- South Korea

- /

- Chemicals

- /

- KOSE:A011790

Market Participants Recognise SKC Co., Ltd.'s (KRX:011790) Revenues Pushing Shares 28% Higher

SKC Co., Ltd. (KRX:011790) shares have had a really impressive month, gaining 28% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

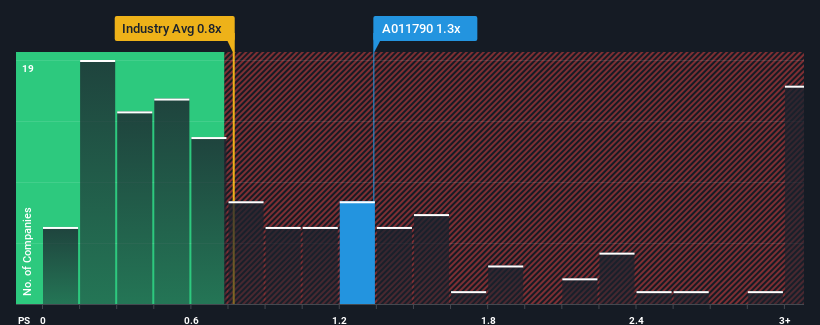

After such a large jump in price, given close to half the companies operating in Korea's Chemicals industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider SKC as a stock to potentially avoid with its 1.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for SKC

How Has SKC Performed Recently?

While the industry has experienced revenue growth lately, SKC's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SKC.Is There Enough Revenue Growth Forecasted For SKC?

There's an inherent assumption that a company should outperform the industry for P/S ratios like SKC's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 8.0% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 16% each year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 11% per year, which is noticeably less attractive.

With this in mind, it's not hard to understand why SKC's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

SKC shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into SKC shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for SKC that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011790

SKC

Manufactures and sells basic chemical raw materials and copper foils for batteries.

Limited growth with minimal risk.

Similar Companies

Market Insights

Community Narratives