- South Korea

- /

- Metals and Mining

- /

- KOSE:A019440

We Wouldn't Be Too Quick To Buy SeAH SPECIAL STEEL CO., LTD. (KRX:019440) Before It Goes Ex-Dividend

SeAH SPECIAL STEEL CO., LTD. (KRX:019440) stock is about to trade ex-dividend in three days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. This means that investors who purchase SeAH SPECIAL STEEL's shares on or after the 27th of December will not receive the dividend, which will be paid on the 21st of April.

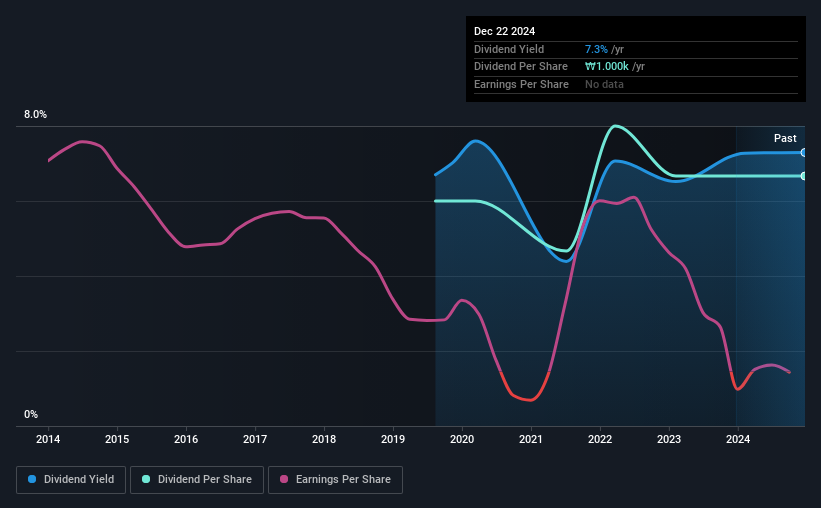

The company's upcoming dividend is ₩1000.00 a share, following on from the last 12 months, when the company distributed a total of ₩1,000 per share to shareholders. Calculating the last year's worth of payments shows that SeAH SPECIAL STEEL has a trailing yield of 7.3% on the current share price of ₩13710.00. If you buy this business for its dividend, you should have an idea of whether SeAH SPECIAL STEEL's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for SeAH SPECIAL STEEL

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. SeAH SPECIAL STEEL reported a loss last year, so it's not great to see that it has continued paying a dividend. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If SeAH SPECIAL STEEL didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. It distributed 30% of its free cash flow as dividends, a comfortable payout level for most companies.

Click here to see how much of its profit SeAH SPECIAL STEEL paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. SeAH SPECIAL STEEL was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. SeAH SPECIAL STEEL has delivered an average of 2.1% per year annual increase in its dividend, based on the past five years of dividend payments.

Get our latest analysis on SeAH SPECIAL STEEL's balance sheet health here.

Final Takeaway

Has SeAH SPECIAL STEEL got what it takes to maintain its dividend payments? It's hard to get used to SeAH SPECIAL STEEL paying a dividend despite reporting a loss over the past year. At least the dividend was covered by free cash flow, however. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Although, if you're still interested in SeAH SPECIAL STEEL and want to know more, you'll find it very useful to know what risks this stock faces. To that end, you should learn about the 4 warning signs we've spotted with SeAH SPECIAL STEEL (including 2 which are significant).

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A019440

SeAH SPECIAL STEEL

SeAH SPECIALSTEEL CO., LTD. manufactures and sells wire rods and steel bars in South Korea and internationally.

Good value slight.