- South Korea

- /

- Chemicals

- /

- KOSDAQ:A121600

3 Growth Companies With High Insider Ownership And Up To 45% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate through a period of uncertainty marked by inflation concerns and fluctuating interest rates, investors are keenly observing the performance of growth stocks. Amidst this backdrop, companies with high insider ownership can offer potential advantages, as they often indicate strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

Advanced Nano Products (KOSDAQ:A121600)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Nano Products Co., Ltd. manufactures and sells high-tech materials, including displays, semiconductors, secondary batteries, and solar cells in South Korea and internationally with a market cap of ₩774.11 billion.

Operations: The company's revenue from Specialty Chemicals is ₩86.63 billion.

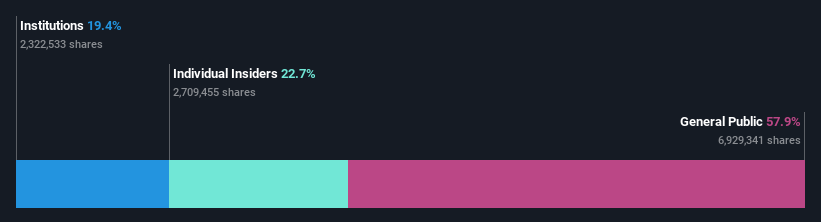

Insider Ownership: 22.6%

Revenue Growth Forecast: 45% p.a.

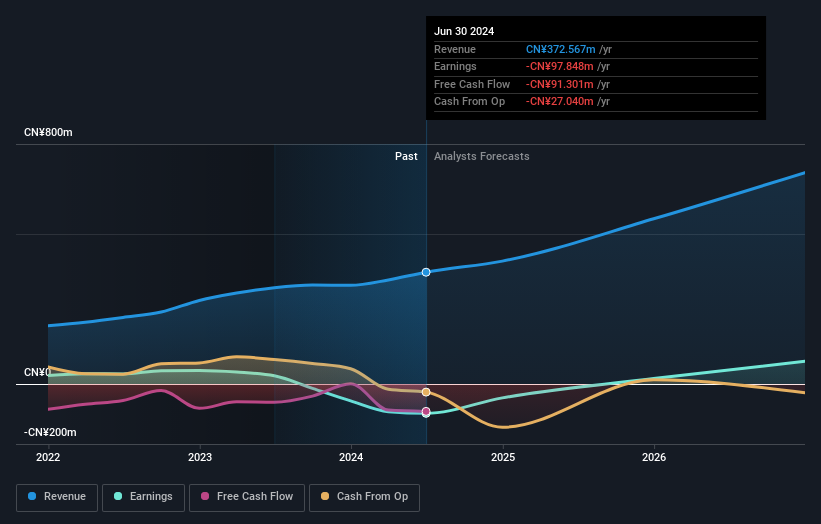

Advanced Nano Products demonstrates significant growth potential with expected annual revenue and earnings growth of 45% and 70%, respectively, outpacing the Korean market. Despite a decline in profit margins from 14.5% to 8.8%, the company is trading at a discount of 12% below its estimated fair value. Recent earnings showed a drop in net income to KRW 488 million for Q3 compared to KRW 4,398 million last year, highlighting challenges amid high insider ownership stability.

- Get an in-depth perspective on Advanced Nano Products' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Advanced Nano Products' share price might be too optimistic.

Primarius Technologies (SHSE:688206)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Primarius Technologies Co., Ltd. is engaged in the research, design, and development of EDA tools in China, with a market cap of approximately CN¥7.61 billion.

Operations: The company's revenue primarily comes from EDA Solutions, amounting to CN¥386.03 million.

Insider Ownership: 16.2%

Revenue Growth Forecast: 27.5% p.a.

Primarius Technologies is poised for robust growth, with expected annual revenue expansion of 27.5%, surpassing the Chinese market average. While still unprofitable, earnings are projected to grow substantially at 121.9% annually, becoming profitable within three years—an above-average market trajectory. Despite a net loss increase to CNY 57.16 million for the first nine months of 2024, insider ownership remains stable without significant recent trading activity, supporting confidence in long-term prospects amidst ongoing share buybacks totaling CNY 20.01 million.

- Click here and access our complete growth analysis report to understand the dynamics of Primarius Technologies.

- The analysis detailed in our Primarius Technologies valuation report hints at an inflated share price compared to its estimated value.

Shenzhen Sunnypol OptoelectronicsLtd (SZSE:002876)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Sunnypol Optoelectronics Co., Ltd. operates in the optoelectronics industry and has a market capitalization of CN¥4.22 billion.

Operations: The company's revenue primarily comes from its Polarizer segment, which generated CN¥2.39 billion.

Insider Ownership: 29.2%

Revenue Growth Forecast: 32.6% p.a.

Shenzhen Sunnypol Optoelectronics is set for significant growth, with earnings projected to increase 60% annually, outpacing the Chinese market. Revenue growth is also strong at 32.6% per year. Despite lower profit margins and interest payments not well covered by earnings, insider ownership remains high without substantial recent trading activity. Recent financials show sales rising to CNY 1.87 billion and net income improving slightly to CNY 64.74 million for the first nine months of 2024.

- Navigate through the intricacies of Shenzhen Sunnypol OptoelectronicsLtd with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Shenzhen Sunnypol OptoelectronicsLtd shares in the market.

Next Steps

- Navigate through the entire inventory of 1442 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A121600

Advanced Nano Products

Manufactures and sells high-tech materials, such as displays, semiconductors, secondary batteries, and solar cells in South Korea and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives