- China

- /

- Electronic Equipment and Components

- /

- SZSE:002937

High Growth Tech Stocks And 2 More Promising Picks With Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating indices and mixed economic signals, the technology sector remains a focal point with the Nasdaq Composite and S&P MidCap 400 Index experiencing record highs before sharp declines. In this environment, identifying high-growth tech stocks requires an understanding of both macroeconomic trends and company-specific fundamentals, as investors seek opportunities that align with evolving market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Shanghai Fengyuzhu Culture Technology (SHSE:603466)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Fengyuzhu Culture Technology Co., Ltd. operates in the digital experience industry and has a market capitalization of CN¥5.12 billion.

Operations: Fengyuzhu Culture Technology generates revenue primarily from its digital experience segment, amounting to CN¥1.47 billion. The company focuses on delivering innovative digital solutions within this sector.

Shanghai Fengyuzhu Culture Technology, amidst a challenging phase with a significant revenue drop to CNY 958.32 million from last year's CNY 1.84 billion, still forecasts an ambitious annual growth of 17.8%. This contrasts sharply with its current unprofitability, where recent reports show a net loss of CNY 117.12 million compared to prior profits. However, the company is not just navigating through turbulence; it's investing in the future with R&D expenses aimed at revitalizing its offerings and competitive edge in the tech-driven media landscape. With earnings expected to surge by 98% annually, these strategic bets on innovation might just redefine its market stance in the coming years.

Willfar Information Technology (SHSE:688100)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Willfar Information Technology Co., Ltd. offers smart utility services and IoT solutions both in China and internationally, with a market capitalization of CN¥20.16 billion.

Operations: Willfar Information Technology Co., Ltd. focuses on delivering smart utility services and IoT solutions across domestic and international markets. The company operates with a market capitalization of CN¥20.16 billion, reflecting its significant presence in the technology sector.

