- South Korea

- /

- Basic Materials

- /

- KOSE:A004090

There's Reason For Concern Over Korea Petroleum Industries Company's (KRX:004090) Massive 33% Price Jump

Korea Petroleum Industries Company (KRX:004090) shares have continued their recent momentum with a 33% gain in the last month alone. The annual gain comes to 130% following the latest surge, making investors sit up and take notice.

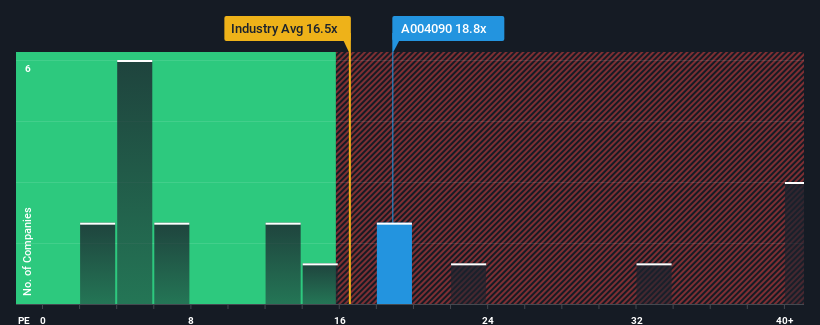

Since its price has surged higher, Korea Petroleum Industries' price-to-earnings (or "P/E") ratio of 18.8x might make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 11x and even P/E's below 6x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Korea Petroleum Industries has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Korea Petroleum Industries

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Korea Petroleum Industries' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 78% gain to the company's bottom line. The latest three year period has also seen an excellent 107% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 31% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it concerning that Korea Petroleum Industries is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Shares in Korea Petroleum Industries have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Korea Petroleum Industries currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Korea Petroleum Industries is showing 2 warning signs in our investment analysis, you should know about.

You might be able to find a better investment than Korea Petroleum Industries. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Korea Petroleum Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A004090

Korea Petroleum Industries

Manufactures and sells asphalt, solvents, and building materials in South Korea and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives