- South Korea

- /

- Personal Products

- /

- KOSE:A051900

Shareholders in LG H&H (KRX:051900) are in the red if they invested five years ago

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. For example, we sympathize with anyone who was caught holding LG H&H Co., Ltd. (KRX:051900) during the five years that saw its share price drop a whopping 76%. Shareholders have had an even rougher run lately, with the share price down 14% in the last 90 days.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for LG H&H

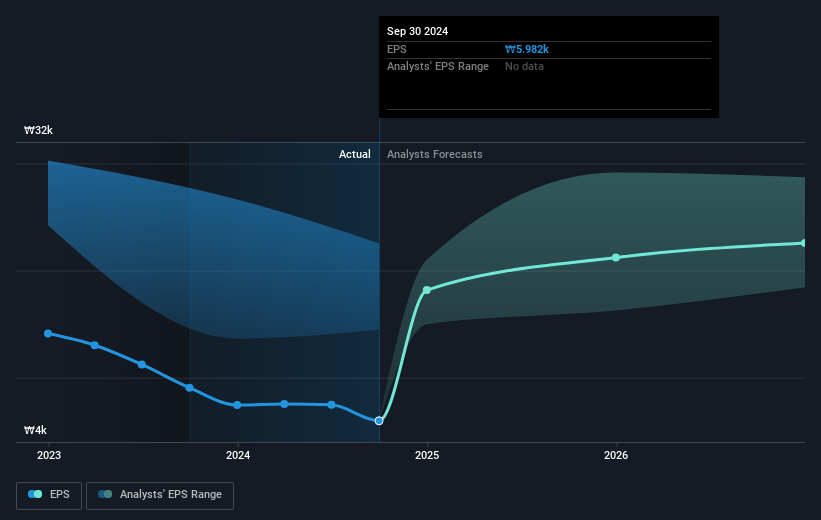

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Looking back five years, both LG H&H's share price and EPS declined; the latter at a rate of 33% per year. The share price decline of 25% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve. The high P/E ratio of 49.73 suggests that shareholders believe earnings will grow in the years ahead.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on LG H&H's earnings, revenue and cash flow.

A Different Perspective

LG H&H shareholders are down 5.7% for the year (even including dividends), but the market itself is up 0.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 12% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - LG H&H has 2 warning signs we think you should be aware of.

But note: LG H&H may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A051900

LG H&H

Operates as cosmetics, household goods, and beverage company in South Korea and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives