- South Korea

- /

- Personal Products

- /

- KOSDAQ:A234690

Subdued Growth No Barrier To GREEN CROSS WellBeing Corporation (KOSDAQ:234690) With Shares Advancing 28%

GREEN CROSS WellBeing Corporation (KOSDAQ:234690) shares have continued their recent momentum with a 28% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 50% in the last year.

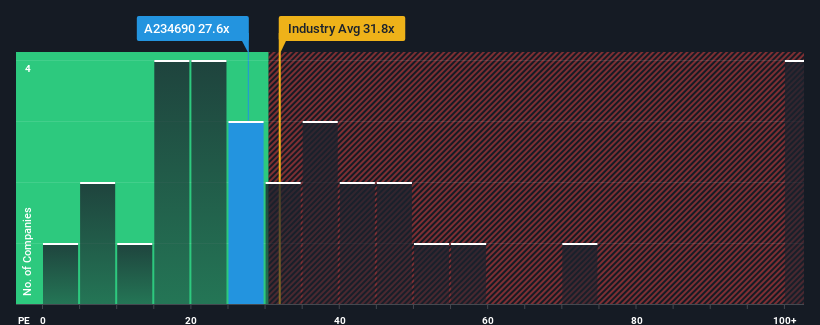

After such a large jump in price, given close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 14x, you may consider GREEN CROSS WellBeing as a stock to avoid entirely with its 27.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

It looks like earnings growth has deserted GREEN CROSS WellBeing recently, which is not something to boast about. It might be that many are expecting an improvement to the uninspiring earnings performance over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for GREEN CROSS WellBeing

Is There Enough Growth For GREEN CROSS WellBeing?

In order to justify its P/E ratio, GREEN CROSS WellBeing would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Although pleasingly EPS has lifted 89% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that GREEN CROSS WellBeing's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On GREEN CROSS WellBeing's P/E

GREEN CROSS WellBeing's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of GREEN CROSS WellBeing revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 2 warning signs for GREEN CROSS WellBeing that you should be aware of.

If you're unsure about the strength of GREEN CROSS WellBeing's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A234690

GREEN CROSS WellBeing

Provides personalized nutrition injections in South Korea.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives