- South Korea

- /

- Metals and Mining

- /

- KOSE:A001390

We Think KG Chemical (KRX:001390) Is Taking Some Risk With Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that KG Chemical Corporation (KRX:001390) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for KG Chemical

What Is KG Chemical's Net Debt?

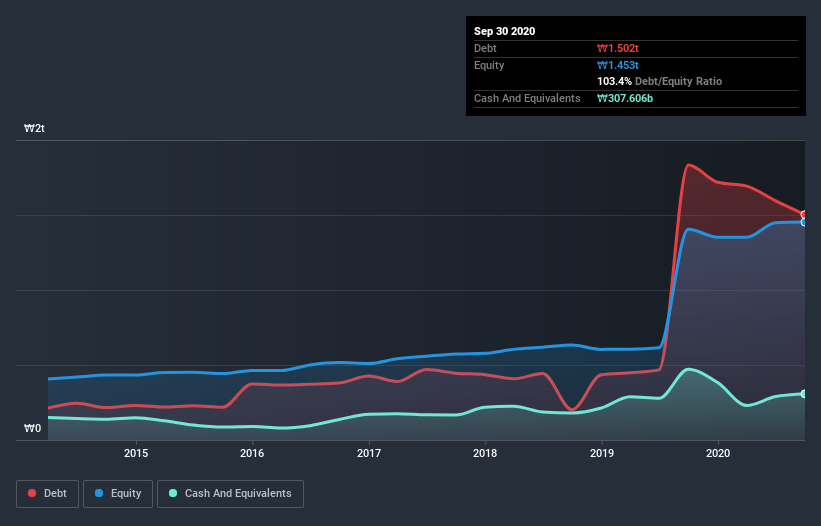

You can click the graphic below for the historical numbers, but it shows that KG Chemical had ₩1.50t of debt in September 2020, down from ₩1.83t, one year before. However, because it has a cash reserve of ₩307.6b, its net debt is less, at about ₩1.19t.

How Strong Is KG Chemical's Balance Sheet?

According to the last reported balance sheet, KG Chemical had liabilities of ₩1.37t due within 12 months, and liabilities of ₩1.25t due beyond 12 months. On the other hand, it had cash of ₩307.6b and ₩412.0b worth of receivables due within a year. So it has liabilities totalling ₩1.89t more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the ₩357.3b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, KG Chemical would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

KG Chemical has a debt to EBITDA ratio of 3.7 and its EBIT covered its interest expense 6.4 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Pleasingly, KG Chemical is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 152% gain in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since KG Chemical will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, KG Chemical recorded free cash flow worth a fulsome 87% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

We feel some trepidation about KG Chemical's difficulty level of total liabilities, but we've got positives to focus on, too. To wit both its conversion of EBIT to free cash flow and EBIT growth rate were encouraging signs. Looking at all the angles mentioned above, it does seem to us that KG Chemical is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for KG Chemical you should be aware of, and 1 of them doesn't sit too well with us.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade KG Chemical, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KG Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A001390

KG Chemical

Manufactures and supplies fertilizers and concrete compound ingredients products in South Korea and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives