- South Korea

- /

- Basic Materials

- /

- KOSDAQ:A198440

KOREA CEMENT co., Ltd's (KOSDAQ:198440) 27% Price Boost Is Out Of Tune With Revenues

KOREA CEMENT co., Ltd (KOSDAQ:198440) shareholders have had their patience rewarded with a 27% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

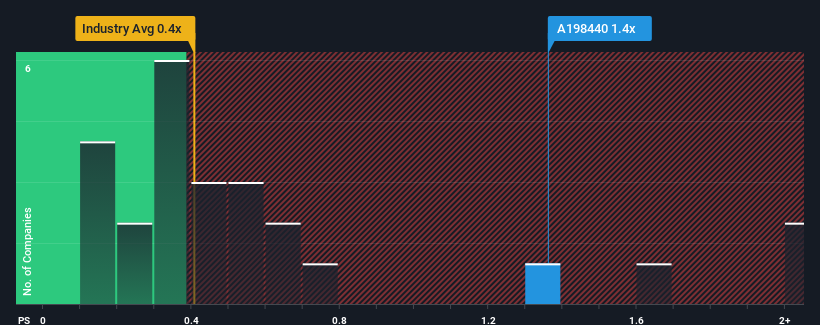

Since its price has surged higher, you could be forgiven for thinking KOREA CEMENT is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.4x, considering almost half the companies in Korea's Basic Materials industry have P/S ratios below 0.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for KOREA CEMENT

What Does KOREA CEMENT's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at KOREA CEMENT over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on KOREA CEMENT will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like KOREA CEMENT's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 28%. The last three years don't look nice either as the company has shrunk revenue by 28% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to shrink 1.3% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

With this information, it's strange that KOREA CEMENT is trading at a higher P/S in comparison. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Bottom Line On KOREA CEMENT's P/S

KOREA CEMENT shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that KOREA CEMENT currently trades on a much higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. Right now we aren't comfortable with the high P/S as this revenue performance is unlikely to support such positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. Unless the company's relative performance improves markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 3 warning signs for KOREA CEMENT (1 makes us a bit uncomfortable!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kangdong C&L might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A198440

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives