- South Korea

- /

- Metals and Mining

- /

- KOSDAQ:A060380

Dongyang S.Tec Co.,Ltd's (KOSDAQ:060380) Subdued P/E Might Signal An Opportunity

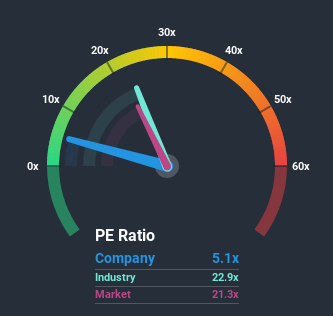

With a price-to-earnings (or "P/E") ratio of 5.1x Dongyang S.Tec Co.,Ltd (KOSDAQ:060380) may be sending very bullish signals at the moment, given that almost half of all companies in Korea have P/E ratios greater than 22x and even P/E's higher than 48x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Dongyang S.TecLtd certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Dongyang S.TecLtd

Is There Any Growth For Dongyang S.TecLtd?

The only time you'd be truly comfortable seeing a P/E as depressed as Dongyang S.TecLtd's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 178% gain to the company's bottom line. The latest three year period has also seen an excellent 236% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 47% shows it's about the same on an annualised basis.

With this information, we find it odd that Dongyang S.TecLtd is trading at a P/E lower than the market. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Dongyang S.TecLtd revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching the company's performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

It is also worth noting that we have found 4 warning signs for Dongyang S.TecLtd that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you decide to trade Dongyang S.TecLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A060380

Solid track record with excellent balance sheet.

Market Insights

Community Narratives