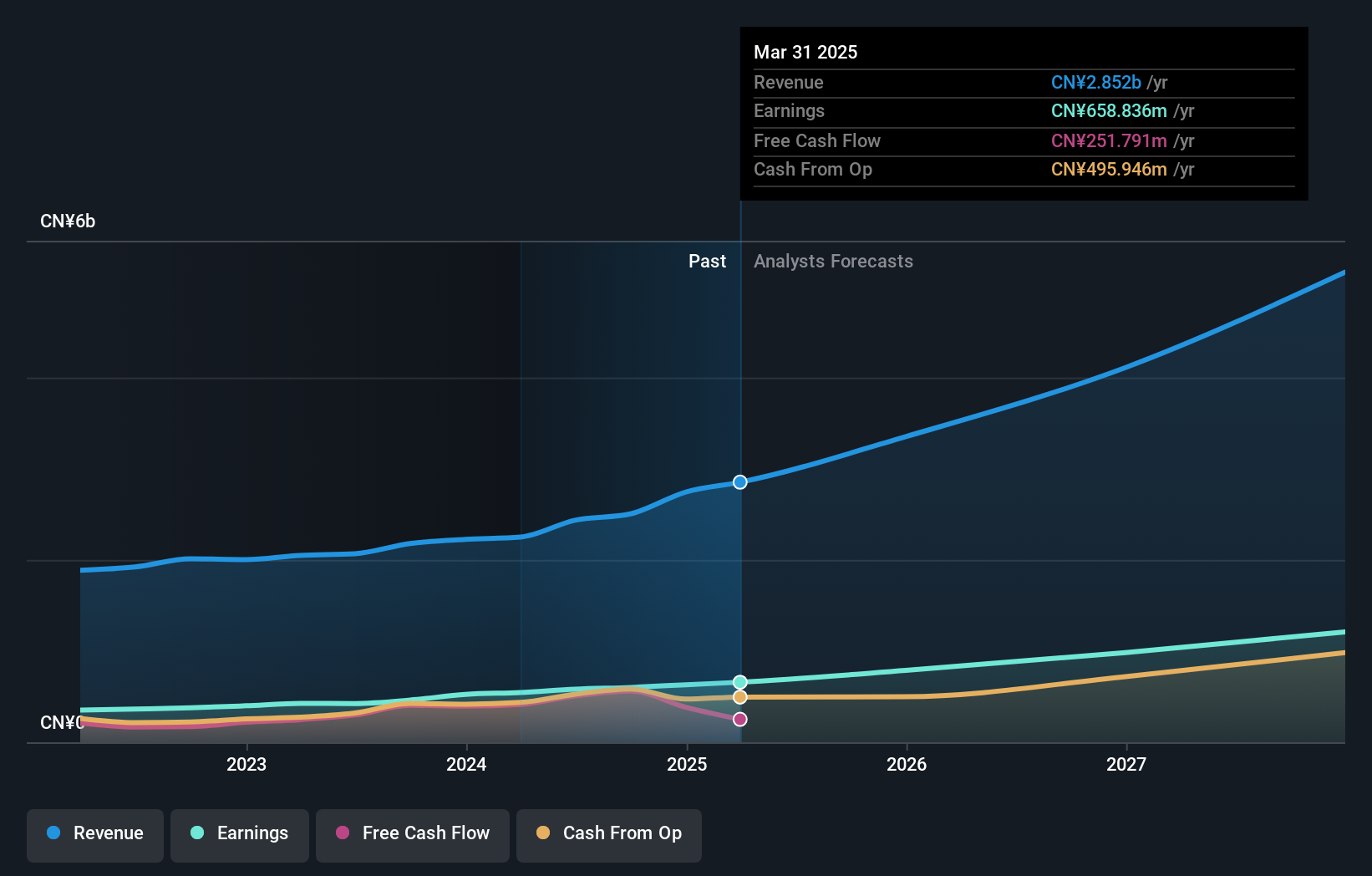

Willfar Information Technology has demonstrated robust financial performance, with a notable increase in sales to CNY 1.94 billion, up from CNY 1.66 billion year-over-year, and a rise in net income to CNY 422.47 million from CNY 346.45 million. This growth is underpinned by an aggressive R&D strategy that not only fuels innovation but also aligns with anticipated revenue growth of 22.6% annually, outpacing the broader Chinese market's forecast of 14%. Moreover, earnings are expected to surge by an impressive 22.2% per year, reflecting the company's effective scaling and operational efficiency in a competitive tech landscape.

Ningbo Sunrise Elc TechnologyLtd (SZSE:002937)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Sunrise Elc Technology Co., Ltd specializes in the manufacturing and sale of precision components, with a market capitalization of CN¥5.39 billion.

Operations: The company focuses on manufacturing and selling precision components. It operates with a market capitalization of approximately CN¥5.39 billion, indicating its scale in the industry.

