and Mining

- /

- KOSE:A139990

AJUSTEEL Co.,Ltd's (KRX:139990) Shares Not Telling The Full Story

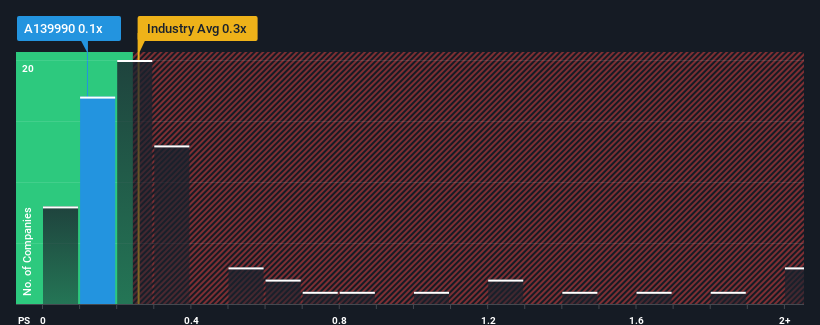

With a median price-to-sales (or "P/S") ratio of close to 0.3x in the Metals and Mining industry in Korea, you could be forgiven for feeling indifferent about AJUSTEEL Co.,Ltd's (KRX:139990) P/S ratio of 0.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for AJUSTEELLtd

How Has AJUSTEELLtd Performed Recently?

Recent times have been pleasing for AJUSTEELLtd as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. Those who are bullish on AJUSTEELLtd will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AJUSTEELLtd.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like AJUSTEELLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 29% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 24% over the next year. That's shaping up to be materially higher than the 8.8% growth forecast for the broader industry.

In light of this, it's curious that AJUSTEELLtd's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On AJUSTEELLtd's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at AJUSTEELLtd's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 3 warning signs for AJUSTEELLtd you should be aware of, and 2 of them don't sit too well with us.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A139990

AJUSTEELLtd

Manufactures and sells steel products in South Korea and internationally.

Slight risk and slightly overvalued.

Market Insights

Community Narratives