- South Korea

- /

- Electrical

- /

- KOSDAQ:A065350

Shinsung Delta Tech Co.,Ltd.'s (KOSDAQ:065350) P/S Is On The Mark

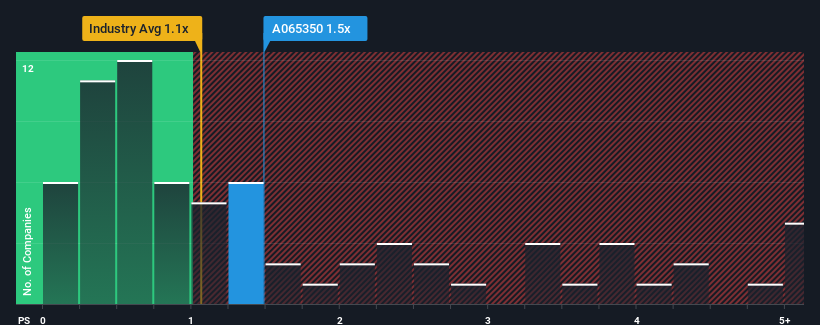

It's not a stretch to say that Shinsung Delta Tech Co.,Ltd.'s (KOSDAQ:065350) price-to-sales (or "P/S") ratio of 1.5x right now seems quite "middle-of-the-road" for companies in the Electrical industry in Korea, where the median P/S ratio is around 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Shinsung Delta TechLtd

What Does Shinsung Delta TechLtd's Recent Performance Look Like?

For example, consider that Shinsung Delta TechLtd's financial performance has been pretty ordinary lately as revenue growth is non-existent. Perhaps the market believes the recent run-of-the-mill revenue performance isn't enough to outperform the industry, which has kept the P/S muted. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Shinsung Delta TechLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Shinsung Delta TechLtd?

The only time you'd be comfortable seeing a P/S like Shinsung Delta TechLtd's is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 29% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 8.4% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we can see why Shinsung Delta TechLtd is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What We Can Learn From Shinsung Delta TechLtd's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears to us that Shinsung Delta TechLtd maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you settle on your opinion, we've discovered 2 warning signs for Shinsung Delta TechLtd (1 is significant!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A065350

Shinsung Delta TechLtd

Produces and sells various home appliance, automotive, IT, and B2C products in South Korea and internationally.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives