- South Korea

- /

- Semiconductors

- /

- KOSE:A003160

Exploring Three KRX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The South Korea stock market has recently experienced a downward trend, with the KOSPI index declining over consecutive sessions amid global economic uncertainties and mixed performances across various sectors. In such a market environment, exploring growth companies with high insider ownership might offer investors potential resilience, as these firms often benefit from aligned interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| SamyoungLtd (KOSE:A003720) | 25% | 30.4% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| S&S Tech (KOSDAQ:A101490) | 21.6% | 44.1% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 76.8% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 78.1% |

| Devsisters (KOSDAQ:A194480) | 27.2% | 73.5% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

We'll examine a selection from our screener results.

Advanced Nano Products (KOSDAQ:A121600)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Nano Products Co., Ltd. specializes in manufacturing and selling high-tech materials for displays, semiconductors, secondary batteries, and solar cells, operating both in South Korea and internationally with a market cap of approximately ₩1.26 trillion.

Operations: The company generates revenue from the production and international sale of high-tech materials used in various applications including displays, semiconductors, secondary batteries, and solar cells.

Insider Ownership: 24%

Advanced Nano Products, a South Korean company, showcases strong growth potential with its revenue forecast to increase by 58.2% annually, outpacing the local market's 10.3%. Despite a recent drop in net income and earnings per share as reported in Q1 2024, the firm's aggressive revenue trajectory and anticipated earnings growth of 80.24% per year highlight its robust prospects. However, investor caution is advised due to recent shareholder dilution and lower profit margins compared to the previous year.

- Get an in-depth perspective on Advanced Nano Products' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Advanced Nano Products implies its share price may be too high.

Devsisters (KOSDAQ:A194480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Devsisters Corporation, based in South Korea, specializes in developing mobile games for both domestic and international markets, with a market capitalization of approximately ₩575.39 billion.

Operations: The company generates revenue primarily from the development of mobile games across both domestic and international markets.

Insider Ownership: 27.2%

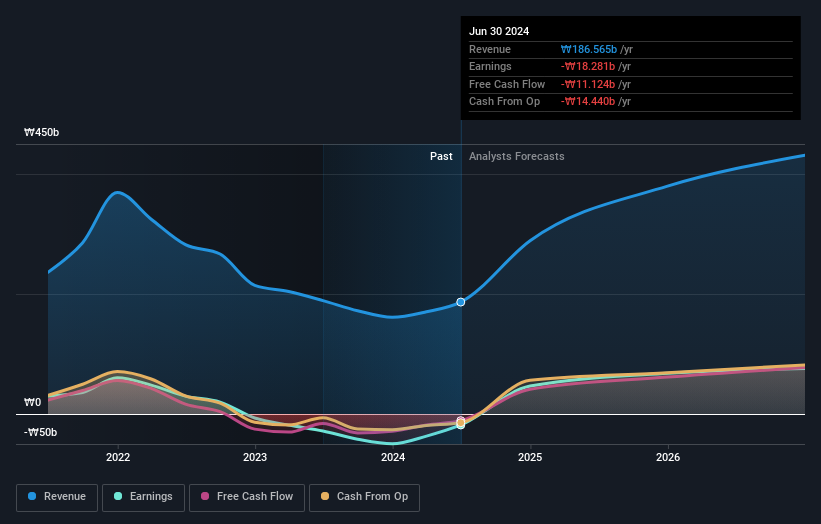

Devsisters, a South Korean company, is poised for significant growth with expected revenue increases of 22.4% annually, surpassing the local market's average of 10.3%. The firm is also projected to achieve profitability within the next three years with an anticipated annual profit surge of 73.54%. Additionally, its forecasted return on equity is high at 24.4% in three years' time. Currently trading at a modest discount to its fair value, Devsisters demonstrates strong internal confidence without recent insider selling or buying activity reported.

- Click to explore a detailed breakdown of our findings in Devsisters' earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Devsisters shares in the market.

D.I (KOSE:A003160)

Simply Wall St Growth Rating: ★★★★★★

Overview: D.I Corporation, with a market cap of approximately ₩469.51 billion, specializes in manufacturing and supplying semiconductor inspection equipment both domestically in South Korea and internationally.

Operations: The company generates its revenue primarily from the production and international sale of semiconductor inspection equipment.

