- South Korea

- /

- Personal Products

- /

- KOSE:A278470

Investors Appear Satisfied With APR Co., Ltd.'s (KRX:278470) Prospects As Shares Rocket 26%

APR Co., Ltd. (KRX:278470) shares have continued their recent momentum with a 26% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

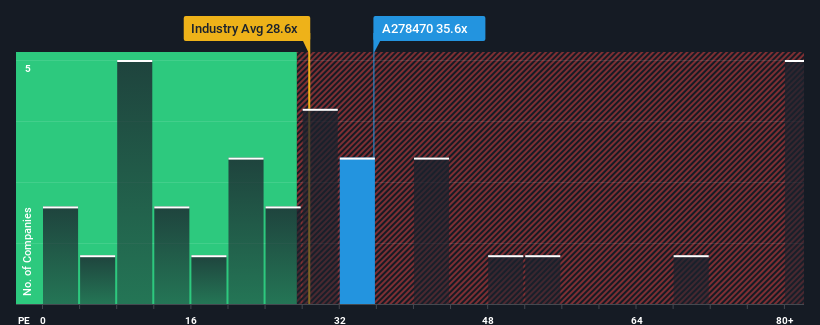

Since its price has surged higher, given close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 12x, you may consider APR as a stock to avoid entirely with its 35.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

APR certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for APR

What Are Growth Metrics Telling Us About The High P/E?

APR's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 67%. Pleasingly, EPS has also lifted 1,265% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 27% each year during the coming three years according to the eight analysts following the company. That's shaping up to be materially higher than the 20% per annum growth forecast for the broader market.

In light of this, it's understandable that APR's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From APR's P/E?

APR's P/E is flying high just like its stock has during the last month. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that APR maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for APR (1 is potentially serious) you should be aware of.

If these risks are making you reconsider your opinion on APR, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A278470

APR

APR Co.,Ltd manufactures and sells cosmetic products for men and women.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives