- South Korea

- /

- Metals and Mining

- /

- KOSE:A003030

What Kind Of Shareholders Hold The Majority In SeAH Steel Holdings Corporation's (KRX:003030) Shares?

If you want to know who really controls SeAH Steel Holdings Corporation (KRX:003030), then you'll have to look at the makeup of its share registry. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

SeAH Steel Holdings is not a large company by global standards. It has a market capitalization of ₩188b, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutional investors have bought into the company. We can zoom in on the different ownership groups, to learn more about SeAH Steel Holdings.

Check out our latest analysis for SeAH Steel Holdings

What Does The Institutional Ownership Tell Us About SeAH Steel Holdings?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

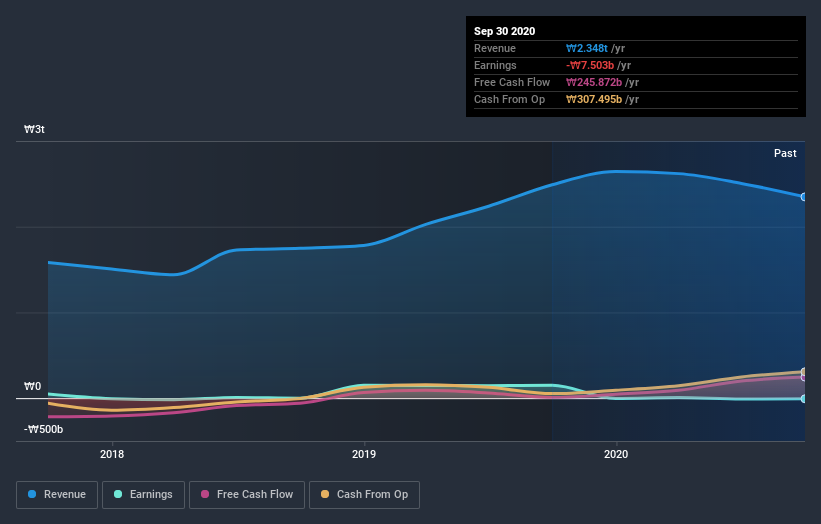

As you can see, institutional investors have a fair amount of stake in SeAH Steel Holdings. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of SeAH Steel Holdings, (below). Of course, keep in mind that there are other factors to consider, too.

Hedge funds don't have many shares in SeAH Steel Holdings. Looking at our data, we can see that the largest shareholder is Apac Investors Co., Ltd. with 23% of shares outstanding. For context, the second largest shareholder holds about 22% of the shares outstanding, followed by an ownership of 13% by the third-largest shareholder. Two of the top three shareholders happen to be Senior Key Executive and Chairman of the Board, respectively. That is, insiders feature higher up in the heirarchy of the company's top shareholders.

To make our study more interesting, we found that the top 3 shareholders have a majority ownership in the company, meaning that they are powerful enough to influence the decisions of the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of SeAH Steel Holdings

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own a reasonable proportion of SeAH Steel Holdings Corporation. It has a market capitalization of just ₩188b, and insiders have ₩71b worth of shares in their own names. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

With a 23% ownership, the general public have some degree of sway over SeAH Steel Holdings. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

We can see that Private Companies own 23%, of the shares on issue. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with SeAH Steel Holdings (including 2 which are potentially serious) .

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade SeAH Steel Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A003030

SeAH Steel Holdings

Manufactures and sells steel products in South Korea, the United States, Japan, China, Vietnam, the United Arab Emirates, Italy, and Indonesia.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026