There are a few key trends to look for if we want to identify the next multi-bagger. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. Having said that, from a first glance at LG Chem (KRX:051910) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for LG Chem, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.03 = ₩1.9t ÷ (₩82t - ₩19t) (Based on the trailing twelve months to March 2024).

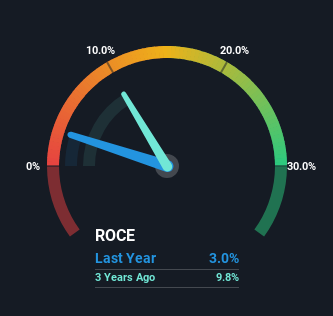

So, LG Chem has an ROCE of 3.0%. In absolute terms, that's a low return and it also under-performs the Chemicals industry average of 5.9%.

Check out our latest analysis for LG Chem

In the above chart we have measured LG Chem's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for LG Chem .

What Can We Tell From LG Chem's ROCE Trend?

Unfortunately, the trend isn't great with ROCE falling from 8.0% five years ago, while capital employed has grown 174%. However, some of the increase in capital employed could be attributed to the recent capital raising that's been completed prior to their latest reporting period, so keep that in mind when looking at the ROCE decrease. The funds raised likely haven't been put to work yet so it's worth watching what happens in the future with LG Chem's earnings and if they change as a result from the capital raise.

In Conclusion...

In summary, LG Chem is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. And investors may be recognizing these trends since the stock has only returned a total of 25% to shareholders over the last five years. So if you're looking for a multi-bagger, the underlying trends indicate you may have better chances elsewhere.

If you'd like to know about the risks facing LG Chem, we've discovered 1 warning sign that you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A051910

LG Chem

Engages in the petrochemicals, energy, advanced materials, and life science businesses in Korea, China, Asia/Oceania, the United States, Europe, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives