- South Korea

- /

- Biotech

- /

- KOSDAQ:A196170

KRX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The South Korean market has experienced a flat performance over the last week but has shown a 6.4% increase over the past year, with earnings projected to grow by 31% annually. In this context, growth companies with high insider ownership can be particularly appealing as they often reflect strong confidence from those closest to the business, potentially aligning well with anticipated market growth.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

Let's review some notable picks from our screened stocks.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩19.60 trillion.

Operations: The company's revenue primarily comes from its biotechnology segment, totaling ₩90.79 million.

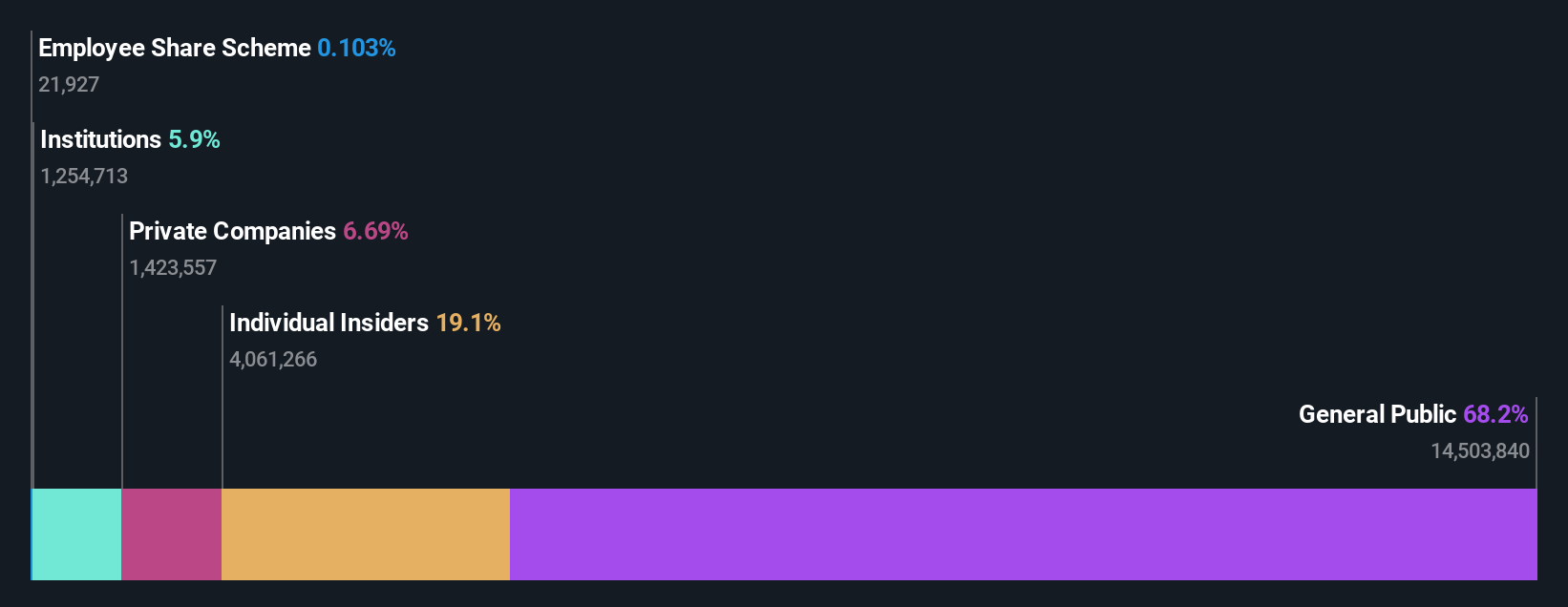

Insider Ownership: 26.6%

Return On Equity Forecast: 66% (2027 estimate)

