Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that KD Chem Co., Ltd. (KOSDAQ:221980) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for KD Chem

How Much Debt Does KD Chem Carry?

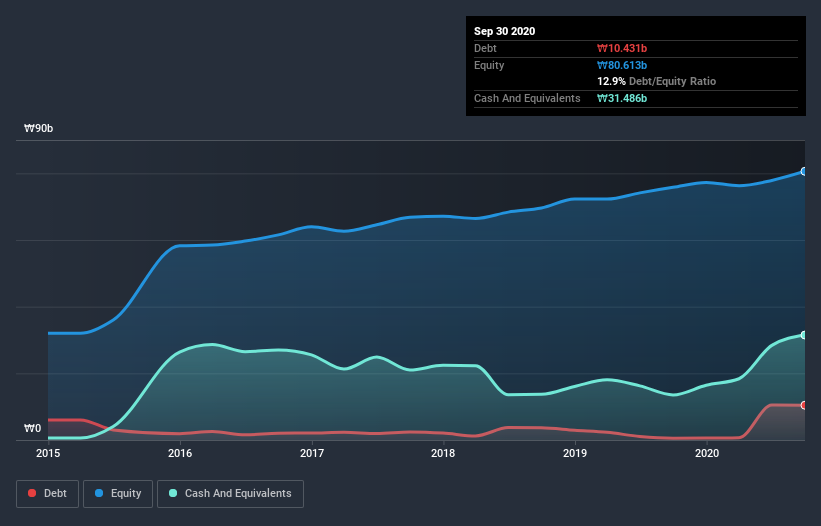

You can click the graphic below for the historical numbers, but it shows that as of September 2020 KD Chem had ₩10.4b of debt, an increase on ₩542.2m, over one year. However, it does have ₩31.5b in cash offsetting this, leading to net cash of ₩21.1b.

How Strong Is KD Chem's Balance Sheet?

According to the last reported balance sheet, KD Chem had liabilities of ₩12.7b due within 12 months, and liabilities of ₩3.47b due beyond 12 months. On the other hand, it had cash of ₩31.5b and ₩11.2b worth of receivables due within a year. So it can boast ₩26.5b more liquid assets than total liabilities.

This excess liquidity is a great indication that KD Chem's balance sheet is almost as strong as Fort Knox. Having regard to this fact, we think its balance sheet is as strong as an ox. Succinctly put, KD Chem boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, KD Chem's EBIT dived 12%, over the last year. If that rate of decline in earnings continues, the company could find itself in a tight spot. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since KD Chem will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. KD Chem may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, KD Chem actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that KD Chem has net cash of ₩21.1b, as well as more liquid assets than liabilities. And it impressed us with free cash flow of ₩11b, being 113% of its EBIT. So we don't think KD Chem's use of debt is risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that KD Chem is showing 2 warning signs in our investment analysis , you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading KD Chem or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KD Chem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A221980

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026