- South Korea

- /

- Chemicals

- /

- KOSE:A003240

Taekwang Industrial's (KRX:003240) Shareholders Are Down 24% On Their Shares

While it may not be enough for some shareholders, we think it is good to see the Taekwang Industrial Co., Ltd. (KRX:003240) share price up 19% in a single quarter. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 24% in the last three years, falling well short of the market return.

See our latest analysis for Taekwang Industrial

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, Taekwang Industrial actually saw its earnings per share (EPS) improve by 9.3% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

The modest 0.2% dividend yield is unlikely to be guiding the market view of the stock. Arguably the revenue decline of 4.0% per year has people thinking Taekwang Industrial is shrinking. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

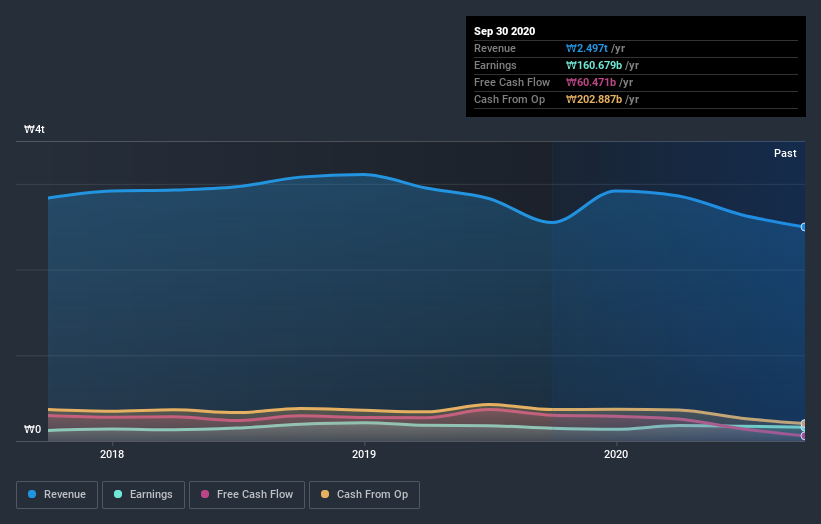

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Taekwang Industrial shareholders gained a total return of 18% during the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 1.4% per year, over five years. So this might be a sign the business has turned its fortunes around. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Taekwang Industrial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taekwang Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A003240

Taekwang Industrial

Taekwang Industrial Co., Ltd. petrochemicals, synthetic fibers, textiles, and advanced materials in South Korea and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives