- South Korea

- /

- Personal Products

- /

- KOSDAQ:A352480

C&C International Co., Ltd.'s (KOSDAQ:352480) Business Is Yet to Catch Up With Its Share Price

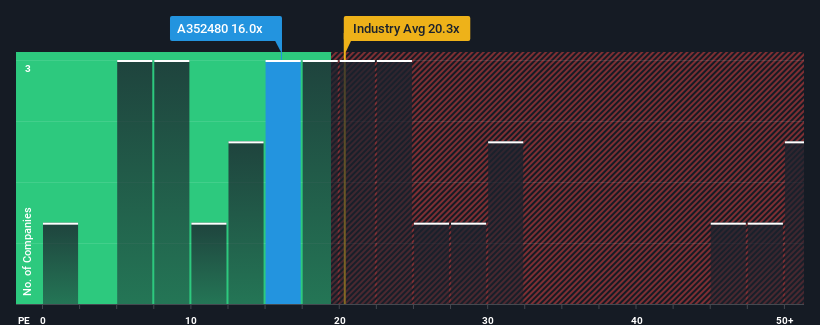

When close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 11x, you may consider C&C International Co., Ltd. (KOSDAQ:352480) as a stock to potentially avoid with its 16x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings growth that's superior to most other companies of late, C&C International has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for C&C International

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like C&C International's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 82% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 18% each year over the next three years. That's shaping up to be similar to the 16% each year growth forecast for the broader market.

With this information, we find it interesting that C&C International is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that C&C International currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for C&C International (1 is a bit concerning!) that you need to be mindful of.

If you're unsure about the strength of C&C International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A352480

C&C International

C&C International Co.,Ltd engages in the research and development, manufacture, and sale of cosmetics in Korea.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives