- South Korea

- /

- Metals and Mining

- /

- KOSE:A058430

3 Dividend Stocks Yielding Up To 7.2%

Reviewed by Simply Wall St

In a week marked by volatility, global markets experienced mixed outcomes as the U.S. Federal Reserve held interest rates steady while the European Central Bank opted for a rate cut, influencing investor sentiment across regions. Amidst these economic shifts and competitive pressures in technology sectors, dividend stocks remain an attractive option for investors seeking income stability and potential growth within their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.84% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.70% | ★★★★★★ |

Click here to see the full list of 1961 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

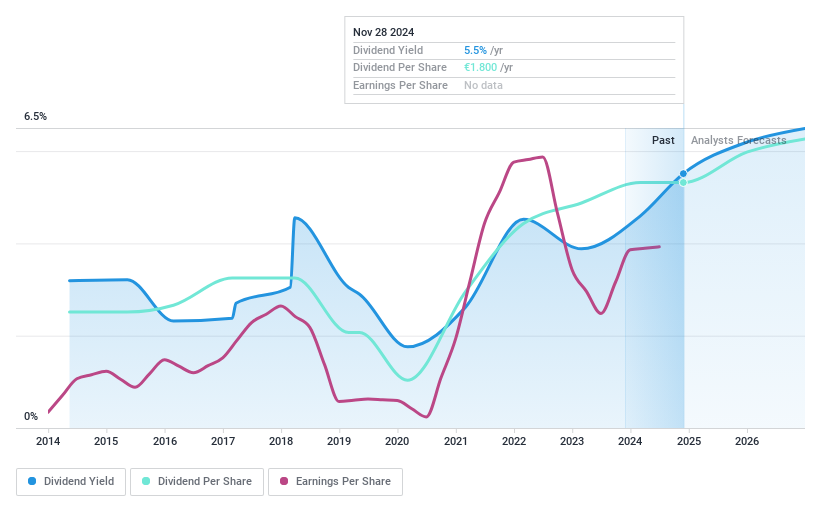

NV Bekaert (ENXTBR:BEKB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NV Bekaert SA is a global company specializing in steel wire transformation and coating technologies, with a market capitalization of €1.75 billion.

Operations: NV Bekaert SA's revenue segments include €1.77 billion from Rubber Reinforcement, €1.13 billion from Steel Wire Solutions, €672.27 million from Specialty Businesses, and €548.20 million from Bridon-Bekaert Ropes Group.

Dividend Yield: 5.3%

NV Bekaert's dividend payments are covered by both earnings and cash flows, with payout ratios of 37.3% and 52.5% respectively, indicating sustainability. However, the dividends have been volatile over the past decade, affecting reliability for investors seeking stable income streams. Despite recent earnings growth of 52.4%, future sales are projected to be slightly below €4 billion due to lower volumes and pricing pressures. The dividend yield is modest compared to top-tier Belgian payers at 5.33%.

- Click here to discover the nuances of NV Bekaert with our detailed analytical dividend report.

- The analysis detailed in our NV Bekaert valuation report hints at an deflated share price compared to its estimated value.

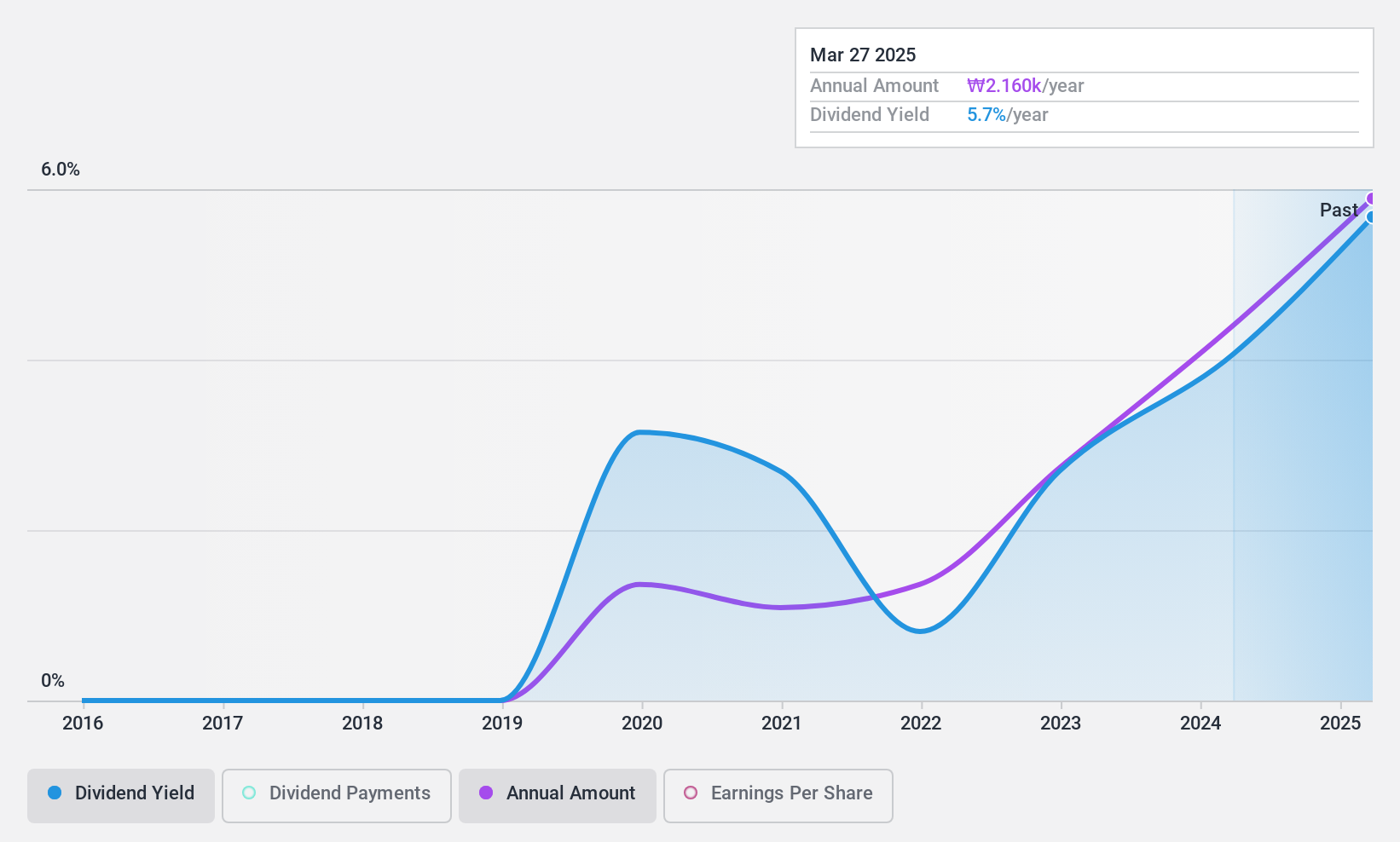

POSCO STEELEON (KOSE:A058430)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: POSCO STEELEON Co., Ltd. manufactures, processes, and sells steel products both in South Korea and internationally, with a market cap of ₩175.22 billion.

Operations: POSCO STEELEON Co., Ltd.'s revenue primarily comes from its Metal Processors and Fabrication segment, generating approximately ₩1.21 billion.

Dividend Yield: 5.5%

POSCO STEELEON's dividends are well-covered by earnings and cash flows, with payout ratios of 35.4% and 24.2% respectively, suggesting sustainability. Its dividend yield of 5.52% ranks in the top quarter of Korean payers, though its track record is unstable due to volatility over five years. Despite a significant earnings growth last year, the dividends remain unreliable for those prioritizing consistent income streams. The stock trades significantly below its estimated fair value.

- Dive into the specifics of POSCO STEELEON here with our thorough dividend report.

- Upon reviewing our latest valuation report, POSCO STEELEON's share price might be too pessimistic.

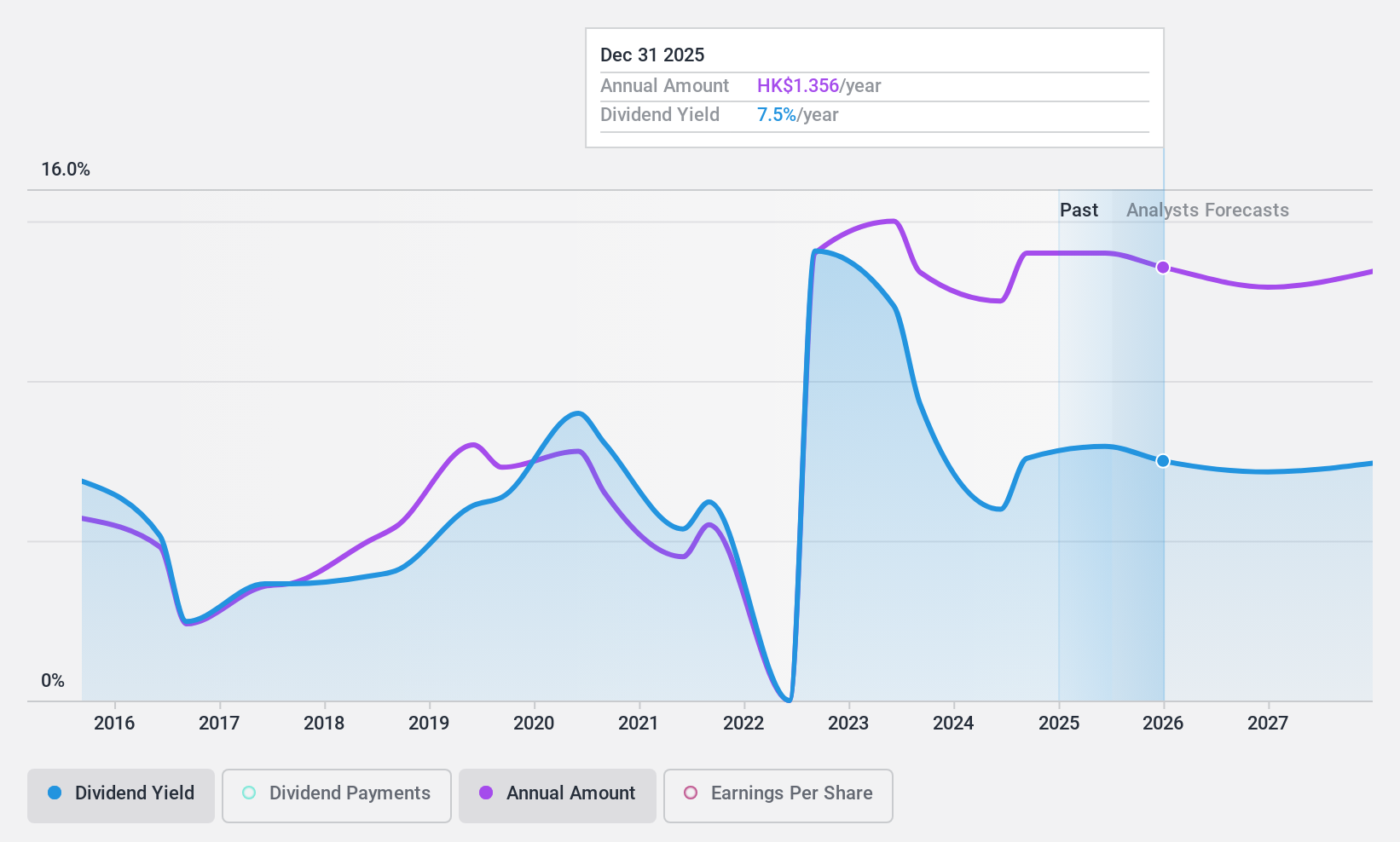

CNOOC (SEHK:883)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNOOC Limited is an investment holding company involved in the exploration, development, production, and sale of crude oil and natural gas in China, Canada, and internationally, with a market cap of approximately HK$923.98 billion.

Operations: CNOOC Limited's revenue primarily comes from its operations in the exploration, development, production, and sale of crude oil and natural gas across various regions including China and Canada.

Dividend Yield: 7.2%

CNOOC's dividend yield of 7.23% is below the top 25% in Hong Kong, yet its dividends are covered by earnings and cash flows, with payout ratios of 41.7% and 55.4%, respectively. Despite a decade-long volatile dividend history, recent earnings growth of 9.4% supports coverage sustainability. The stock trades at a significant discount to estimated fair value, though future earnings are expected to decline slightly over the next three years.

- Get an in-depth perspective on CNOOC's performance by reading our dividend report here.

- Our valuation report here indicates CNOOC may be undervalued.

Where To Now?

- Delve into our full catalog of 1961 Top Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A058430

POSCO STEELEON

Manufactures, processes, and sells steel products in South Korea and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives