- South Korea

- /

- Chemicals

- /

- KOSE:A093370

Revenues Tell The Story For Foosung Co., Ltd. (KRX:093370) As Its Stock Soars 62%

Despite an already strong run, Foosung Co., Ltd. (KRX:093370) shares have been powering on, with a gain of 62% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 53% in the last year.

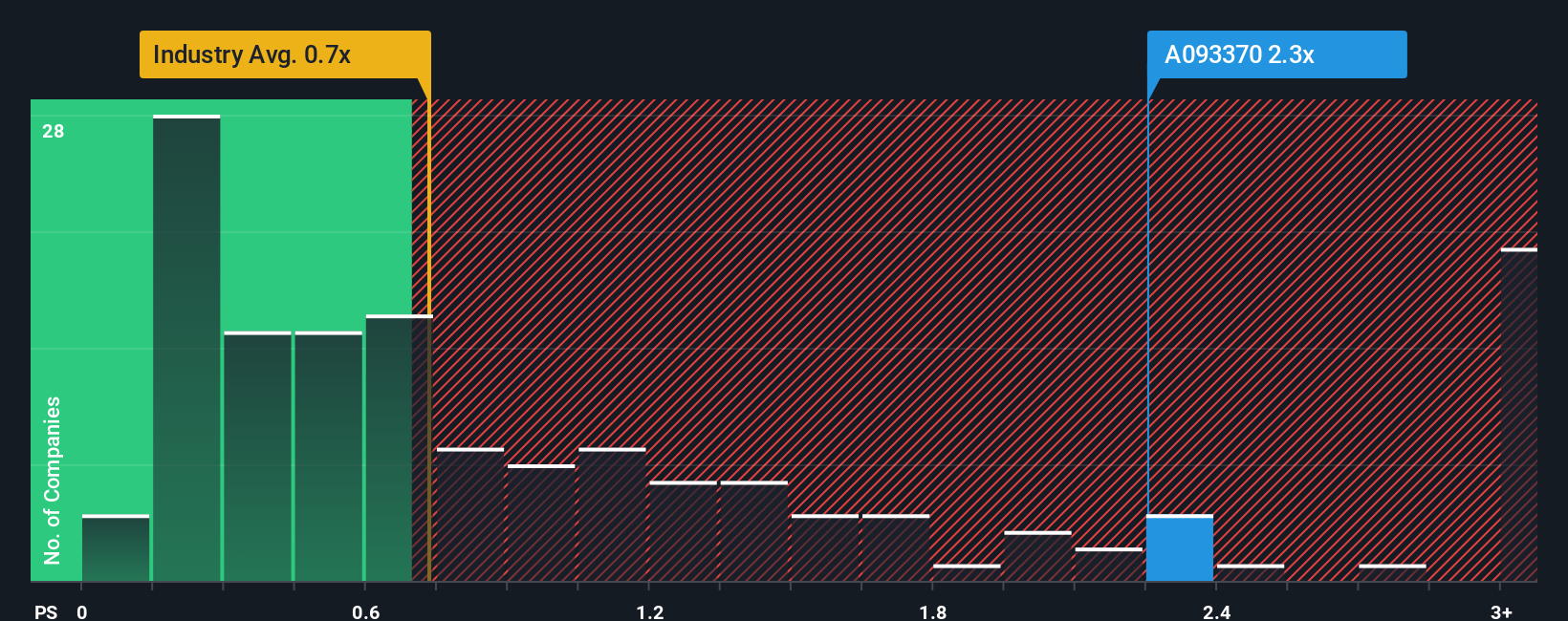

Since its price has surged higher, you could be forgiven for thinking Foosung is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.3x, considering almost half the companies in Korea's Chemicals industry have P/S ratios below 0.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Foosung

How Has Foosung Performed Recently?

Foosung hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Foosung.How Is Foosung's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Foosung's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. This isn't what shareholders were looking for as it means they've been left with a 19% decline in revenue over the last three years in total. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 19% over the next year. That's shaping up to be materially higher than the 11% growth forecast for the broader industry.

With this information, we can see why Foosung is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Foosung's P/S

Foosung's P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Foosung maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Chemicals industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Foosung that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A093370

Foosung

Engages in the manufacture and sale of chemical products for automotive, iron and steel, semiconductor, construction, and environmental industries in South Korea.

Reasonable growth potential with very low risk.

Market Insights

Community Narratives