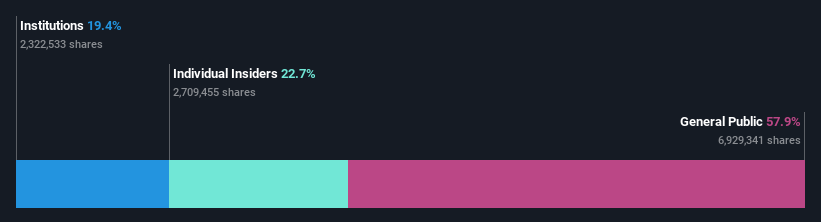

Insider Ownership: 32%

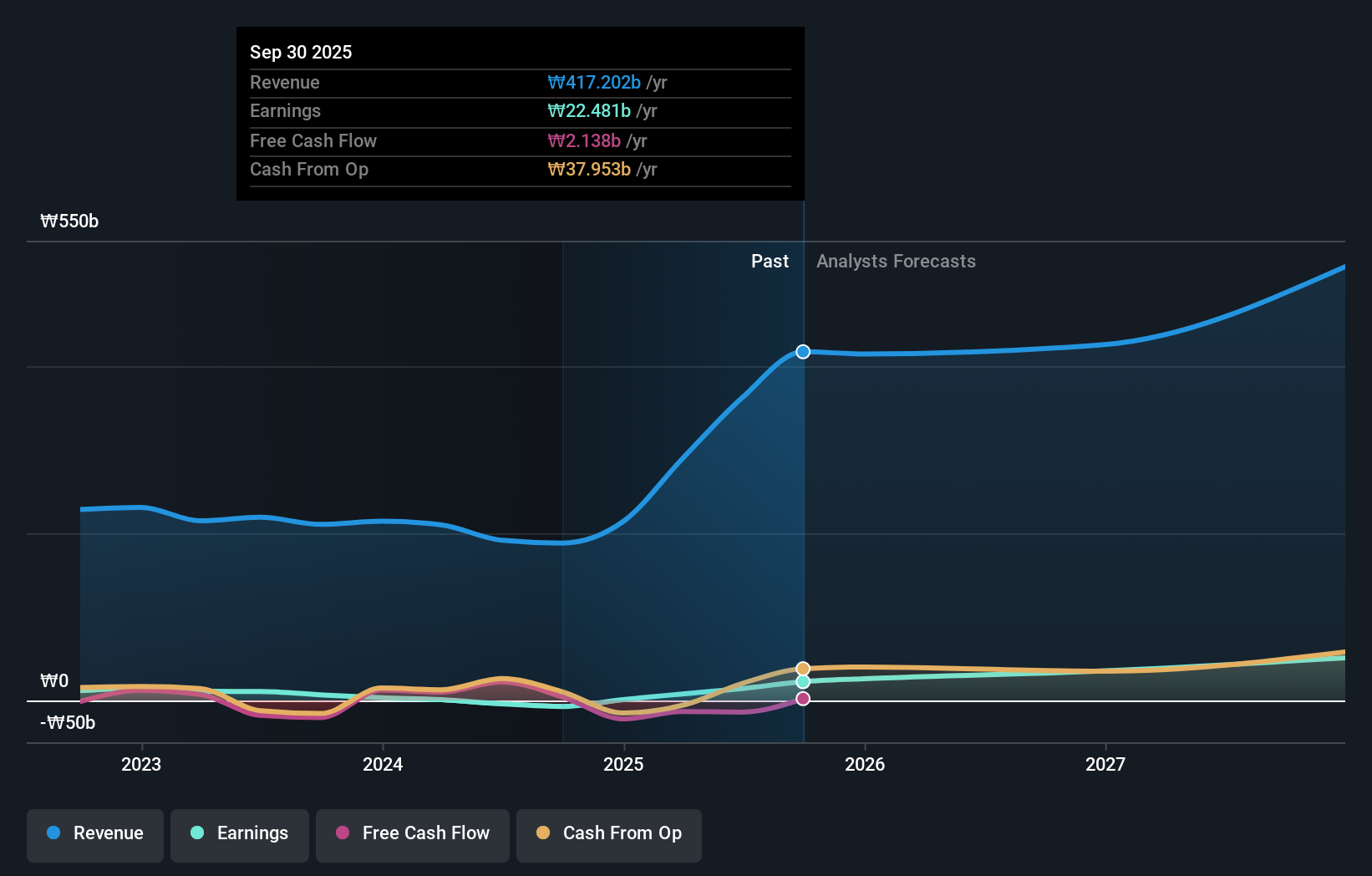

D.I Corporation, despite its lower net profit margin this year at 0.4%, compared to last year's 5.1%, shows promising growth prospects in South Korea with expected earnings and revenue increases significantly outpacing the market at 77.5% and 37.5% per year respectively. While the share price has been volatile recently, the company's forecasted return on equity is impressively high at 29.7%. However, financial results have been affected by large one-off items, suggesting caution regarding earnings quality.

- Click here to discover the nuances of D.I with our detailed analytical future growth report.

- According our valuation report, there's an indication that D.I's share price might be on the expensive side.

Summing It All Up

- Embark on your investment journey to our 80 Fast Growing KRX Companies With High Insider Ownership selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003160

D.I

Manufactures and supplies semiconductor inspection equipment in South Korea and internationally.

Exceptional growth potential with adequate balance sheet.