- South Korea

- /

- Personal Products

- /

- KOSDAQ:A200130

KolmarBNH Co., Ltd. (KOSDAQ:200130) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?

KolmarBNH (KOSDAQ:200130) has had a rough three months with its share price down 19%. But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Specifically, we decided to study KolmarBNH's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for KolmarBNH

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for KolmarBNH is:

24% = ₩77b ÷ ₩313b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each ₩1 of shareholders' capital it has, the company made ₩0.24 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

KolmarBNH's Earnings Growth And 24% ROE

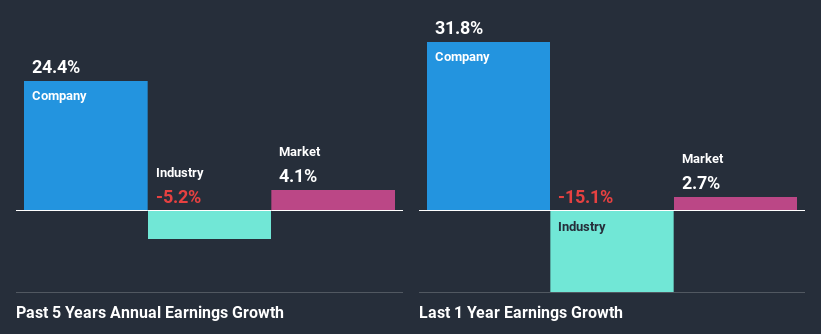

First thing first, we like that KolmarBNH has an impressive ROE. Secondly, even when compared to the industry average of 4.4% the company's ROE is quite impressive. Under the circumstances, KolmarBNH's considerable five year net income growth of 24% was to be expected.

Given that the industry shrunk its earnings at a rate of 5.2% in the same period, the net income growth of the company is quite impressive.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Has the market priced in the future outlook for A200130? You can find out in our latest intrinsic value infographic research report.

Is KolmarBNH Using Its Retained Earnings Effectively?

KolmarBNH's three-year median payout ratio to shareholders is 11%, which is quite low. This implies that the company is retaining 89% of its profits. This suggests that the management is reinvesting most of the profits to grow the business as evidenced by the growth seen by the company.

Additionally, KolmarBNH has paid dividends over a period of three years which means that the company is pretty serious about sharing its profits with shareholders. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 11%. As a result, KolmarBNH's ROE is not expected to change by much either, which we inferred from the analyst estimate of 28% for future ROE.

Conclusion

In total, we are pretty happy with KolmarBNH's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. The latest industry analyst forecasts show that the company is expected to maintain its current growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you decide to trade KolmarBNH, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KOLMAR BNHLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A200130

KOLMAR BNHLtd

Kolmar BNH Co., Ltd. engages in the research and development of materials used in the functional health food and cosmetics market in South Korea and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.