- South Korea

- /

- Chemicals

- /

- KOSDAQ:A036830

Optimistic Investors Push Soulbrain Holdings Co., Ltd. (KOSDAQ:036830) Shares Up 27% But Growth Is Lacking

Soulbrain Holdings Co., Ltd. (KOSDAQ:036830) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. The annual gain comes to 116% following the latest surge, making investors sit up and take notice.

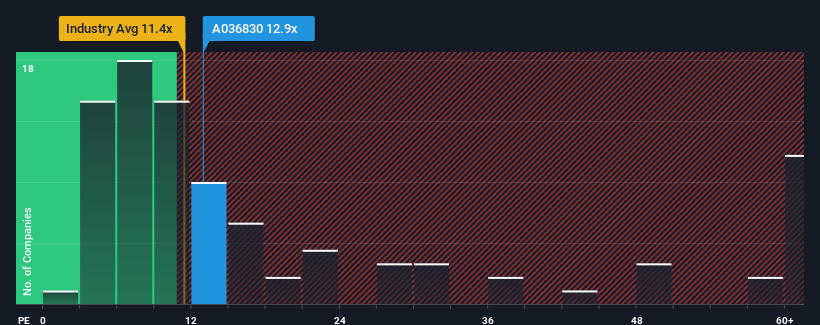

In spite of the firm bounce in price, it's still not a stretch to say that Soulbrain Holdings' price-to-earnings (or "P/E") ratio of 12.9x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 11x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For example, consider that Soulbrain Holdings' financial performance has been pretty ordinary lately as earnings growth is non-existent. It might be that many expect the uninspiring earnings performance to only match most other companies at best over the coming period, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Soulbrain Holdings

Does Growth Match The P/E?

In order to justify its P/E ratio, Soulbrain Holdings would need to produce growth that's similar to the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 46% overall rise in EPS, in spite of its uninspiring short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 33% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Soulbrain Holdings' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Soulbrain Holdings' P/E?

Its shares have lifted substantially and now Soulbrain Holdings' P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Soulbrain Holdings currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Soulbrain Holdings is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Soulbrain Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A036830

Soulbrain Holdings

Develops, manufactures, and supplies technology industry core materials for semiconductor, display, and secondary battery cell industries in South Korea and internationally.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026