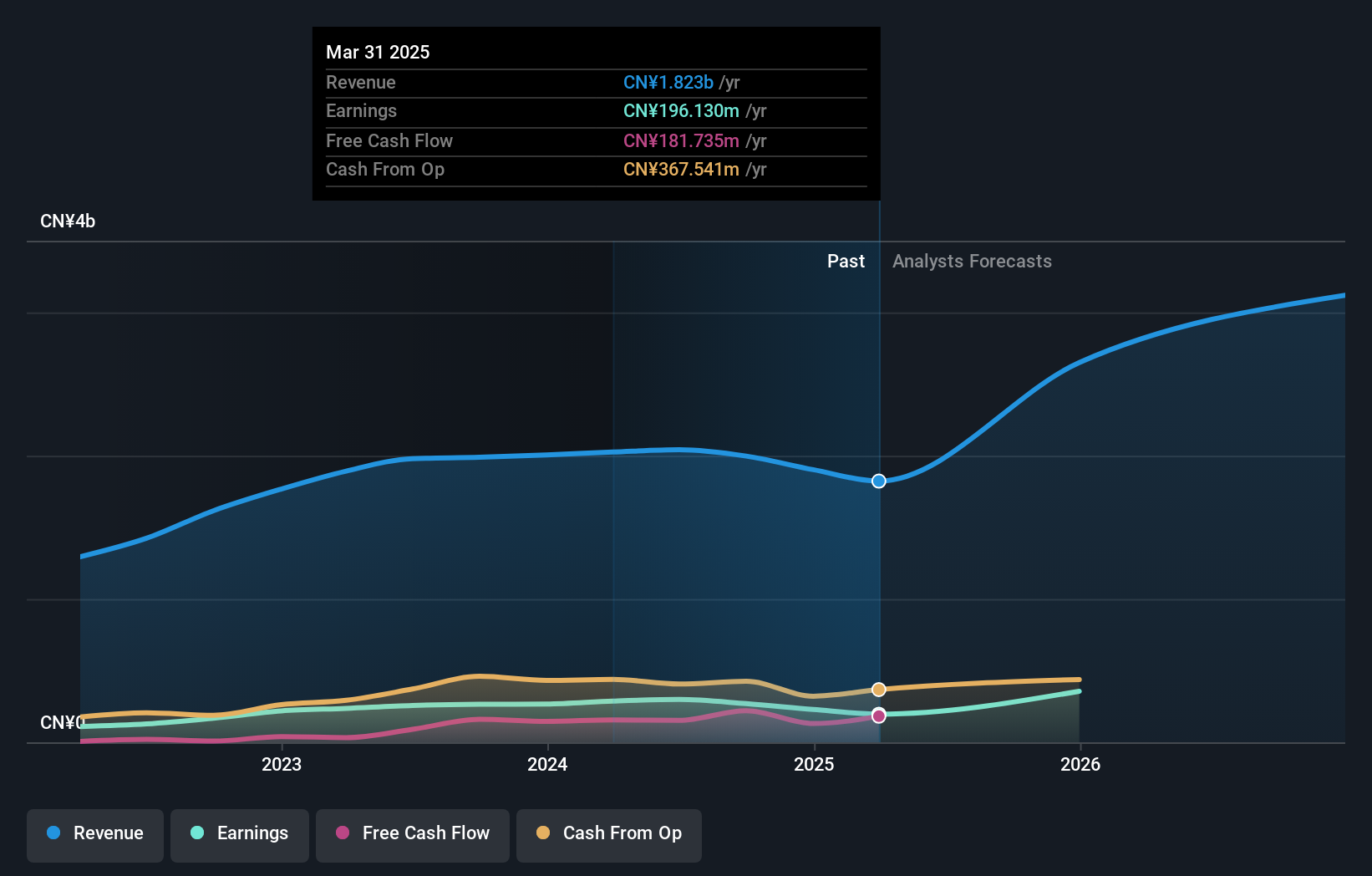

Ningbo Sunrise Elc TechnologyLtd, amidst a challenging market, reported a slight dip in sales to CNY 1.48 billion from CNY 1.49 billion year-over-year while maintaining stable net income at CNY 192.44 million. This resilience is underscored by an aggressive R&D investment strategy, with expenses aimed at fostering innovation and aligning with the company's robust revenue growth forecast of 32.6% annually—significantly outpacing the broader Chinese market's projection of 14%. Furthermore, earnings are expected to surge by an impressive 35.1% per year, reflecting strategic operational efficiencies and a strong focus on high-quality earnings generation in the competitive tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Ningbo Sunrise Elc TechnologyLtd.

Understand Ningbo Sunrise Elc TechnologyLtd's track record by examining our Past report.

Make It Happen

- Delve into our full catalog of 1289 High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Sunrise Elc TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002937

Ningbo Sunrise Elc TechnologyLtd

Engages in the manufactures and sale of precision components.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives