- South Korea

- /

- Metals and Mining

- /

- KOSE:A002710

TCC Steel Corp. (KRX:002710) Stocks Shoot Up 63% But Its P/S Still Looks Reasonable

TCC Steel Corp. (KRX:002710) shares have had a really impressive month, gaining 63% after a shaky period beforehand. The last 30 days were the cherry on top of the stock's 555% gain in the last year, which is nothing short of spectacular.

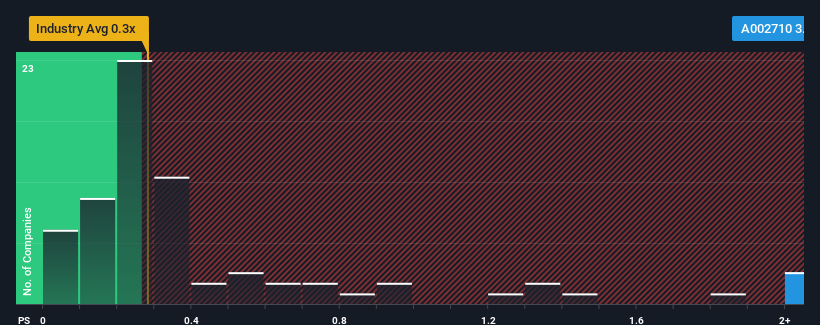

Since its price has surged higher, given around half the companies in Korea's Metals and Mining industry have price-to-sales ratios (or "P/S") below 0.3x, you may consider TCC Steel as a stock to avoid entirely with its 3.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for TCC Steel

What Does TCC Steel's Recent Performance Look Like?

As an illustration, revenue has deteriorated at TCC Steel over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on TCC Steel will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as TCC Steel's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.7%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 47% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

When compared to the industry's one-year growth forecast of 10%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why TCC Steel's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Shares in TCC Steel have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of TCC Steel revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for TCC Steel you should be aware of, and 1 of them is significant.

If you're unsure about the strength of TCC Steel's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if TCC Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A002710

TCC Steel

Engages in the manufacture and sale of stone coated steel sheets, and other surface-treated steel sheets in South Korea, Asia, Europe, the Middle East, North America, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives