- South Korea

- /

- Chemicals

- /

- KOSE:A003780

Even With A 30% Surge, Cautious Investors Are Not Rewarding Chin Yang Industry Co., Ltd.'s (KRX:003780) Performance Completely

Despite an already strong run, Chin Yang Industry Co., Ltd. (KRX:003780) shares have been powering on, with a gain of 30% in the last thirty days. The last 30 days bring the annual gain to a very sharp 79%.

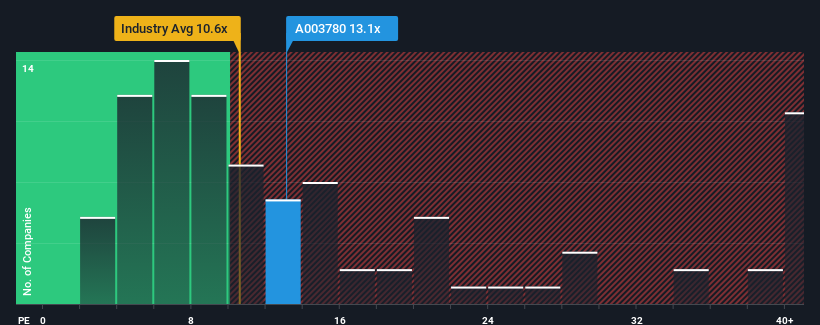

Although its price has surged higher, you could still be forgiven for feeling indifferent about Chin Yang Industry's P/E ratio of 13.1x, since the median price-to-earnings (or "P/E") ratio in Korea is also close to 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, Chin Yang Industry has been doing very well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Chin Yang Industry

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Chin Yang Industry's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 35%. Pleasingly, EPS has also lifted 173% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 33% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Chin Yang Industry's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Chin Yang Industry's P/E?

Its shares have lifted substantially and now Chin Yang Industry's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Chin Yang Industry currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Chin Yang Industry (1 is a bit unpleasant!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Chin Yang Industry. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A003780

Chin Yang Industry

Engages the manufacture and sale of plastic foam molded products in South Korea.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives