Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Kolmar Korea Co., Ltd. (KRX:161890) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Kolmar Korea

How Much Debt Does Kolmar Korea Carry?

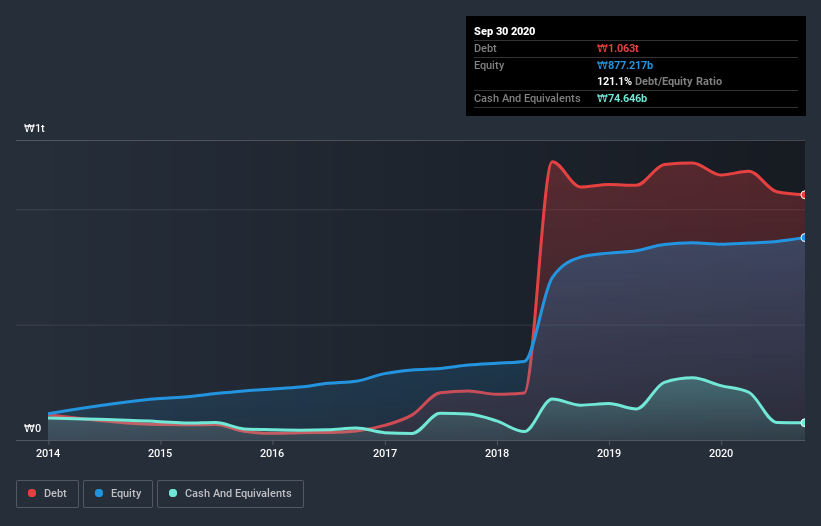

The image below, which you can click on for greater detail, shows that Kolmar Korea had debt of ₩1.06t at the end of September 2020, a reduction from ₩1.20t over a year. On the flip side, it has ₩74.6b in cash leading to net debt of about ₩987.9b.

A Look At Kolmar Korea's Liabilities

According to the last reported balance sheet, Kolmar Korea had liabilities of ₩479.3b due within 12 months, and liabilities of ₩975.2b due beyond 12 months. Offsetting these obligations, it had cash of ₩74.6b as well as receivables valued at ₩175.6b due within 12 months. So its liabilities total ₩1.20t more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's ₩1.04t market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a net debt to EBITDA ratio of 5.6, it's fair to say Kolmar Korea does have a significant amount of debt. But the good news is that it boasts fairly comforting interest cover of 2.8 times, suggesting it can responsibly service its obligations. Even more troubling is the fact that Kolmar Korea actually let its EBIT decrease by 5.3% over the last year. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Kolmar Korea can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Kolmar Korea created free cash flow amounting to 5.5% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

On the face of it, Kolmar Korea's level of total liabilities left us tentative about the stock, and its net debt to EBITDA was no more enticing than the one empty restaurant on the busiest night of the year. And furthermore, its interest cover also fails to instill confidence. We're quite clear that we consider Kolmar Korea to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Kolmar Korea you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Kolmar Korea or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kolmar Korea might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A161890

Kolmar Korea

Researches, develops, produces, and sells beauty and health products in South Korea and internationally.

Very undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives