- South Korea

- /

- Chemicals

- /

- KOSDAQ:A036830

Soulbrain Holdings Co., Ltd.'s (KOSDAQ:036830) Price In Tune With Earnings

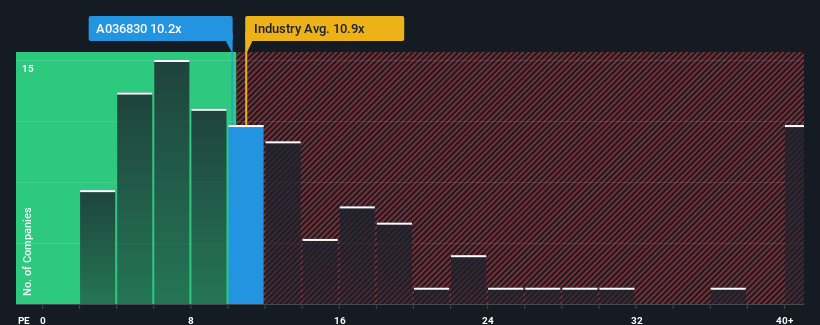

It's not a stretch to say that Soulbrain Holdings Co., Ltd.'s (KOSDAQ:036830) price-to-earnings (or "P/E") ratio of 10.2x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 12x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We check all companies for important risks. See what we found for Soulbrain Holdings in our free report.As an illustration, earnings have deteriorated at Soulbrain Holdings over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Soulbrain Holdings

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Soulbrain Holdings' is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 35%. Still, the latest three year period has seen an excellent 89% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's about the same on an annualised basis.

With this information, we can see why Soulbrain Holdings is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Bottom Line On Soulbrain Holdings' P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Soulbrain Holdings revealed its three-year earnings trends are contributing to its P/E, given they look similar to current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Soulbrain Holdings with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Soulbrain Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A036830

Soulbrain Holdings

Develops, manufactures, and supplies technology industry core materials for semiconductor, display, and secondary battery cell industries in South Korea and internationally.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026