- China

- /

- Oil and Gas

- /

- SHSE:601666

3 Reliable Dividend Stocks Yielding Up To 9.5%

Reviewed by Simply Wall St

In a week marked by heightened economic activity and mixed signals from the labor market, global indices experienced some volatility, with major U.S. stock indexes mostly finishing lower after reaching record highs midweek. Amidst this backdrop of cautious earnings reports and fluctuating employment data, investors are increasingly turning their attention to reliable dividend stocks as potential sources of steady income. In such an environment, a good dividend stock is characterized by its ability to offer consistent payouts and maintain financial stability despite broader market uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Globeride (TSE:7990) | 4.10% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.06% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.45% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.91% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.76% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.18% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.55% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.36% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

Click here to see the full list of 2012 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

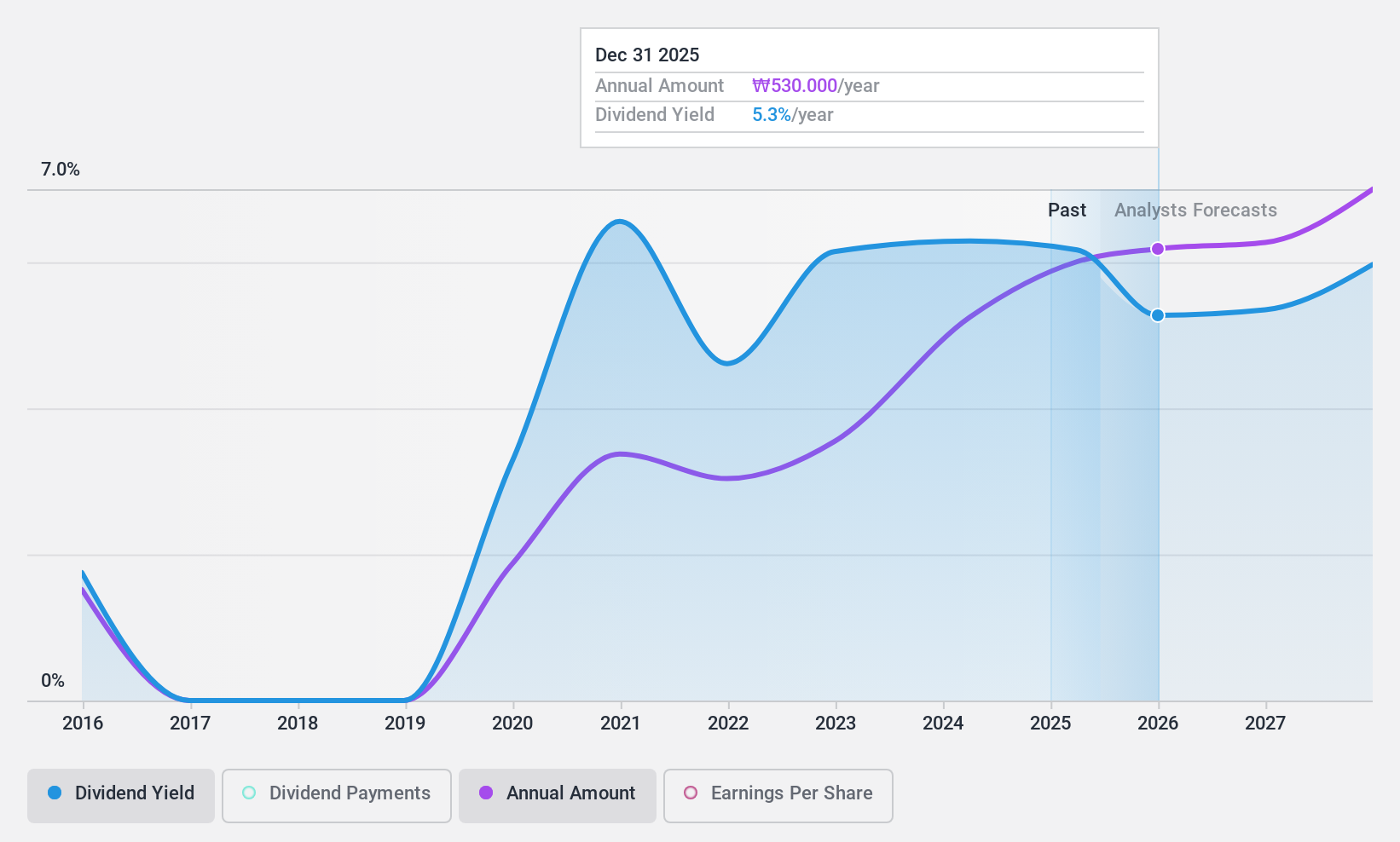

Korean Reinsurance (KOSE:A003690)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Korean Reinsurance Company offers life and non-life reinsurance products both in Korea and internationally, with a market cap of ₩1.40 trillion.

Operations: Korean Reinsurance Company's revenue from its reinsurance segment amounts to ₩4.26 billion.

Dividend Yield: 6.8%

Korean Reinsurance's dividend yield is in the top 25% of the KR market, supported by a low cash payout ratio of 7.8%, ensuring dividends are well-covered by cash flows. Despite a stable dividend history, it's been paying for less than a decade and has an unstable track record. Recent earnings declines and lower profit margins may impact future payouts, but analysts expect stock price growth and forecast earnings to grow annually by 16.11%.

- Click here and access our complete dividend analysis report to understand the dynamics of Korean Reinsurance.

- According our valuation report, there's an indication that Korean Reinsurance's share price might be on the cheaper side.

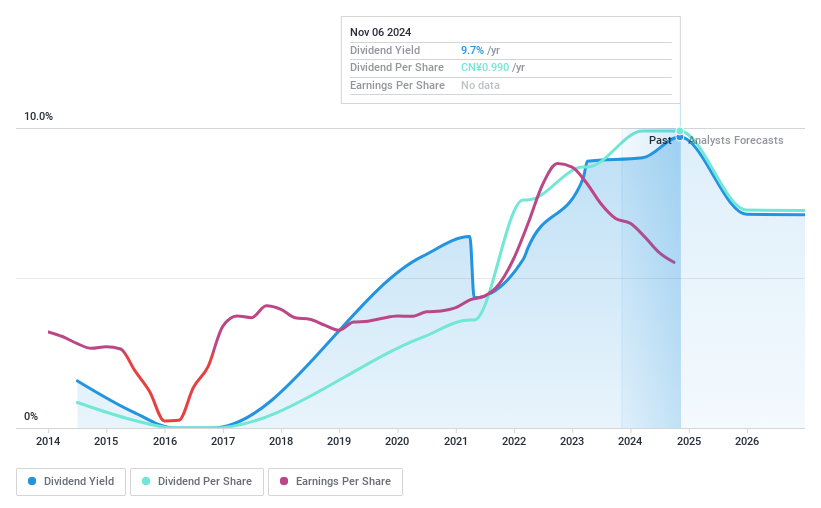

Pingdingshan Tianan Coal. Mining (SHSE:601666)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pingdingshan Tianan Coal Mining Co., Ltd. is engaged in the extraction and sale of coal, with a market cap of CN¥25.27 billion.

Operations: Pingdingshan Tianan Coal Mining Co., Ltd. generates revenue primarily through its coal extraction and sales operations.

Dividend Yield: 9.6%

Pingdingshan Tianan Coal. Mining offers a high dividend yield, ranking in the top 25% of CN market payers, yet its sustainability is questionable due to an 81.9% payout ratio and cash flow coverage issues. Despite recent earnings declines and reduced profit margins, dividends have grown over the past decade but remain volatile. The company recently announced a CNY 500 million share buyback program, potentially indicating confidence in future performance despite current financial pressures.

- Take a closer look at Pingdingshan Tianan Coal. Mining's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Pingdingshan Tianan Coal. Mining shares in the market.

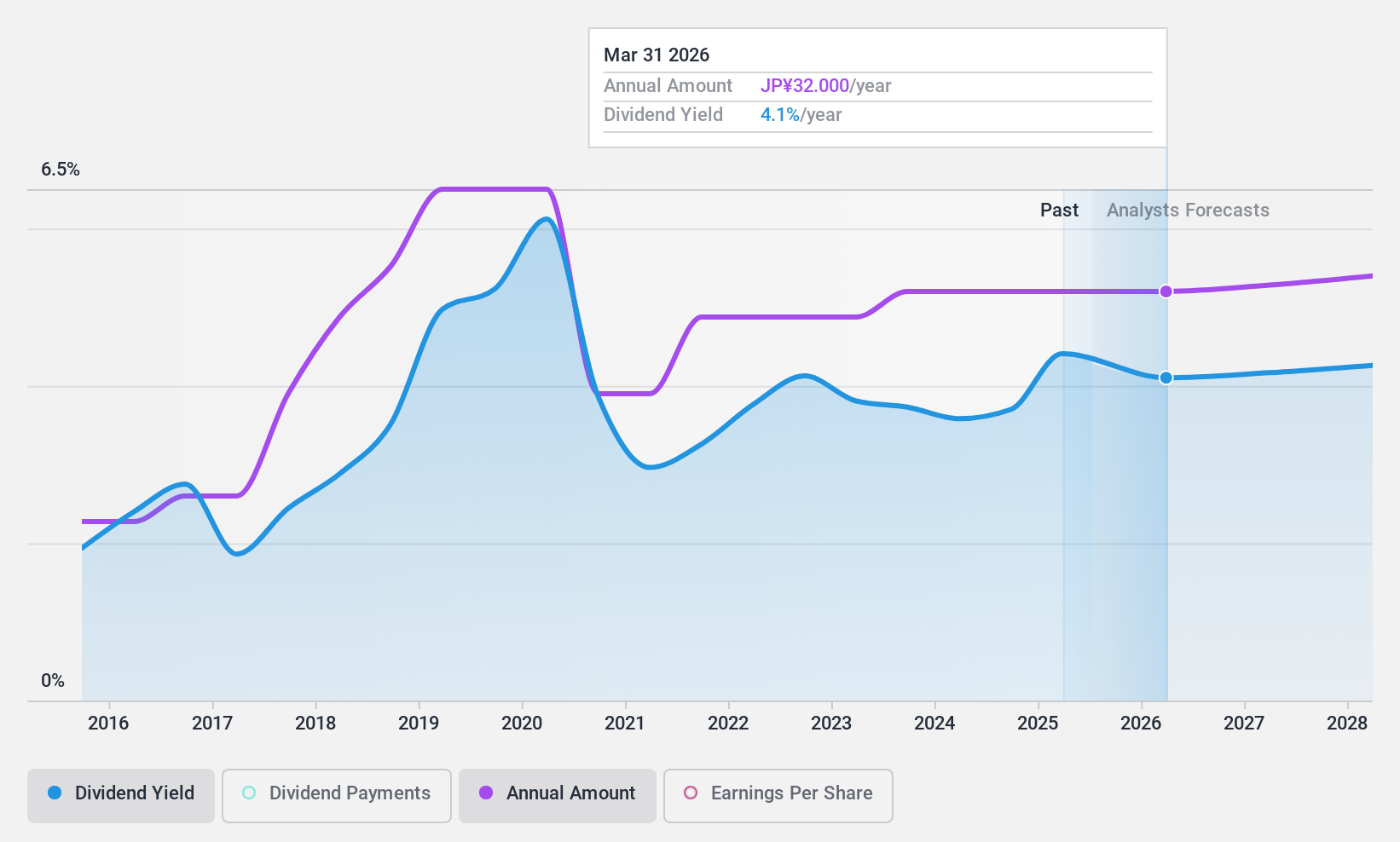

Mitsubishi Chemical Group (TSE:4188)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsubishi Chemical Group Corporation operates in the production of performance products, chemicals, industrial gases, and healthcare products both in Japan and globally, with a market capitalization of ¥1.22 trillion.

Operations: Mitsubishi Chemical Group Corporation's revenue segments include Industrial Gases at ¥1.29 billion, Specialty Materials at ¥1.25 billion, Basic Materials & Polymers at ¥1.04 billion, Pharma at ¥450.55 million, and MMA & Derivatives at ¥340.87 million.

Dividend Yield: 3.7%

Mitsubishi Chemical Group's dividend payments, while covered by earnings with a payout ratio of 48.8% and cash flows at 20.3%, have been volatile over the past decade, making them unreliable for consistent income. Despite this instability, dividends have increased over ten years. The company is trading below its estimated fair value and has shown strong earnings growth historically. Current M&A rumors suggest potential strategic moves to enhance its business portfolio.

- Dive into the specifics of Mitsubishi Chemical Group here with our thorough dividend report.

- Our valuation report unveils the possibility Mitsubishi Chemical Group's shares may be trading at a discount.

Seize The Opportunity

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 2009 more companies for you to explore.Click here to unveil our expertly curated list of 2012 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601666

Pingdingshan Tianan Coal. Mining

Pingdingshan Tianan Coal. Mining Co., Ltd.

Undervalued with adequate balance sheet and pays a dividend.