Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, LTC Co.,Ltd (KOSDAQ:170920) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for LTCLtd

How Much Debt Does LTCLtd Carry?

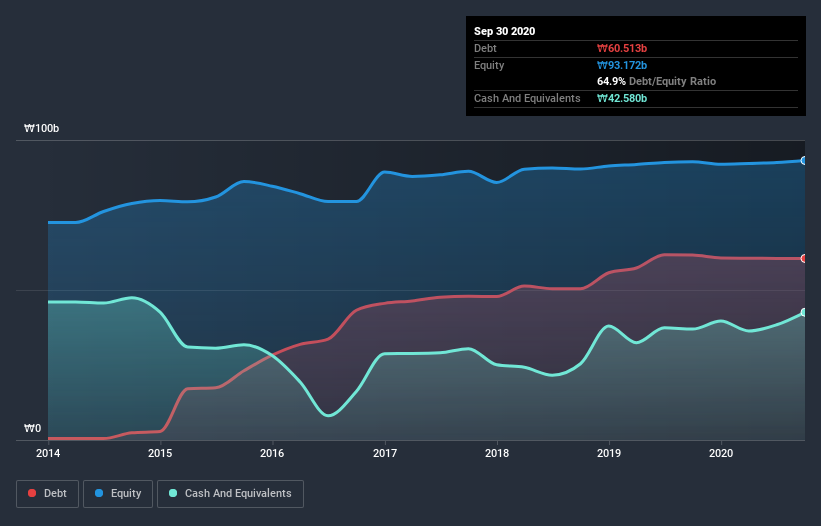

As you can see below, LTCLtd had ₩60.5b of debt, at September 2020, which is about the same as the year before. You can click the chart for greater detail. However, it does have ₩42.6b in cash offsetting this, leading to net debt of about ₩17.9b.

How Strong Is LTCLtd's Balance Sheet?

We can see from the most recent balance sheet that LTCLtd had liabilities of ₩46.2b falling due within a year, and liabilities of ₩33.7b due beyond that. Offsetting this, it had ₩42.6b in cash and ₩20.7b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩16.7b.

Of course, LTCLtd has a market capitalization of ₩88.9b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

LTCLtd has a very low debt to EBITDA ratio of 1.5 so it is strange to see weak interest coverage, with last year's EBIT being only 1.8 times the interest expense. So while we're not necessarily alarmed we think that its debt is far from trivial. Shareholders should be aware that LTCLtd's EBIT was down 28% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But it is LTCLtd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last two years, LTCLtd generated free cash flow amounting to a very robust 85% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

LTCLtd's EBIT growth rate and interest cover definitely weigh on it, in our esteem. But the good news is it seems to be able to convert EBIT to free cash flow with ease. Looking at all the angles mentioned above, it does seem to us that LTCLtd is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Take risks, for example - LTCLtd has 4 warning signs (and 2 which are potentially serious) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade LTCLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A170920

LTCLtd

Provides FPD and semiconductor chemical solutions in Korea and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives