- South Korea

- /

- Paper and Forestry Products

- /

- KOSE:A000180

Did Sungchang Enterprise Holdings' (KRX:000180) Share Price Deserve to Gain 74%?

Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. To wit, the Sungchang Enterprise Holdings Limited (KRX:000180) share price is 74% higher than it was a year ago, much better than the market return of around 52% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! On the other hand, longer term shareholders have had a tougher run, with the stock falling 14% in three years.

View our latest analysis for Sungchang Enterprise Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Sungchang Enterprise Holdings went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

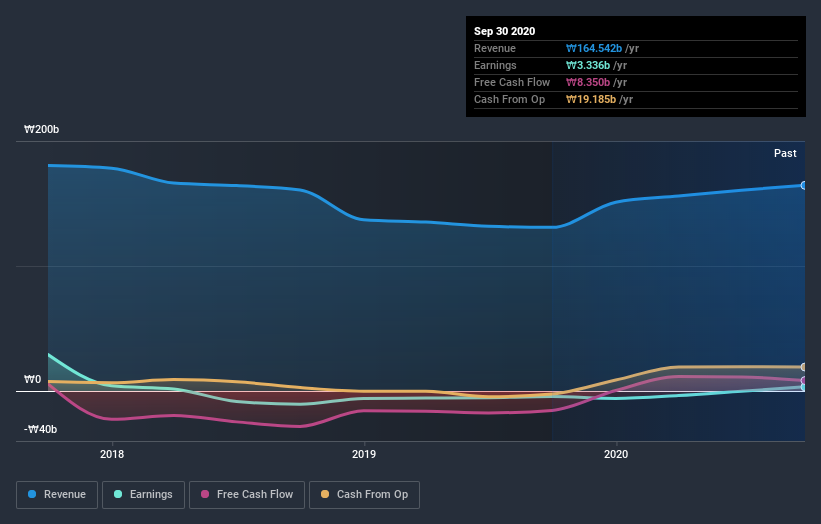

We think that the revenue growth of 25% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Sungchang Enterprise Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Sungchang Enterprise Holdings shareholders have received a total shareholder return of 74% over the last year. That certainly beats the loss of about 7% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before deciding if you like the current share price, check how Sungchang Enterprise Holdings scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Sungchang Enterprise Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A000180

Sungchang Enterprise Holdings

Engages in the development of various plant species and forest restoration activities in South Korea.

Adequate balance sheet and fair value.

Market Insights

Community Narratives