- South Korea

- /

- Paper and Forestry Products

- /

- KOSDAQ:A025900

Revenues Not Telling The Story For Dongwha Enterprise Co.,Ltd (KOSDAQ:025900) After Shares Rise 27%

Dongwha Enterprise Co.,Ltd (KOSDAQ:025900) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 49% over that time.

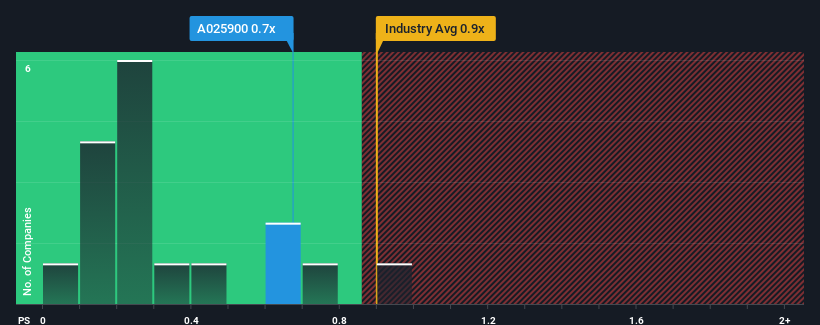

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Dongwha EnterpriseLtd's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Forestry industry in Korea is also close to 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Dongwha EnterpriseLtd

What Does Dongwha EnterpriseLtd's P/S Mean For Shareholders?

The recently shrinking revenue for Dongwha EnterpriseLtd has been in line with the industry. It seems that few are expecting the company's revenue performance to deviate much from most other companies, which has held the P/S back. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues tracking the industry.

Want the full picture on analyst estimates for the company? Then our free report on Dongwha EnterpriseLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Dongwha EnterpriseLtd would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.1%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 15% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 0.9% over the next year. With the industry predicted to deliver 11% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Dongwha EnterpriseLtd's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Dongwha EnterpriseLtd's P/S Mean For Investors?

Dongwha EnterpriseLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Dongwha EnterpriseLtd's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 2 warning signs for Dongwha EnterpriseLtd (1 makes us a bit uncomfortable!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A025900

Dongwha EnterpriseLtd

Manufactures and sells wood materials in South Korea.

Slightly overvalued with minimal risk.

Market Insights

Community Narratives