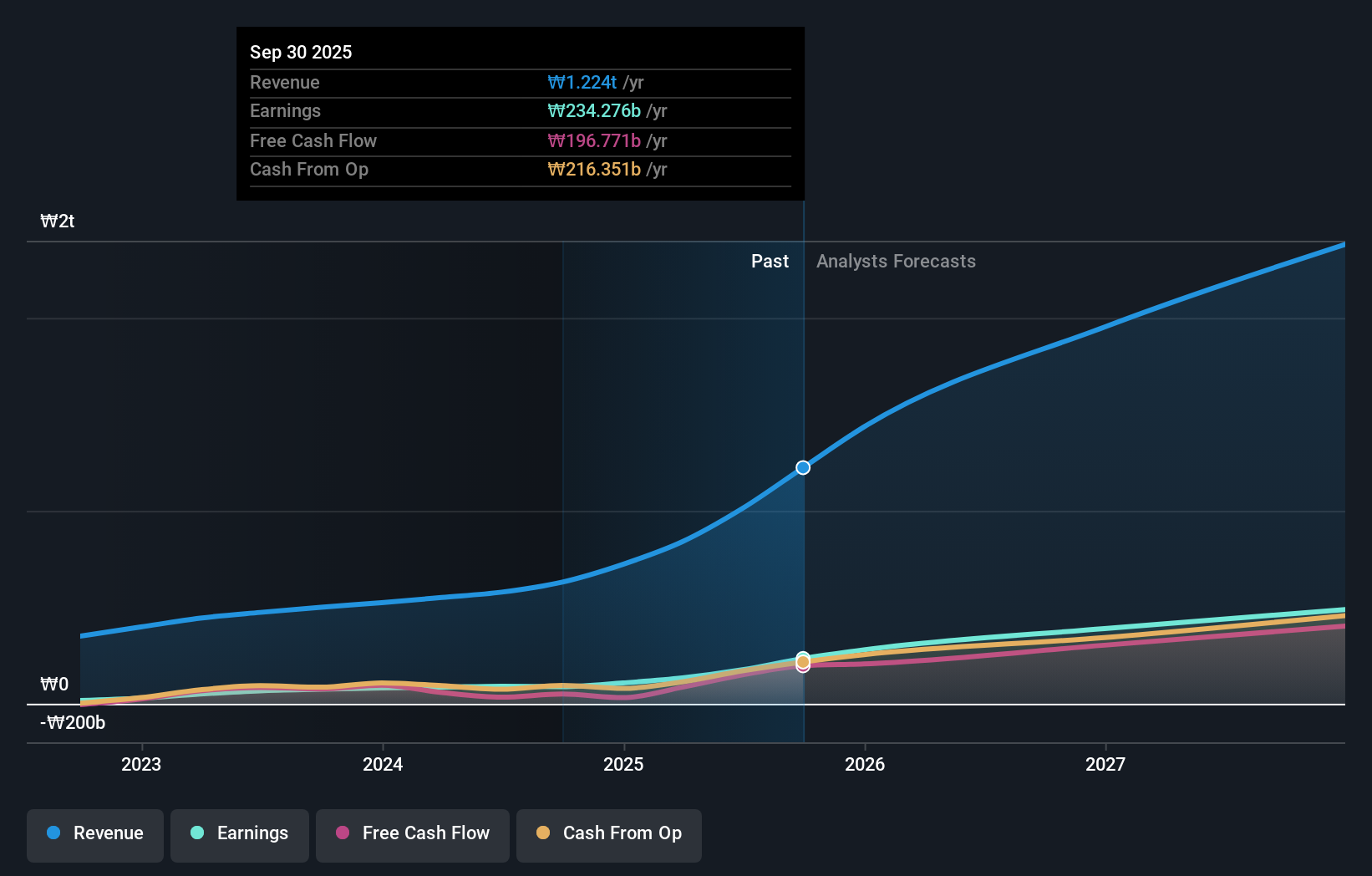

ALTEOGEN is poised for significant growth, with revenue projected to increase by 64.2% annually, outpacing the South Korean market's 10.5% growth rate. Despite past shareholder dilution, its return on equity is expected to reach a very high level of 66.3% in three years. The company trades at a substantial discount, at 71.7% below estimated fair value, and is forecasted to achieve profitability within the next three years with above-average market growth expectations.

- Click to explore a detailed breakdown of our findings in ALTEOGEN's earnings growth report.

- Upon reviewing our latest valuation report, ALTEOGEN's share price might be too optimistic.

Enchem (KOSDAQ:A348370)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enchem Co., Ltd. manufactures and sells electrolytes and additives for secondary batteries and EDLC, with a market cap of ₩4.24 trillion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, amounting to ₩348.75 million.

Insider Ownership: 19.4%

Return On Equity Forecast: N/A (2027 estimate)

Enchem is set for strong expansion, with revenue projected to grow 63% annually, surpassing the South Korean market's 10.5% growth rate. Despite past shareholder dilution and recent share price volatility, the company is expected to achieve profitability within three years, outpacing average market growth. Insider ownership remains significant, though recent insider trading data is unavailable. The company's earnings are forecasted to increase by a substantial 155.2% annually over the same period.

- Delve into the full analysis future growth report here for a deeper understanding of Enchem.

- Insights from our recent valuation report point to the potential overvaluation of Enchem shares in the market.

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: APR Co., Ltd is a company that manufactures and sells cosmetic products for men and women, with a market cap of ₩2.02 billion.

Operations: The company's revenue segments include Cosmetics, generating ₩614.77 billion, and Apparel Fashion, contributing ₩64.46 billion.

Insider Ownership: 33.8%

Return On Equity Forecast: 32% (2027 estimate)

APR Co., Ltd.'s earnings are projected to grow significantly, with an annual increase of 25.6%, although slightly below the South Korean market's 30.1% forecast. The company's revenue growth is expected to outpace the market at 21.6% annually, and its Return on Equity is anticipated to reach a high level in three years. Trading at nearly half its estimated fair value, APR has completed a share buyback worth ₩19 billion and was recently added to the S&P Global BMI Index.

- Take a closer look at APR's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that APR is trading behind its estimated value.

Key Takeaways

- Embark on your investment journey to our 85 Fast Growing KRX Companies With High Insider Ownership selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A196170

ALTEOGEN

A bio company, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Exceptional growth potential with excellent balance sheet.