- South Korea

- /

- Personal Products

- /

- KOSDAQ:A352480

Here's Why C&C International (KOSDAQ:352480) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like C&C International (KOSDAQ:352480), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide C&C International with the means to add long-term value to shareholders.

View our latest analysis for C&C International

C&C International's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Outstandingly, C&C International's EPS shot from ₩1,646 to ₩3,142, over the last year. It's not often a company can achieve year-on-year growth of 91%. That could be a sign that the business has reached a true inflection point.

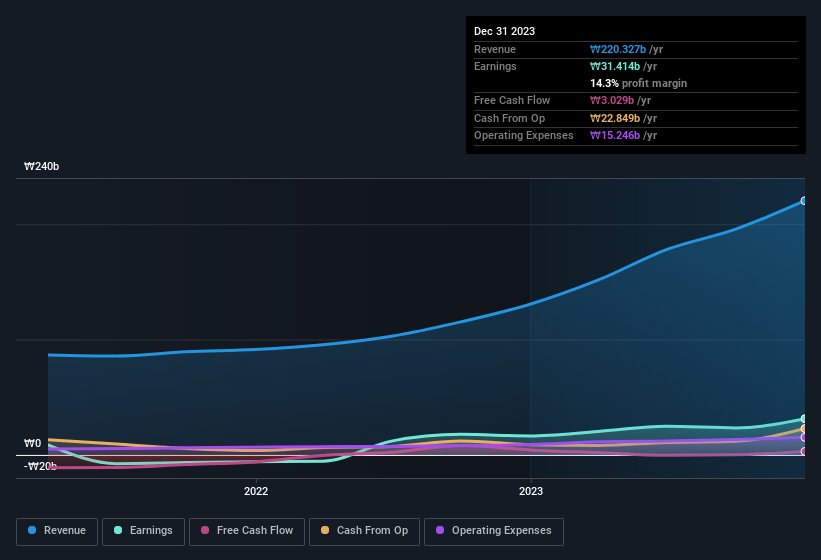

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note C&C International achieved similar EBIT margins to last year, revenue grew by a solid 69% to ₩220b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for C&C International?

Are C&C International Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that C&C International insiders own a significant number of shares certainly is appealing. In fact, they own 66% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. That means they have plenty of their own capital riding on the performance of the business!

Does C&C International Deserve A Spot On Your Watchlist?

C&C International's earnings per share have been soaring, with growth rates sky high. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So at the surface level, C&C International is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with C&C International , and understanding this should be part of your investment process.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of South Korean companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A352480

C&C International

C&C International Co.,Ltd engages in the research and development, manufacture, and sale of cosmetics in Korea.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives