- South Korea

- /

- Chemicals

- /

- KOSE:A004430

Songwon Industrial's (KRX:004430) Stock Price Has Reduced 31% In The Past Three Years

Many investors define successful investing as beating the market average over the long term. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Songwon Industrial Co., Ltd. (KRX:004430) shareholders have had that experience, with the share price dropping 31% in three years, versus a market return of about 28%. It's down 2.4% in the last seven days.

See our latest analysis for Songwon Industrial

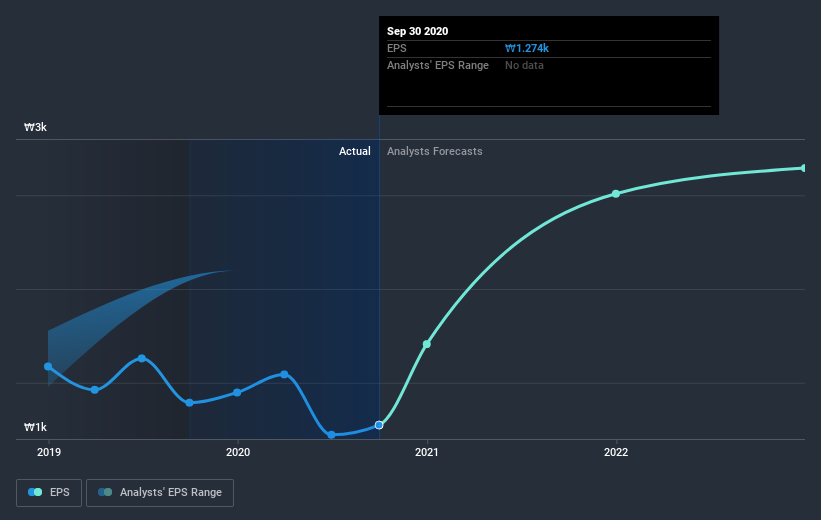

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Songwon Industrial saw its EPS decline at a compound rate of 4.3% per year, over the last three years. This reduction in EPS is slower than the 12% annual reduction in the share price. So it seems the market was too confident about the business, in the past.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Songwon Industrial's earnings, revenue and cash flow.

A Different Perspective

Songwon Industrial shareholders are up 12% for the year (even including dividends). Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 3% per year over five year. It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand Songwon Industrial better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Songwon Industrial you should know about.

We will like Songwon Industrial better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Songwon Industrial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A004430

Songwon Industrial

Manufactures and sells polymer stabilizers, tin intermediates, PVC stabilizers, and specialty chemicals in South Korea, Rest of Asia, Europe, North and South America, Australia, the Middle East, and Africa.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives