- South Korea

- /

- Basic Materials

- /

- KOSDAQ:A038500

Investor Optimism Abounds SAMPYO Cement Co., Ltd. (KOSDAQ:038500) But Growth Is Lacking

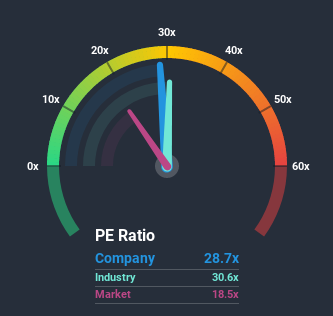

When close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 18x, you may consider SAMPYO Cement Co., Ltd. (KOSDAQ:038500) as a stock to avoid entirely with its 28.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For example, consider that SAMPYO Cement's financial performance has been poor lately as it's earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for SAMPYO Cement

Is There Enough Growth For SAMPYO Cement?

The only time you'd be truly comfortable seeing a P/E as steep as SAMPYO Cement's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 75% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 41% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that SAMPYO Cement's P/E sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On SAMPYO Cement's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of SAMPYO Cement revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 2 warning signs for SAMPYO Cement (1 is significant!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you’re looking to trade SAMPYO Cement, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A038500

SAMPYO Cement

Engages in the manufacture and distribution of cement in South Korea.

Good value with adequate balance sheet.

Market Insights

Community Narratives