- South Korea

- /

- Personal Products

- /

- KOSE:A192820

What Type Of Shareholders Make Up Cosmax, Inc.'s (KRX:192820) Share Registry?

If you want to know who really controls Cosmax, Inc. (KRX:192820), then you'll have to look at the makeup of its share registry. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. Companies that used to be publicly owned tend to have lower insider ownership.

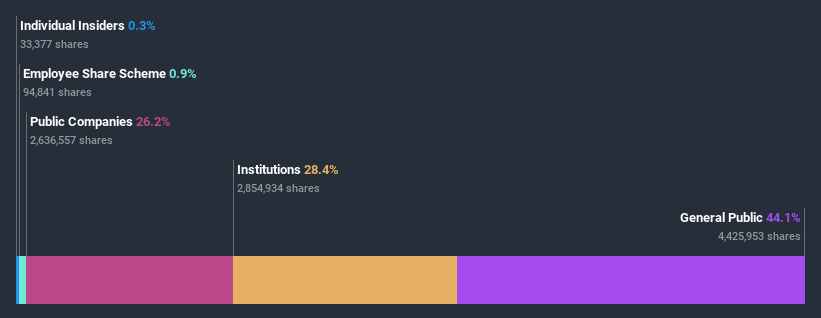

With a market capitalization of ₩1.1t, Cosmax is a decent size, so it is probably on the radar of institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutional investors have bought into the company. We can zoom in on the different ownership groups, to learn more about Cosmax.

See our latest analysis for Cosmax

What Does The Institutional Ownership Tell Us About Cosmax?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

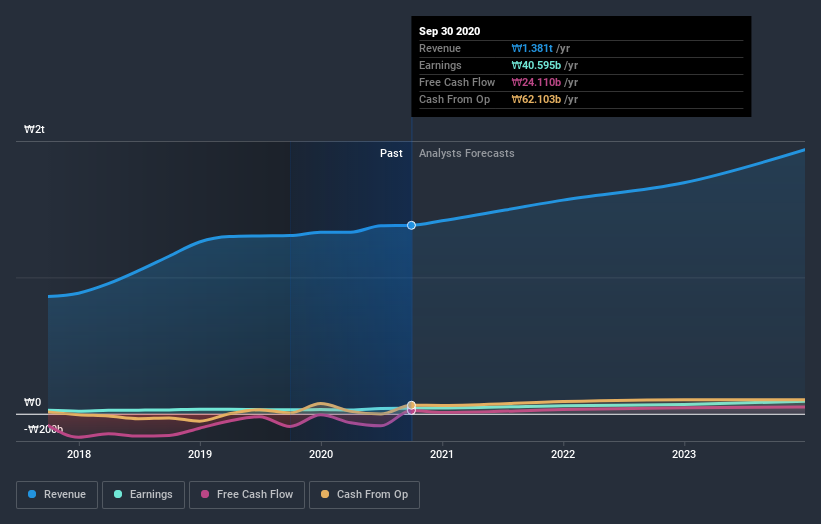

Cosmax already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Cosmax, (below). Of course, keep in mind that there are other factors to consider, too.

We note that hedge funds don't have a meaningful investment in Cosmax. Looking at our data, we can see that the largest shareholder is Cosmax BTI, Inc. with 26% of shares outstanding. In comparison, the second and third largest shareholders hold about 13% and 1.9% of the stock.

We also observed that the top 10 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Cosmax

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that Cosmax, Inc. insiders own under 1% of the company. It appears that the board holds about ₩3.5b worth of stock. This compares to a market capitalization of ₩1.1t. I generally like to see a board more invested. However it might be worth checking if those insiders have been buying.

General Public Ownership

The general public, with a 44% stake in the company, will not easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Public Company Ownership

It appears to us that public companies own 26% of Cosmax. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Cosmax better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Cosmax (including 1 which is a bit concerning) .

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Cosmax or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A192820

Cosmax

Researches, develops, produces, and manufactures cosmetic and health function food products in Korea and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026