As global markets experience record highs, with U.S. indices like the S&P 500 and Nasdaq Composite reaching new peaks, investors are increasingly looking for stable income sources amidst mixed economic signals such as resilient job growth and fluctuating manufacturing activity. In this context, dividend stocks present a compelling option for generating yield, offering both potential capital appreciation and regular income streams that can be particularly attractive in times of market uncertainty.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.48% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.21% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.33% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.04% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.45% | ★★★★★★ |

| Daicel (TSE:4202) | 4.86% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.13% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.66% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.39% | ★★★★★★ |

Click here to see the full list of 1517 stocks from our Top Global Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

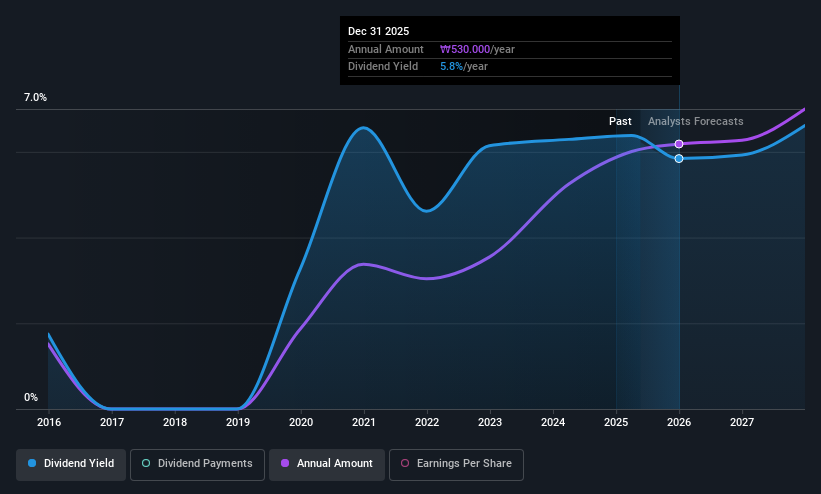

Korean Reinsurance (KOSE:A003690)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Korean Reinsurance Company is a reinsurance firm offering life and non-life reinsurance products both in Korea and internationally, with a market cap of ₩1.86 trillion.

Operations: Korean Reinsurance Company generates its revenue primarily through its reinsurance segment, which accounts for ₩4.43 trillion.

Dividend Yield: 4.6%

Korean Reinsurance's stable and growing dividends over the past decade, with a payout ratio of 29.3% and a cash payout ratio of 7.4%, indicate strong coverage by earnings and cash flows. The company's recent net income increase to KRW 95.19 billion for Q1 2025 supports its dividend reliability. Trading at a significant discount to fair value, it offers an attractive dividend yield of 4.59%, placing it in the top quartile among Korean dividend payers.

- Click here to discover the nuances of Korean Reinsurance with our detailed analytical dividend report.

- The analysis detailed in our Korean Reinsurance valuation report hints at an deflated share price compared to its estimated value.

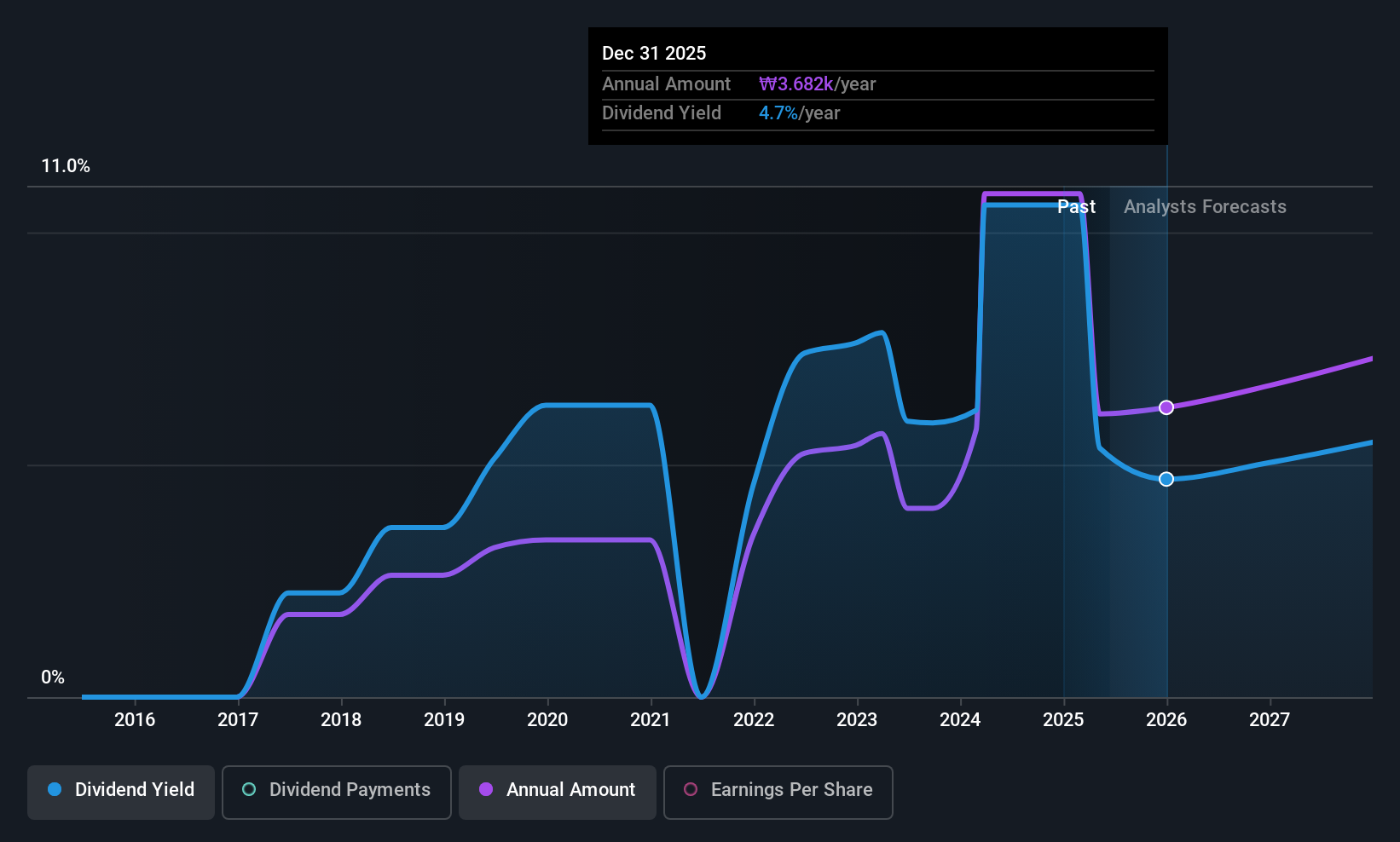

Hana Financial Group (KOSE:A086790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hana Financial Group Inc., with a market cap of ₩25.80 trillion, operates in South Korea offering financial services through its subsidiaries.

Operations: Hana Financial Group Inc. generates revenue from several segments, including Banking (₩9.10 billion), Credit Card Debt (₩565.41 million), Capital Financing (₩1.05 billion), and the Securities Sector (₩858.31 million).

Dividend Yield: 3.8%

Hana Financial Group's dividend yield of 3.82% ranks it in the top 25% of Korean dividend payers, though its dividends have been volatile over the past eight years. With a payout ratio of 30%, dividends are well covered by earnings and forecasted to remain so. Despite an unstable dividend record, recent share buybacks totaling KRW 400 billion reflect management's commitment to shareholder returns, supporting potential long-term value for investors seeking income.

- Get an in-depth perspective on Hana Financial Group's performance by reading our dividend report here.

- Our expertly prepared valuation report Hana Financial Group implies its share price may be lower than expected.

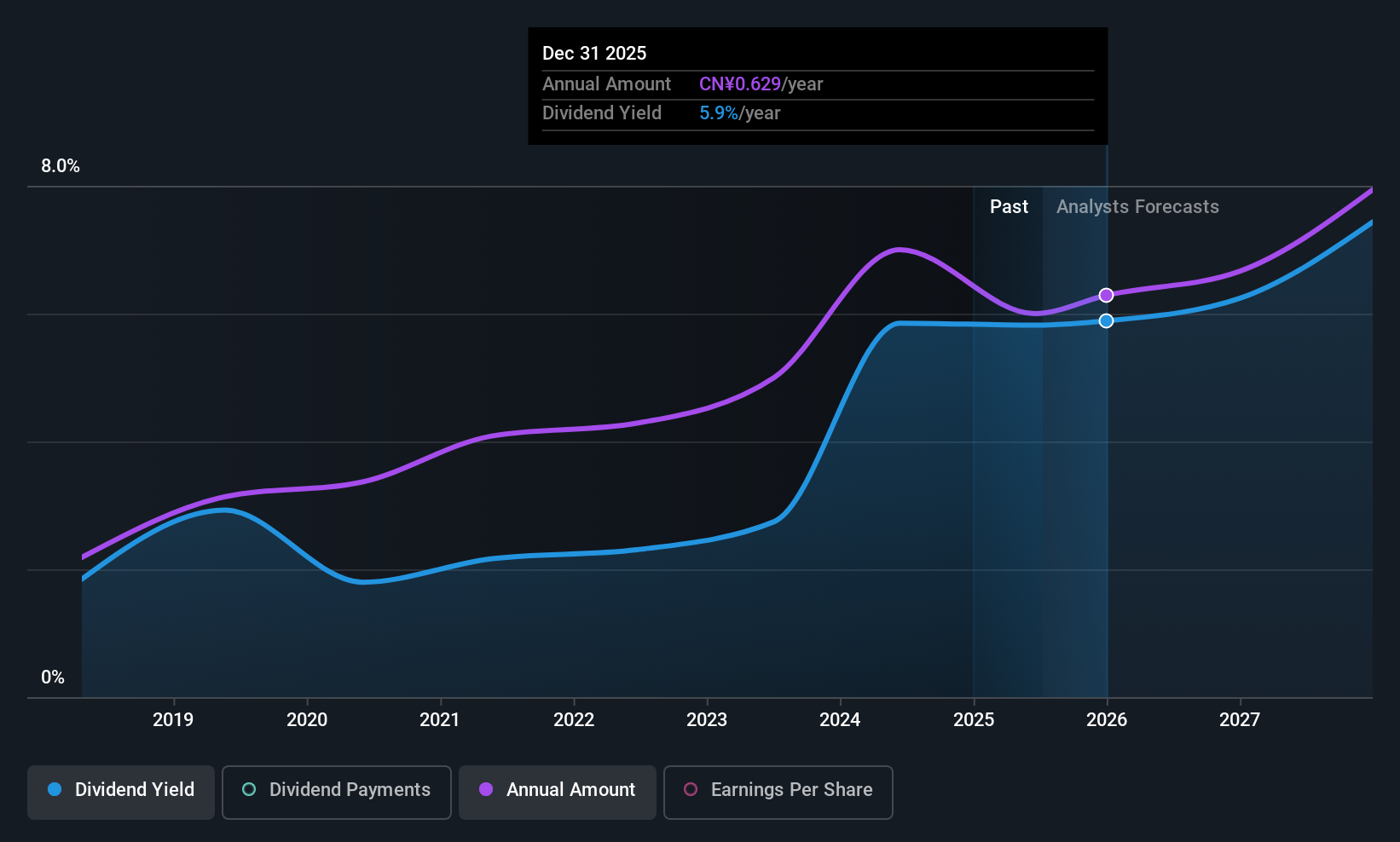

Zbom Home CollectionLtd (SHSE:603801)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zbom Home Collection Co., Ltd specializes in the research, development, production, and sale of customized building products both in China and internationally, with a market cap of CN¥4.33 billion.

Operations: Zbom Home Collection Co., Ltd generates its revenue primarily from its Furniture Manufacturing segment, which accounts for CN¥5.26 billion.

Dividend Yield: 5.5%

Zbom Home Collection Ltd's dividend yield places it among the top 25% of Chinese dividend payers. Despite a recent decrease, its dividends remain covered by earnings and cash flows, with a payout ratio of 68.2% and a cash payout ratio of 80.3%. Trading significantly below estimated fair value enhances its appeal for value-focused investors. However, the company's shorter track record of less than ten years in paying dividends warrants consideration for those prioritizing stability.

- Take a closer look at Zbom Home CollectionLtd's potential here in our dividend report.

- Our valuation report unveils the possibility Zbom Home CollectionLtd's shares may be trading at a discount.

Where To Now?

- Discover the full array of 1517 Top Global Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zbom Home CollectionLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603801

Zbom Home CollectionLtd

Engages in the research, development, production and sale of customized building products in China and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives